Russia’s partial blocade of Ukrainian grain exports as well as extreme weather events have fuelled fears about global food supplies, but things may not be as bad as they seem, according to the OECD.

The global grain export outlook had to be amended after major exporter Ukraine once again began to face Russian military threat on its shipments on the Black Sea. The situation has been aggravated by extreme heat decimating the produce of the world’s largest exporters in Asia, and India announcing a partial ban on its rice exports.

This perfect storm of diminishing grain supplies and heat waves has inflamed fears that global food security could be in dire straits. But are these concerns well-founded?

Why has Russia’s invasion of Ukraine been so dangerous for food supplies?

Since Moscow pulled out of the Black Sea Grain Initiative in July 2023, there’s been no guarantee of safe passage for tens of millions of tonnes of produce from Ukraine.

Russia has blockaded the country’s Black Sea ports, and ships that carry grain are under the constant threat of attack by its forces.

Turkey and the UN are currently in discussions with Moscow to restore the deal, which would allow Ukrainian grain vessels to pass through unhindered. However, President Vladimir Putin poured cold water on any sense of that happening after talks with his Turkish counterpart Recep Tayyip Erdoğan on Monday, demanding first that the West facilitate Russian agricultural exports.

Both Russia and Ukraine are two of the world's key agricultural producers and major suppliers of grains such as wheat, maize, and oilseeds such as rapeseed and sunflower seed, many of which developing African nations rely on.

According to the UN, while the Black Sea Grain Initiative was in place, low and middle-income countries collectively received 57% of the grain leaving those ports.

The World Food Programme, which provides food assistance worldwide, got half of its wheat supply from Ukrainian export last year and more than three quarters this year, which was sent to countries with low food security such as Somalia, Sudan, and Yemen.

Other African countries also import a large proportion of their cereals through the Black Sea region.

The African Development Bank (ADB) estimates that 15 out of 54 African nations buy more than half their wheat from either Ukraine or Russia.

Many of these countries face high inflation and growing difficulties in feeding their populations, and the strengthening dollar, a reaction to tense and uncertain geopolitics, has further escalated the problem.

“Some of these countries have been victims of a triple shock,” said Marion Jansen, director for trade and agriculture at the OECD. “Originally, the dollar price of grains went up. On top of that, the dollar became more expensive. And on top of that, those countries were suffering from supply chain shocks in logistics.”

Extreme heat takes a toll on crops across Asia

It’s not just the war that is threatening global food security, but the weather too. Both rice and wheat supplies are now facing alarming shortages.

China’s grain production has suffered significantly from the extreme heat, mainly due to the intensification of El Niño. The climatic phenomenon, which triggers changes in temperature and rainfall, has impacted grain produce across Asia.

Forecasts for lower rainfall in September are further threatening to disrupt supplies.

“We are still waiting for the official numbers of these [cereal production in China, ed.] to come out, but these are things that can impact markets,” explained Jansen.

Meanwhile India, which accounts for 40% of global rice exports, has announced an export ban on non-basmati white rice and broken rice, to curb high prices inside the country, essentially halving Indian rice exports.

The lack of rain has also taken a toll on Australia's wheat output.

"Wheat production is going to be three million (metric) tonnes lower than our initial estimate of 33 million tonnes," Ole Houe, director of advisory services at agricultural brokerage IKON Commodities, told Reuters. "If the dryness continues in September, we are looking at an even lower crop."

How much produce is missing from the food market?

With grain exports stalled in Ukraine and the heat wreaking havoc with crop production in Asia, you might be wondering just how much of a shortfall there is.

In July, the UN’s Food and Agriculture Organization had foreseen record high production: 2,819 million tonnes in 2023, 1.1% higher than in the previous year.

Since then, the latest data from the International Grains Council’s August forecasts has suggested a lower output, but also a strong global production with just below 2,230 million tonnes of produce worldwide.

The report also notes the increasing risks stemming from global supply uncertainty.

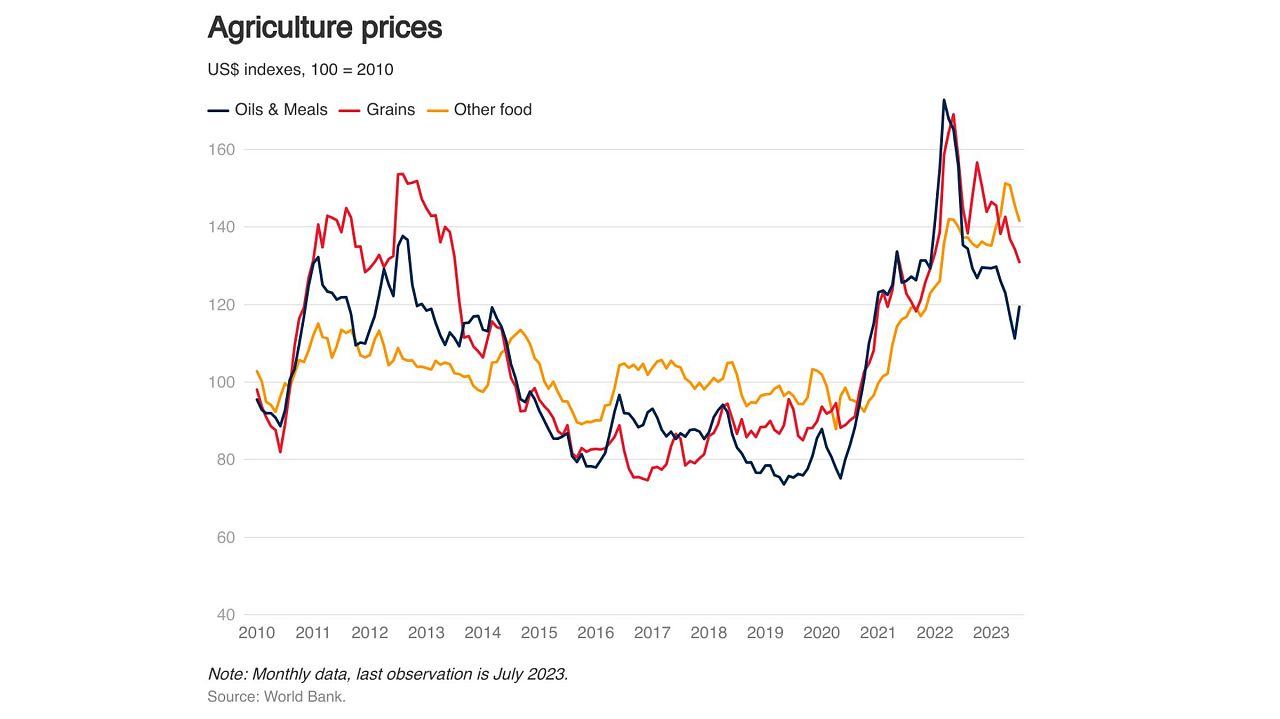

The Council doesn’t exclude a price rally in grains and oilseeds due to the situation in Ukraine. The IMF previously estimated a 10-15% rise in grain prices if the Black Sea Grain Initiative is not restored.

However, recent events are unlikely to cause a seismic shift in the global food industry, according to the OECD.

“Now we are seeing a slight downward adjustment because of the weather conditions in places like Canada, Europe, and also China.” said Jansen. “So far we do not have the impression that we expect big shocks in terms of renewed big price increases.”

“Production has adjusted, logistics chains have adjusted and this will continue to happen,“ she explained.

“What is very important in situations like this, is for countries to remain calm and not contribute to nervousness in the market by, for instance, introducing new export restrictions because this could drive prices up again,“ Jansen added.

Restoring Ukrainian exports to their full potential remains crucial, especially seeing as the country foresees a better cereal yield than expected, along with Kazakhstan. But with talks between Moscow and the West stalled, the grain deal’s future remains uncertain.

Nevertheless, overall output can be supported by the winter wheat production in the Americas. The US has a good chance to benefit from above-average precipitation in southern states from November to February: a positive by-product of El Niño.

South American weather is also expected to be crop-friendly for soybeans and corn which will be harvested in early 2024.