Surveys show that most Europeans still expect grocery prices to rise this year, despite ECB expectations that food costs increases will cool.

Food inflation in the EU is expected to outpace overall inflation in 2025. Eurostat data put the rise in prices for food and non-alcoholic beverages at 3.3%, compared with an overall inflation rate of 2.5%.

In the eurozone, the European Central Bank projects that food inflation will ease as the impact of earlier increases in global food commodity prices and adverse summer weather fades, before stabilising slightly above 2% by late 2026.

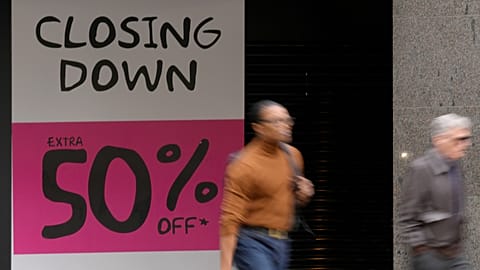

Even so, consumer sentiment suggests price pressures still feel acute.

ING Consumer Research finds that rising food prices remain a key concern for EU consumers in 2026, with many expecting grocery prices to keep increasing quickly — especially in countries where food and non-alcoholic beverages account for a large share of household spending.

When it comes to expectations of an improvement in purchasing power, pessimists outnumber those who are hopeful.

So how are food prices expected to evolve across Europe in 2026? Where do consumers expect further increases? And how does the share of food in household budgets vary across Europe?

Price fears exceed 60% in three countries

Overall, 58% of respondents said they strongly agreed or agreed with the statement: “I expect the price level of groceries in my country to increase more rapidly over the next 12 months.”

Just 14% of respondents across the six countries disagreed. ING economist Thijs Geijer described this as a sign that price pressures are slowing — while cautioning that many households still feel the legacy of recent food inflation.

“It’s a sign that many consumers are mentally prepared or preparing for even higher inflation,” Geijer said. He added that consumers may need to see inflation moderating for longer before their expectations shift.

The ING survey covered six European countries — Germany, Spain, the Netherlands, Belgium, Poland and Romania — with around 1,000 respondents in each.

Except for Spain, concern about rising prices was higher across the other countries, exceeding two in three people in some cases. In Romania, 73% of respondents expect grocery prices to rise more rapidly over the next 12 months. The figure is 66% in Belgium and 64% in the Netherlands.

In Germany, more than half of respondents (57%) expect grocery prices to rise faster, while the figure in Poland is close to half (49%).

Why is Spain’s rate lower?

Spain records the lowest share, with only around two in five (39%) holding this expectation.

Spain’s economy grew by 2.8% in 2025, well above the eurozone average of 1.5%. Lower energy prices and easing inflation have helped sustain consumer confidence and encouraged spending.

Data from Indeed also shows that Spain ranks second among the five largest European economies for job postings, which stood 54% above pre-pandemic levels as of late 2025.

OECD projections also place Spain at the top among Europe’s five largest economies, with real GDP growth expected at 2.2%, compared with 1.2% in both the euro area and the UK.

The OECD expects that strong job creation and real wage growth will continue to support private consumption in Spain.

Consumers sceptical

Are European consumers hopeful about an improvement in purchasing power? Not particularly.

Across six countries, 39% of respondents disagreed with the statement, “I expect my purchasing power in 2026 to increase compared with this year”, well above the 29% who agreed.

“Even with real wages largely recovered, consumers remain downbeat about their purchasing power heading into 2026,” said ING economist Thijs Geijer.

Germany shows the highest level of pessimism, with more than half of respondents (53%) disagreeing with the statement, closely followed by Belgium (50%).

The share of respondents expressing pessimism is lower elsewhere, standing at 40% in the Netherlands, 36% in Poland and 34% in Romania.

Spain again stands out. Only 18% of respondents do not expect an improvement in purchasing power, while more than half (52%) agree with the statement, pointing to a more optimistic outlook.

Geijer noted that Spanish consumers are considerably more upbeat, likely reflecting the relatively strong improvement in real wages over the past few years.

Food inflation versus household spending share

There is a positive correlation between average annual inflation in food and non-alcoholic beverages and their share in household spending. As one rises, the other tends to increase as well. The relationship is not perfect, but it is fairly strong.

This means some countries are hit harder, as they face higher food inflation while households also spend a larger share of their budgets on food.

For example, in Romania, food inflation stood at 6.8% in 2025, while households spent 23.1% of their budgets on food and beverages.

This pattern is generally observed across several Eastern European and Balkan countries.