Even if the U.S. economy is slowing, that doesn’t mean we're headed back to the dark days of the Great Recession.

Suddenly they're everywhere, the modern-day Paul Reveres with their distressed cry: "The Recession is coming!" You can hardly blame them for worrying, what with the frantic ups and downs of the stock market and China's destabilizing decision to let the value of its currency fall.

But this whole mindset is terribly misguided, as if the United States has just two economic gears: strong growth or deep recession; plentiful jobs or vicious unemployment. There's actually a lot of space in between — for slowing growth and mild recessions — so, even if there is a downturn ahead, it’s way too early to fret about widespread layoffs or collapsing home values.

Trouble is, the scars from the Great Recession of 2008 run deep. The memory of that fall from the best to the worst of times has locked us into this all-or-nothing view, where every unpromising sign seems like it might set off another tragedy for U.S. businesses, workers and homeowners.

But we need to move past that collective trauma, because it’s stoking panic and distorting our sense of economic reality. Even if the U.S. economy is slowing, that doesn’t necessarily mean we're headed back to the dark days of 2008. More likely, we are facing a “lesser” recession rather than a “great” one, like the damaging but not cataclysmic downturns of 1990 and 2001, when the unemployment rate rose 2-3 percentage points rather than 5.

One positive sign is that there's no obvious bubble ready to burst: Home prices are high right now but not as extreme as in 2006; stock prices seem elevated but again, not like the dot-com years. And corporate debt, which sometimes gets invoked as the true bubble of our time, just doesn't seem big enough to trigger a systemic crisis. (And while you might be thinking, "Maybe there’s a bubble that we just can't see," it's worth remembering that the housing and dot-com risks were widely espied — and decried — before the pop.)

Note, too, that many of the flashing yellow lights right now are coming from Wall Street, not Main Street. Stocks seem to have become more volatile and investors are racing toward long-term bonds, a sign they’re worried about near-term troubles. But back in the real economy, most indicators suggest something less dire.

Take gross domestic product. It grew slightly faster than expected in the second quarter, thanks to strong consumer spending. And while more recent numbers show a slowdown in both the manufacturing and nonmanufacturing sectors, those areas are still expected to grow — not shrink. Some slowing down was virtually inevitable following the short-term bounce from the Republican tax cuts that boosted economic activity last year. Meanwhile, the labor market remains extremely strong, with unemployment at 50-year lows and morejob openings than companies can readily fill.

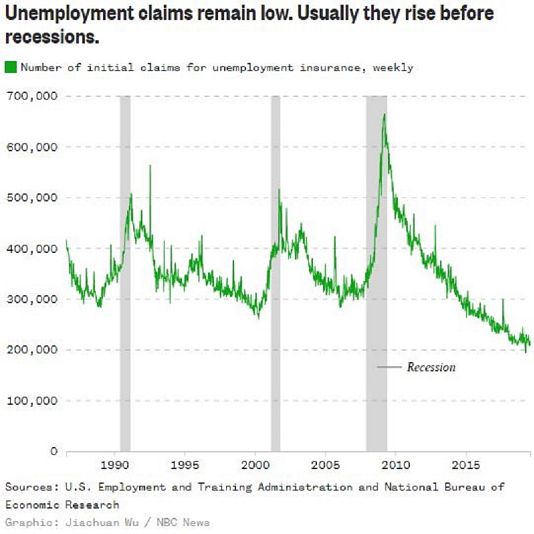

True, some of these are are lagging indicators — the kind that don't decline until a downturn has already taken hold. But consider one of the indicators that usually changes before recessions hit: initial claims for unemployment insurance. New claims for unemployment rose for a year before the 2001 recession, and again for six months leading up to the last downturn. This time around, there's absolutely no sign of an increase.

Does this mean today's recession fears are completely unfounded? Not necessarily. But recessions come in many forms and there's a lot of economic room between where we are today and where we were in 2008. Just because the Great Recession took the U.S. economy and knocked it down a flight of stairs doesn't mean that's the norm. Sometimes you get pushed back just a stair or two, which means fewer real-world black and blue marks and a speedier trip back to the top.

As hope goes, maybe this doesn’t amount to much; no doubt it’d be preferable if the big question were "How fast can growth get?" rather than "How deep will our downturn be?" Still, it’s important not to exaggerate the risk. The lingering trauma of the Great Recession has made it hard to remember that there are lesser recessions, too. And if we are really headed toward a downturn, that's the most likely kind.

Evan Horowitz is the director of research communication at FCLT Global, a financial think tank. The views expressed here are his own.

This piece was first published by NBC Think.

_________

Are you a recognised expert in your field? At Euronews, we believe all views matter. Contact us at view@euronews.com to send pitches or submissions and be part of the conversation.