UBS has bucked the trend downwards on the European markets, bolstered by rumours it is about to massively restructure.

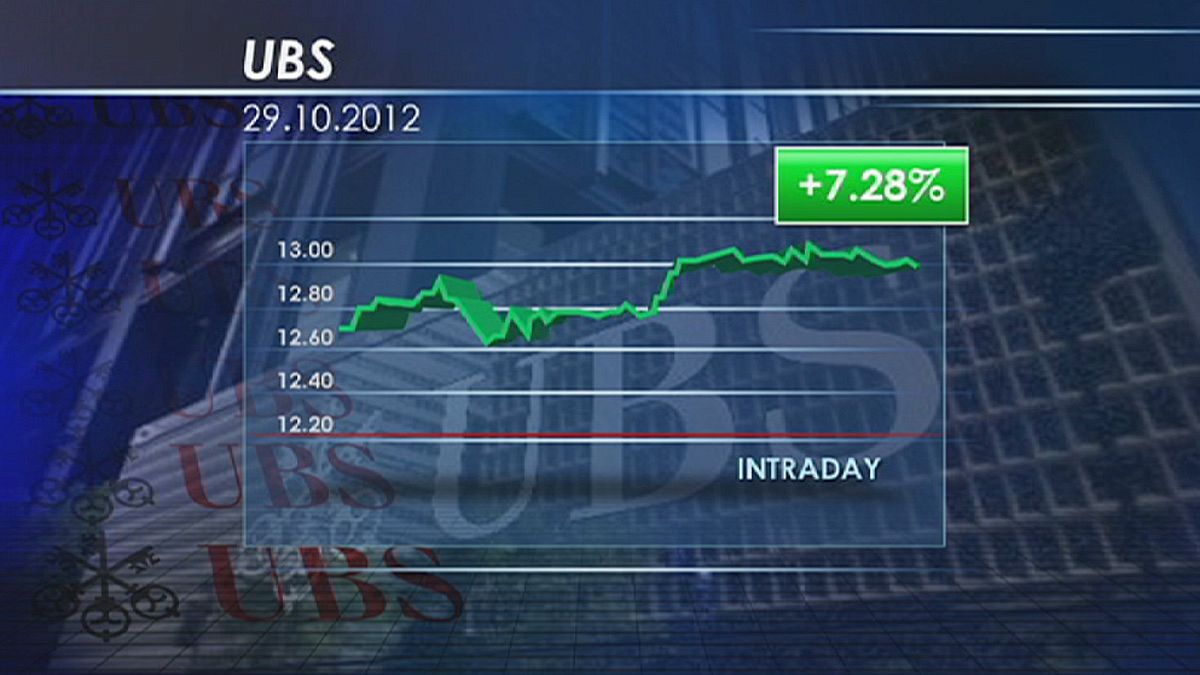

Shares in Switzerland’s largest bank closed up more than 7% in Zürich, the highest riser on a falling SMI.

The economic press thinks UBS may take advantage of its quarterly results, published on Tuesday to announce up to 10,000 job losses, or 16% of the global workforce.

Cuts will mostly fall in the investment bank division which currently accounts for a third of UBS group’s operating profit.

However, with tougher banking rules coming in the investment arm’s activities require more and more capital, and so profits dwindle. The idea is to reorient the bank around its core activities, which internationally means wealth management that reaps double-digit returns. In Switzerland UBS will retain its retail banking operation.

Since the start of the subprime crisis in America in July 2007, UBS has lost 82% of its value on the stock exchanges.

This, added to problems at the investment banking division meant UBS had to launch a rescue plan in 2008.

The share has risen by more than 17% this year.