With a prudent approach and a dose of humility, Global Gateway may achieve for the EU what the BRI has yet to achieve for China — lasting influence at an acceptable cost, Rémi Meehan and Earl Wang write.

Scepticism of the European Union’s ability to execute big ideas is almost a cliché in foreign policy circles.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

Perhaps this is why media and talking heads have mostly dismissed or ignored Global Gateway, the EU’s ambitious €300 billion development financing strategy, or “connectivity” in Brussels parlance.

The criticisms are familiar: Global Gateway is too small to be effective. It is burdened by bureaucracy and social and environmental standards.

Yet despite its slow start, sceptics would be unwise to write it off too soon. Just last December, the EU signed a landmark Economic Partnership Agreement with Kenya — the first with an African state since 2016 — aiming at closer cooperation in trade, investment and sustainable development.

Today, Global Gateway is uniquely set up to succeed where other similar development financing initiatives have disappointed.

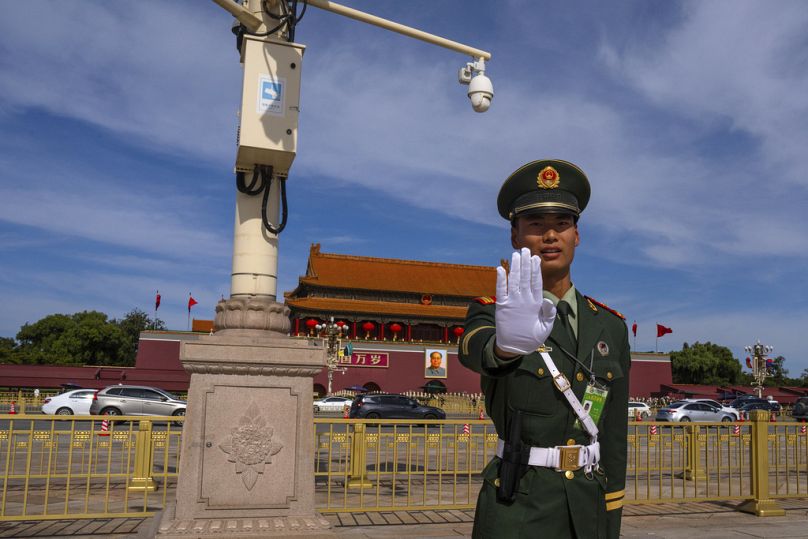

The geopolitical context of development finance has shifted substantially over the past decade. Once the undisputed leader in development financing, China quietly dialled back new Belt and Road Initiative (BRI) investments over the past four years.

Meanwhile, demand for new infrastructure spending in developing economies remains at an all-time high. The global infrastructure financing gap over the next 15 years is estimated at $15 trillion (€13.7tn).

With Global Gateway finally taking off, the EU is well-positioned to step in where China is stepping back—all while learning from China’s mistakes.

China’s BRI: Growing challenges and declining fortunes

Before the BRI’s launch in 2013, only 5% of China’s overseas lending portfolio was allocated to countries in financial distress.

By 2022, it had ballooned to 60%. Indeed, the list of countries trapped in bad BRI loans keeps getting longer.

When China does agree to delay interest payments or provide emergency refinancing, it often imposes stringent conditions, undercutting Beijing's image as a benevolent development partner.

In perhaps its most blatant act of financial aggression, China took control of Sri Lanka’s strategically located Hambantota Port in 2022 following Sri Lanka’s dramatic default, prompting cries of neo-colonialism and neo-imperialism. Other troubling examples abound.

In Montenegro, a failed highway project had loan terms that permitted China to seize Montenegro’s main port.

While more BRI loans have soured, China has also faced rising financial pressures at home. Just a month ago, Moody’s lowered China’s rating outlook to negative.

Prudence: The footprint of wisdom

The restructurings and looming insolvencies of BRI borrowers present opportunities for the EU. Despite being the world’s largest economy, the EU has struggled to turn its economic heft into strategic influence on the world stage.

Global Gateway offers an opportunity to change this dynamic and strengthen the EU’s global influence.

To succeed where the BRI has stumbled, Global Gateway is correct to prioritise prudent investments and avoid overextension.

Although only €66bn of Global Gateway’s total €300bn capacity is currently committed, these smaller sums can still have real impacts.

Sustainable development is most achievable at the project level, particularly when projects are carefully selected, follow best practices, and deeply engage local stakeholders.

As China’s overseas development challenges demonstrate, there is more to sustainable development than a big headline number. Global Gateway’s public-private model can supercharge the impact of its investments, increasing the number of successful projects.

Blended public-private financing structures can create a more attractive risk-reward profile for investors, drawing in additional capital from the private sector.

Global Gateway can also provide below-market financing to portions of projects, empowering developing countries to raise additional capital at market rates.

Combined with its commitment to EU social and environmental standards, Global Gateway’s collaborative investment approach helps ensure Global Gateway will avoid the backlash that has bedevilled many government-led BRI investments.

Focus on your strengths

To the EU’s credit, Global Gateway is rightly focused on five “areas of partnership” where the EU has a competitive advantage. These include digital, climate, transport, health, and education.

These areas match closely with the EU’s existing expertise and also fit neatly with the EU’s narrative of Global Gateway as a “values-based offer” that reflects EU social and environmental standards.

With this language, the EU is presenting Global Gateway as a friendlier, more sustainable option for development financing.

While some autocratic or authoritarian regimes may see this “valued-based offer” as a drawback and despite global democratic backsliding over the past decade, many people in the developing world still prefer democracy to any other form of government.

Afrobarometer, a pan-African, nonpartisan research organisation, found that 70% of respondents in Africa said democracy was their preferred form of government.

Research from the Arab Opinion Index demonstrated similar findings throughout the Middle East.

“De-risking” from China

The EU’s presentation of Global Gateway as another “investment option” for developing economies is also strategically sound. A common refrain from developing economies is that they do not want to choose between China and the US.

By presenting Global Gateway as a means for developing countries to “de-risk” from China should they choose to do so, Global Gateway is respecting the decision-making power of these nations and interacting with them as partners.

Moreover, “de-risking” works both ways. Just as developing economies may diversify their stock of foreign investments, the EU would gladly reorganise some of its supply chains from China to other more trusted economies — a notion of “ally-shoring” or “friend-shoring”.

China has historically been the indispensable global supplier of raw materials required for electric vehicle batteries, solar panels and wind turbines.

Already, Global Gateway projects in Namibia, Kazakhstan, and the Democratic Republic of Congo seek to secure Europe’s supply of critical raw materials for green technologies.

All aspects considered, despite the myriad criticisms of Global Gateway, the strategy remains a unique opportunity for the EU to grow its development brand and develop strategic influence commensurate with its economic strength.

The purported weaknesses of Global Gateway — its size, emphasis on best practices, and dependence on the private sector — may turn out to be features rather than bugs.

With a prudent approach and a dose of humility, Global Gateway may achieve for the EU what the BRI has yet to achieve for China — lasting influence at an acceptable cost.

Rémi Meehan is a doctoral researcher at the Centre for International Studies (CERI) at Sciences Po and former Executive Director at Morgan Stanley. Earl Wang is a doctoral researcher and adjunct lecturer at the Centre for International Studies (CERI)-Sciences Po/CNRS, a fellow at the Franco-German Observatory of the Indo-Pacific and is associated with the Institute for Strategic Research (IRSEM).

At Euronews, we believe all views matter. Contact us at view@euronews.com to send pitches or submissions and be part of the conversation.