After illegal crypto turnover in Kazakhstan hit 95% in 2024, authorities responded by rewriting the rulebook.

Kazakhstan plans to become one of Eurasia’s leading crypto hubs, positioning itself as a secure and transparent jurisdiction for digital assets. The government is steadily integrating crypto into the financial system, bringing what was once a grey market under state oversight.

In January, President Kassym-Jomart Tokayev formally recognised digital assets as part of the economy, enacting a comprehensive framework that legalises, regulates and clearly defines the sector.

But the road has not been smooth.

The country introduced sweeping rules as early as 2023 to curb illegal mining and shadow trading. Yet by 2025, around 95% of digital asset turnover — worth more than €13bn — was still taking place outside the legal system, according to Dauren Karashev, chair of the National Blockchain Association and head of Kazakhstan’s Crypto Forensic Lab.

Kazakhstan had already become a magnet for miners. After China’s 2021 crypto ban triggered a mass relocation, the Central Asian nation briefly turned into the world’s second-largest Bitcoin mining hub. Weak oversight fuelled a surge in unregulated activity.

For regulators, the priority now is control rather than speed.

“Kazakhstan’s ultimate goal is to build a well-developed and fully regulated crypto market with clear rules,” says Karashev.

Because transactions are often hard to trace, authorities focus on transparency, he explains. Tracking flows, mapping wallets and identifying who stands behind each exchange is important.

The shift is already visible on the legal side of the market.

Trading on platforms licensed by the Astana International Financial Centre has surged more than twenty-fold — from just €270 million in 2023 to nearly €6 billion in the first three quarters of 2025.

“The crypto mined locally is considered clean, without a criminal trail,” Karashev says. Trading through licensed exchanges, he adds, increases security and builds trust among investors.

The new crypto rulebook

As of this year, Kazakhstan’s National Bank has taken formal control of crypto regulation. The central financial authority now decides which digital assets can be traded on licensed exchanges.

It shares oversight with the Astana International Financial Centre, creating the region’s first dual supervisory framework.

Officials reject suggestions of overlap. Instead, they describe the system as complementary.

“The National Bank focuses on local supply and demand, retail investors and domestic players, while the AIFC works with international and regional investors,” explains Binur Zhalenov, digital officer and adviser to the National Bank chair.

The goal, he says, is to “build bridges” between the AIFC’s offshore-style jurisdiction and Kazakhstan’s onshore market, allowing the two systems to operate seamlessly.

The shift effectively lifts the previous restriction that limited trading to the AIFC and expands legal crypto activity nationwide.

“It means users and consumers can legally exchange crypto, sell it and operate freely within the regulated environment,” Zhalenov adds.

At the same time, digital platform operators are being reclassified as financial market entities. They will now be licensed and supervised by the National Bank, alongside crypto exchanges.

Digital assets themselves are also being formally defined as a new asset class. The framework divides them into four categories: unsecured cryptocurrencies such as Bitcoin and Ethereum, as well as three types of secured instruments — stablecoins, asset-backed tokens and electronic financial assets. Each are subject to different levels of oversight.

Kazakh-bred crypto exchange

One of Kazakhstan’s homegrown exchanges welcomes the reforms, while cautioning against over-regulation.

ATAIX Eurasia says the growing involvement of commercial banks is a key step forward.

“It will help further develop the country’s crypto-fiat infrastructure,” says CEO Arutyun Pogosyan.

The platform’s trading volumes are already climbing. Last year, turnover exceeded €470 million — up 77% year-on-year. This reflects what Pogosyan calls the “gradual emergence of mature, legal demand for digital assets” in Kazakhstan and across the region.

Founded in 2022, ATAIX chose Kazakhstan after the launch of the Astana International Financial Centre. Pogosyan says the market has since evolved from what he describes as a “handicraft industry” into a transparent, regulated environment.

“We decided to accelerate our launch and become one of the first fully licensed and secure exchanges in the country,” he explains.

Partnerships with eight local banks have allowed the company to build a legal bridge between crypto and traditional finance. This enabled clients to deposit and withdraw funds through standard mobile banking apps. This effectively turns crypto into a routine banking transaction.

With the new rules, the firm expects competition to intensify as smaller providers enter the market and digital assets become more mainstream.

But challenges remain.

“In the effort to maximise security, the market is gradually becoming overloaded with procedures that sometimes exceed even banking requirements,” Pogosyan says.

“Sustainable growth is only possible with a balance between control and innovation.”

Financial literacy is another hurdle. Many consumers still view cryptocurrencies as speculative or opaque rather than part of the formal financial system. This makes education and transparency essential.

Even so, Pogosyan believes Kazakhstan has the foundations to become a regional digital-asset leader — provided regulators and market players continue to work together.

Looking ahead, ATAIX is expanding internationally and preparing new products, including a cryptocurrency payment card launched with Bank CenterCredit. Linked to Google Pay, Apple Pay and Samsung Pay, it will allow users to spend crypto like a regular bank card, with funds automatically converted into tenge at the point of purchase.

Kazakhstan green-lights crypto banks, plans national reserve

Kazakhstan is also moving to further liberalise the digital asset market by considering the launch of dedicated crypto banks.

Responding to a formal parliamentary request in spring 2025, Prime Minister Olzhas Bektenov said the institutions would provide exchange, custody and transaction services through licensed infrastructure providers. These include digital asset platforms, custodians, brokers and dealers. Many already operate within the Astana International Financial Centre (AIFC).

Officials say specialised crypto banks could make the country more attractive to investors and strengthen oversight at the same time.

Bektenov argues the move would modernise Kazakhstan’s financial system for the era of decentralised finance. It would also create demand for new professionals in compliance, blockchain analytics and anti-money laundering.

Beyond jobs and tax revenues, authorities expect the banks to boost liquidity across both fiat and digital markets.

At the same time, the government is preparing to build a national crypto reserve as part of efforts to diversify its sovereign portfolio.

The fund could invest around €1 billion in digital assets and will be partly backed by cryptocurrencies seized in criminal investigations.

By December 2025, the Financial Monitoring Agency had frozen nearly €14 million in illicit crypto, some linked to darknet marketplaces and illegal trading schemes.

In addition to confiscated assets, the reserve may directly purchase major cryptocurrencies such as Bitcoin, as well as invest in related exchange-traded funds and global platforms.

Authorities say the strategy will follow a “risk-based approach” aimed at generating returns while limiting volatility, according to National Bank adviser Binur Zhalenov.

Alatau CryptoCity: a regulatory sandbox for digital finance

In a bid to build a fully digital ecosystem, President Kassym-Jomart Tokayev has announced the Alatau CryptoCity project — Kazakhstan’s first pilot zone where crypto payments will be permitted.

The area will operate under crypto-friendly regulations and function as a special economic zone, alongside the country’s planned national digital asset reserve.

Located 47 kilometres north of Almaty on the Western Europe–Western China transport corridor, the site is expected to double as a logistics and technology hub.

Officials describe it as a “blockchain-native jurisdiction”, where assets such as real estate, land and property rights could be tokenised by default, with residents using digital wallets for transactions.

Authorities say tokenisation would increase transparency, cut transaction costs and attract international capital.

The zone will operate under British common law, offering what Alatau City Authority head Alisher Abdykadyrov calls a “familiar and predictable legal framework” for investors.

A special tax regime — including incentives on corporate income tax and VAT — is designed to improve returns and position the city as a safe harbour for digital assets.

The project will also serve as a large-scale regulatory sandbox, allowing startups to test blockchain and fintech products in real-world conditions before scaling.

Beyond crypto, the zone plans to pilot other technologies, including blockchain analytics, crypto forensics and an electric air taxi service using eVTOL aircraft integrated into the Almaty transport network.

Crypto Forensic Laboratory

Alongside expanding the crypto market, Kazakhstan is also strengthening enforcement.

The government has opened Central Asia’s first Crypto Forensic Laboratory, based at Nazarbayev University, to detect illicit activity and improve transparency in digital asset transactions.

The lab works with law enforcement to trace blockchain transactions, map suspicious networks and identify the individuals behind them. Officials say the goal is to protect users and prevent cryptocurrencies from being used for fraud, drug trafficking or other criminal schemes.

Since 2023, the team — which includes university students and forensic specialists — has reviewed around 40 cases linked to illegal or suspicious crypto activity. Many investigations take months or even years to complete.

“In most fraud cases, the trail is relatively short — usually no more than five hops to a centralised exchange, where we can request KYC data and identify accounts,” said crypto forensic analyst Azamat Atikeyev. “But some actors use more sophisticated tools, such as zero-knowledge technologies, which makes investigations longer and more complex.”

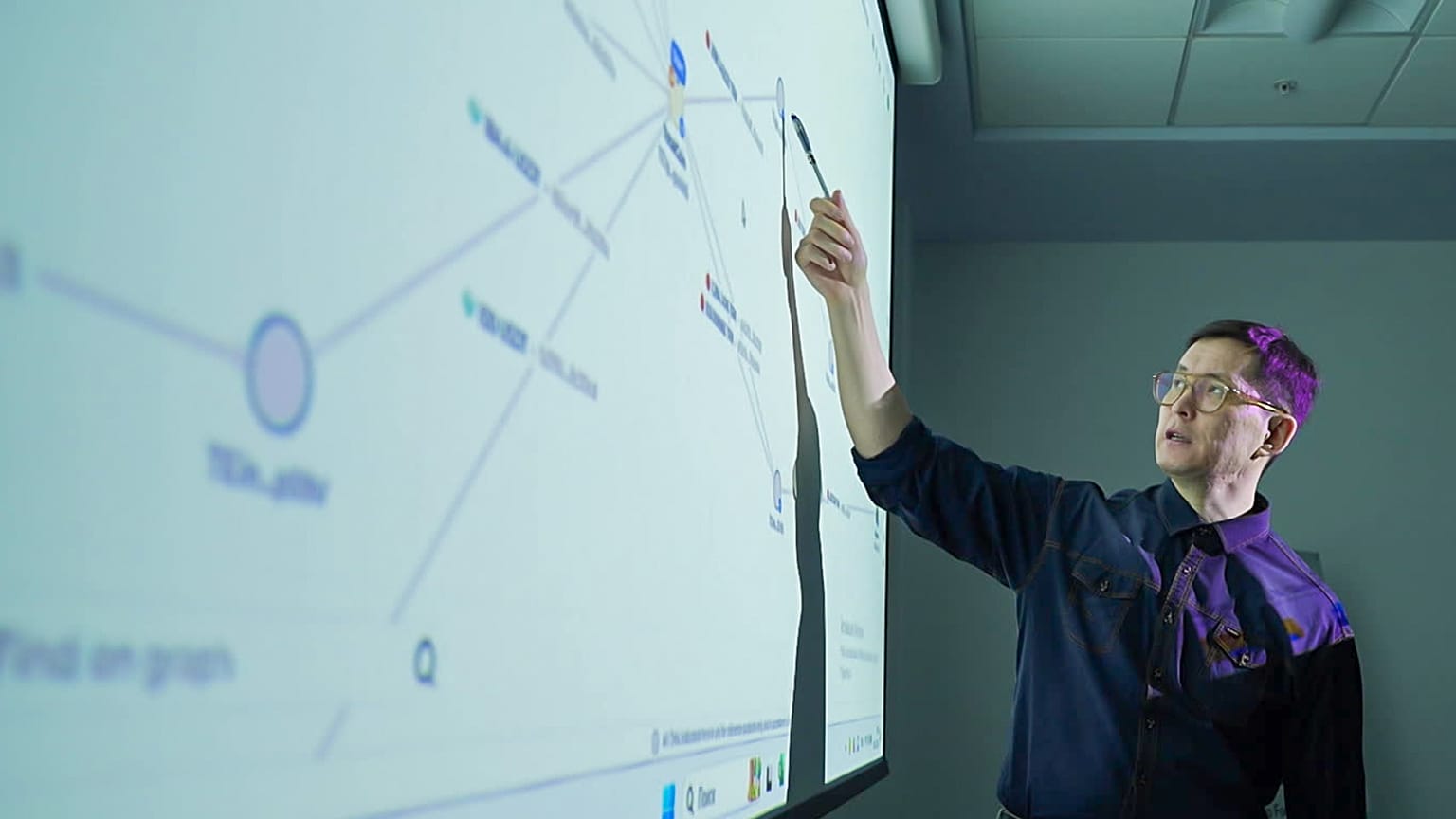

Using blockchain analytics platforms such as Global Ledger, the lab tracks transactions, builds visual maps of fund flows and produces reports that are later submitted to exchanges or used as evidence in court.

Beyond investigations, the centre also trains prosecutors and financial crime specialists, helping build local expertise in crypto compliance.

Interest is already spreading beyond Kazakhstan. “We’ve started receiving requests from neighbouring countries,” Atikeyev said, pointing to potential cooperation across the wider CIS region.

In a bid to become one of Eurasia’s leading crypto hubs, Kazakhstan is pairing market liberalisation with tighter oversight. The goal is to build trust in the sector and position the country as a regulated destination for digital assets.