The economy is showing signs of steady improvement, with lower borrowing costs and increased investment interest. The ESM and MSCI acknowledge progress, but warn of risks from a more uncertain international environment.

The Greek economy seems to have come a long way since the crisis years. Borrowing costs have dropped significantly, access to markets has become much easier, and the country is now viewed with greater confidence by international investors.

On the back of Greece's economic recovery, the nation now faces a new prospect: a possible return to developed markets. Even so, analysts note that returning to “normal” can also bring new risks, notably as the Greek economy becomes increasingly exposed to external shocks.

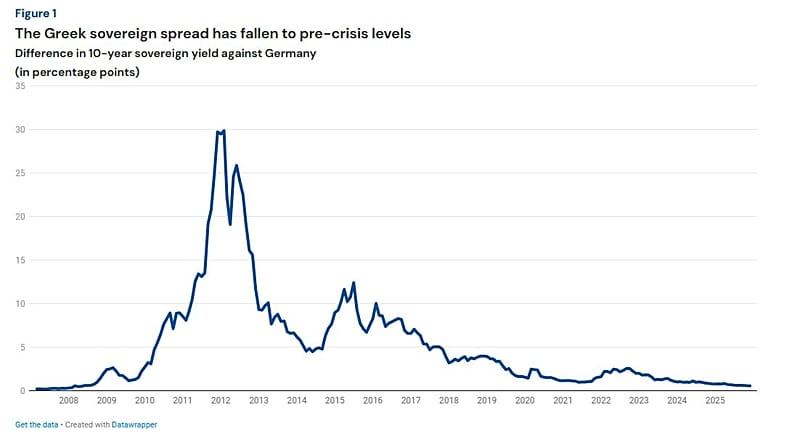

According to analysis published by analyst Mathias Gnevoch at the European Stability Mechanism (ESM), European sovereign bond markets have been largely re-consolidated since 2019, following years of fragmentation that followed the eurozone debt crisis. For Greece, this translates into a clear improvement in funding conditions.

In May 2025, the Greek 10-year government bond spread over the German Bund fell below 80 basis points for the first time since 2007. These levels are reminiscent of the pre-crisis period, when eurozone government bonds were regarded by markets as almost equivalent.

This development reflects the strong recovery of the Greek economy in recent years, with solid growth rates, sustainable fiscal surpluses, and a steady decline in the debt-to-GDP ratio since 2021.

The return of investors

Alongside lower borrowing costs, Greece is facing a second important development. MSCI Inc. has launched a public consultation on the potential reclassification of the Greek stock market from the Emerging Markets category to Developed Markets status.

MSCI is one of the world’s leading providers of stock indices, data, and market analysis. Its indices are used by investors, fund managers, banks, and insurance companies worldwide to make investment decisions and create financial products. By analysing risks and opportunities, MSCI acts as a “common language” for global markets, directly influencing the flow of international capital.

On a practical level, such an upgrade would mean that the Greek market is seen by international investors as more mature and reliable. Many large investment funds, such as pension funds and institutional investors, base their allocations on MSCI indices. Inclusion in Developed Markets would make Greece “visible” to a wider and more stable investor base.

This could lead to increased capital inflows into the Greek stock market, greater liquidity for listed companies, and lower financing costs for businesses. At the same time, it would serve as a strong signal of confidence in the country’s overall image abroad.

MSCI has already acknowledged that Greece meets the criteria for economic growth and has made progress in market accessibility and operations. In the past, the main hurdle was market size and liquidity, issues that are now being reassessed in light of broader European market integration. The final decision is expected by the end of March 2026, with implementation likely in the August 2026 index review.

New risks in a more "integrated" environment

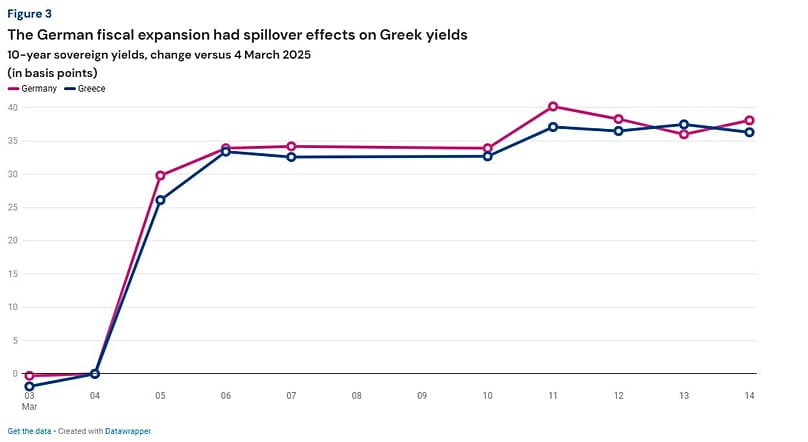

However, both the ESM analyst and other institutions point out that reintegration into the European economic “mainstream” does not only bring benefits. More integrated markets also mean stronger spillover effects between countries.

In practice, this means that Greek bond yields are now much more influenced by developments in the major eurozone economies. For example, a major fiscal expansion announced in Germany in March 2025 led to an increase of about 35 basis points in the German 10-year yield, with Greek yields following almost the same path.

While this correlation is a sign of a return to European normality, it also increases Greece's exposure to external risks that are not directly related to domestic economic performance.

Balancing progress and caution

The ESM analyst warns that, despite the significant narrowing of spreads, the risk of them widening again remains, particularly if economic conditions in the eurozone deteriorate or unforeseen international developments occur. Trade tensions or unexpected fiscal decisions in major economies can directly affect Greece’s borrowing costs.

In this environment, the progress made is significant, but not guaranteed. Maintaining prudent fiscal policies, further reducing debt, and strengthening the economy’s resilience remain essential to ensure that the benefits of returning to European “normalcy” are lasting.