While some lawmakers fear what Beijing will do with the advanced tech, others stress that restrictions will only force China’s homegrown industry to innovate.

The US has eased export restrictions on the sale of Nvidia’s H200 chip to China, according to a regulation published on Tuesday by the Department of Commerce.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

Export applications will now be considered on a case-by-case basis, rather than starting from a presumption of denial.

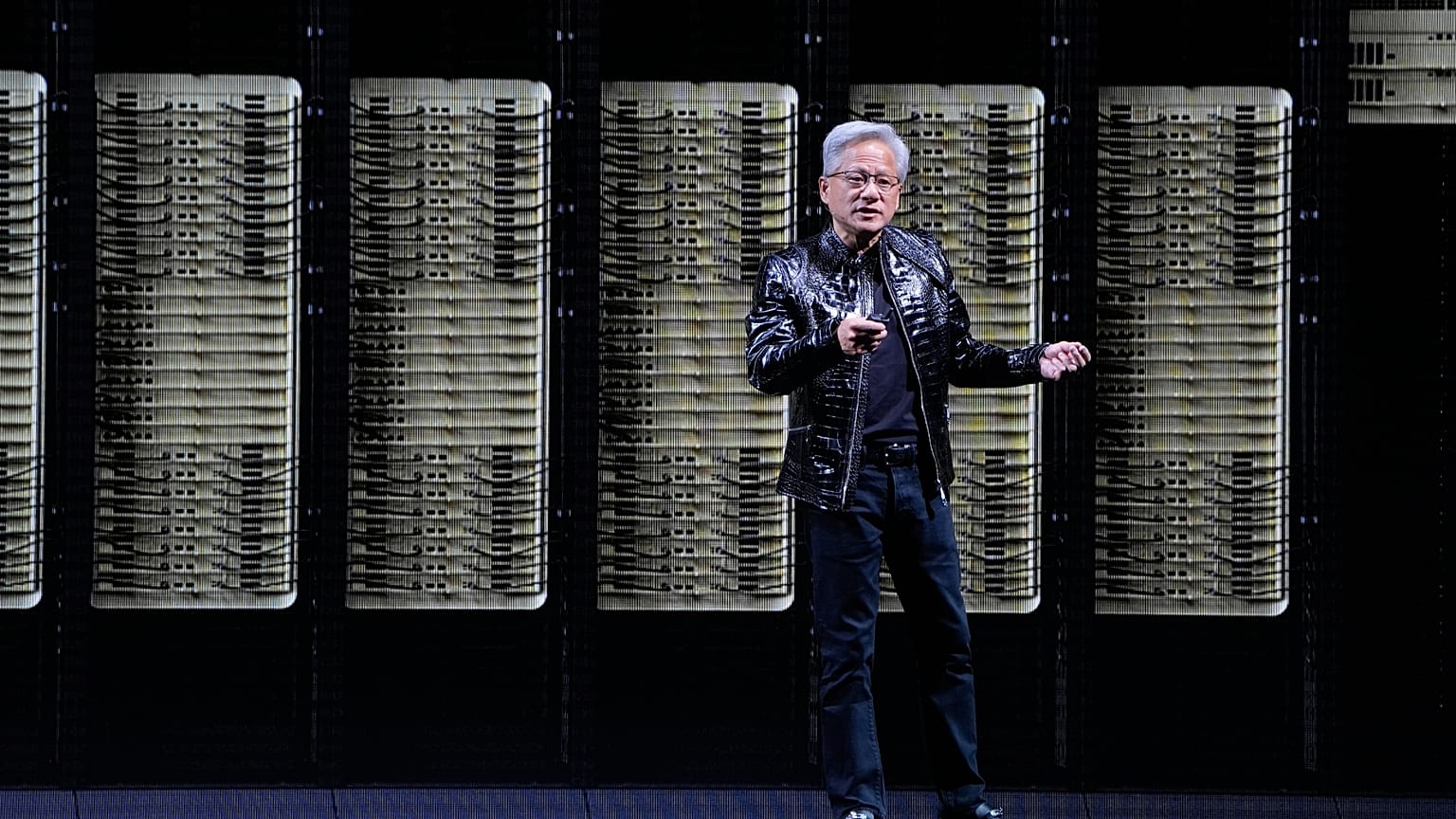

This comes after President Trump said last month that advanced chips could be sent to “approved customers” in China for a 25% government surcharge — following months of lobbying by Nvidia CEO Jensen Huang.

National security concerns had previously led the administration to restrict exports as lawmakers feared that China could use the semiconductors for military purposes.

To address these risks, the new regulation comes with a series of conditions. For example, the chips must be reviewed by a third-party testing lab to confirm their performance capabilities before they can be shipped to China.

Added to this, there must be a sufficient supply of chips in the US for exports to be permitted, and China cannot receive more than 50% of the total products made for the US market. Exporters must apply “Know Your Customer” procedures that verify who the customer is and how the product will be used — intended to “prevent unauthorised remote access to unauthorised parties”.

The updated regulation applies to the H200 chip, Nvidia’s second-most-advanced semiconductor, as well as less advanced products. The firm’s more sophisticated Blackwell processor and the upcoming Rubin model are not part of the deal.

The rules also apply to advanced chips made by rival firms like AMD.

“We applaud President Trump's decision to allow America's chip industry to compete to support high paying jobs and manufacturing in America,” a Nvidia spokesperson told Euronews, adding that the updated regulation “strikes a thoughtful balance”.

“The Administration's critics are unintentionally promoting the interests of foreign competitors on US entity lists,” the spokesperson claimed. “America should always want its industry to compete for vetted and approved commercial business, supporting real jobs for real Americans.”

As the US-China technology race intensifies, semiconductors have become a strategic flashpoint as both sides attempt to disrupt the other’s progress. These tiny chips are used to power a range of electronic devices from smartphones to medical equipment, and they’re essential to AI processing.

While the US is currently the global leader in semiconductor production, China is gaining ground. Critics of Washington’s export bans argue that by restricting access to Nvidia technology, Chinese firms will be forced to innovate, therefore benefitting Beijing in the long run.

Understanding this logic, the Chinese government reportedly ordered its tech companies to boycott Nvidia's chips after Trump lifted an export ban on the less advanced H20 chip in July last year. The ban was originally imposed by the president in April despite the fact that the chip had been designed to comply with Biden-era export curbs.

The H200 delivers roughly six times the performance of the H20.

For Nvidia, Tuesday’s decision represents another win after months of seeking favour with US President Donald Trump. Until China’s domestic capabilities improve, demand for the H200 will remain strong unless Beijing imposes a stricter ban on US chips. This will bolster revenues for Nvidia, even though the Trump administration will continue to take a 25% cut of the sales.

According to a Reuters report from late December, Chinese technology companies have placed orders for more than 2 million H200 chips for 2026, exceeding Nvidia’s inventory of 700,000 of these processors.