"I liken it to giving the keys of a sports car to a 12-year-old," said Tara Falcone, a certified financial planner and the founder of ReisUP, a financial education company.

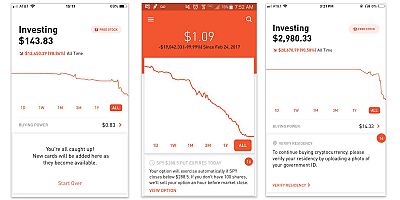

When smartphone owners pull up Robinhood's investment app, they're greeted with a variety of dazzling touches: bursts of confetti to celebrate transactions, the price of bitcoin in neon pink and a list of popular stocks to trade.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

Charles Schwab, meet Candy Crush.

Robinhood, started in 2013, is the most popular of a wave of apps to have emerged in recent years that try to reinvent the previously staid world of personal finance for the smartphone era. Its promise of zero-commission stock trades has helped it grow to more than 6 million users and a valuation of more than $5 billion.

While most financial services companies now offer mobile apps, they tend to be smaller version of their sober websites, geared at keeping users informed and educated while also offering the chance to trade. By comparison, Robinhood's technicolor interface encourages users to buy and sell investments in a slick, smartphone-native environment.

But personal finance experts who spoke to NBC News said that the app's success comes with some risk for consumers, particularly those new to investing. Rather than directing users to adopt a coherent strategy, the app pushes riskier options like individual stocks and cryptocurrencies — and even offers trading on borrowed money, known as margin, and options trading, both of which are used by advanced investors but carry extreme risk.

"I liken it to giving the keys of a sports car to a 12-year-old," said Tara Falcone, a certified financial planner and the founder of ReisUP, a financial education company.

The way that tech companies design their apps — most notably the tricks they employ to spur user engagement — is under more scrutiny than ever before. Facebook and Instagram have been criticized for encouraging endless scrolling through social media feeds, while YouTube's recommendations system that works to keep users watching has been blamed for pushing users toward videos of conspiracy theories and extremist rhetoric.

Robinhood has said it's democratizing America's financial system because it doesn't charge commissions to execute trades.

The app has elements of fun, echoing in subtle ways the congratulatory elements of smartphone games that spur users to keep playing. Financial professionals say those elements encourage people — many of them young and inexperienced — to celebrate day-trading and develop risky habits that will cost users money over time.

The look of numbers showing a stock rising or falling or bursts of confetti matter because they can nudge users toward either long-term financial success or potentially problematic habits or speculative ideas, experts said.

"Any sort of nudges that investors get through these technologies are affecting behaviors," said Brad Barber, a finance professor at the University of California, Davis.

Prajwal Shetty, 39, an engineer in the Los Angeles area who has used Robinhood as well as other brokers, said that Robinhood is attractive to people who are just starting out in investing because it doesn't charge commissions, making it appear to be free to use.

But he said the app offers a toxic combination for people who aren't careful, with low bars to trading on borrowed money and on options, which are contracts that are easy for newcomers to lose money on.

"All these new kids are coming in," Shetty said. "Everything isn't free. There are serious downsides to this if things go wrong."

Trade offs

Financial professionals point to what Robinhood has chosen to put on the first page of its app, and what it hasn't. A ticker for bitcoin is prominent, as are quotes for stocks with big daily swings in price, while exchange-traded funds — a low-cost way of diversifying a stock portfolio — are difficult to find.

"With the people that I work with, who are mostly young college students and college grads, the user interface and user experience of Robinhood really does lead people to get into individual stocks and cryptocurrency," Falcone said.

The app doesn't present users with a lengthy questionnaire about what strategy they want to follow, she added.

Researchers have known for decades that people who trade stocks frequently are likely to get lower returns over time. That's in part because the churn of buying and selling has traditionally racked up commissions for each trade.

In the case of Robinhood, which doesn't charge commissions, each trade may come with a hidden cost that adds up the more someone trades. Robinhood's business model is based in large part on sending orders through high-speed trading firms — a practice known as selling order flow that may result in customers getting worse prices.

"Anytime someone is providing information, you have to think about: What is their incentive?" said Henrik Cronqvist, a finance professor at the University of Miami Business School. "If there's something you can do as broker that would generate trading among your clients, that's how you would benefit more."

Robinhood declined requests for interviews about the design of its app. The company says in the fine print on its website that it provides services to "self-directed" customers and does not provide investment advice.

The app's popularity has spurred some communities to form around it. On Facebook, there area variety of groups dedicated to trading everything from penny stocks to cryptocurrencies on Robinhood.

The app has a particularly dedicated following in a notorious and at times toxic Reddit community called "wallstreetbets," in which people speculate on trades and discuss investment strategy alongside memes and jokes. Users often post screenshots from the Robinhood app of wild swingsin their investments, occasionally joking about suicide when they lose money.

The community even has a rule that a Robinhood screenshot must be of at least $10,000 in stock or $2,500 in options. "You can trade stocks/options, futures, forex, and even crypto with degenerate fly-by-night brokerages like Robinhood," the community's frequently-asked-questions section states.

In May, one user posted a screenshot of an email he received from Robinhood in which the company asked for more than $100,000 due to losses on a margin position. The same user later posted an update that he had been able to cover the costs through profits in other trades.

"Thanks for all the kind words and suicide advice though!" the user wrote.

Vested interests

Robinhood's promise of low-cost stock trading has paid off. The company, based in Menlo Park, California, was valued at $5.6 billion during a funding round last year and is preparing for a possible initial public offering.

The company also raised a sizable amount of venture capital, bringing in a total of $862 million, according to Crunchbase, a database that track startups.

The company's co-founders, Baiju Bhatt and Vladimir Tenev, are Stanford graduates who majored in mathematics. They worked on software for big investment banks and have said that the Occupy Wall Street protests of 2011 inspired them to start a no-commission trading app.

They've also said investment habits aren't their primary concern.

"The bigger problem is that people don't have savings," Bhatt told Fast Company in an interview for a 2017 article. People using Robinhood save more money than they otherwise would, he told the magazine, and at the time the median age of users was 28.

The company, though, has also acknowledged that it is very aware of the implications of its design choices.

In 2015, after Apple gave Robinhood an award for design, Robinhood said in a blog post: "Design is core to what we do. It determines the directions we take, the features we build, and the ways we communicate with our customers. It's our hope that the carefully-crafted Robinhood experience will inspire more and more people to start investing."

Back then, Silicon Valley was still celebrating the idea that startup businesses should try to grow as quickly as possible to reach a mass audience, a concept known as growth hacking. But the stakes behind addictive apps are different for photo sharing than they are for managing investments.

If something goes wrong on the Robinhood app, "it's not Facebook, where you can't put your cat picture up. Some people use this platform to make a living," said Jeffrey Pederson, a lawyer in Colorado who represents investors in disputes with brokers, including Robinhood.

By design

Even small choices that app designers make can affect behavior. One study in 2017 found that showing investment losses in the color red reduces people's appetite for risk, which may cause them to overreact to a falling stock or assume it will keep falling.

"There are many signs in our lives where red means, 'be cautious, be careful,'" said Cronqvist, one of the authors of the study. He noted that stop signs are red, and teachers often use the color red to grade papers. "This should not influence people in a rational market sense, but what we found is that it does influence people," he said.

Another recent study examined what happened when a brokerage changed the display of portfolio information to make capital gains more prominent. It found that investors changed their behavior around selling, making it more likely that they would sell winning investments and hold on to losing investments.

Betterment, another startup brokerage based in New York and a competitor to Robinhood, said it is taking such research into account when making design decisions about its app. Although it shows some numbers in bright colors, it does so to tell users whether they're on track to meet long-term goals rather than what's happening with short-term swings in the market. The company, which collects management fees, says it actively tries to discourage day-trading.

"It's almost like being in Las Vegas," Dan Egan, Betterment's managing director of behavioral finance and investing, said of other investment apps though he did not call any out by name. "They want to maximize the emotional impact of seeing that number."

"You can see in the design the incentives of the company, and the incentives of the company will drive the design," Egan said.