Denmark's Nationalbank has called for economic caution with regard to future policy making, also predicting hovering inflation to come.

Denmark's Nationalbank has issued a stark warning about the continued threat of high inflation in the years ahead.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

In its latest forecast published on Wednesday, the central bank painted a picture of economic challenges and emphasised the need for prudent fiscal measures.

According to the Nationalbank's analysis, inflation in Denmark is projected to hover at around 3.8% this year and remain at 3% the following year, with wage increases identified as a primary driver of this persistent inflationary trend.

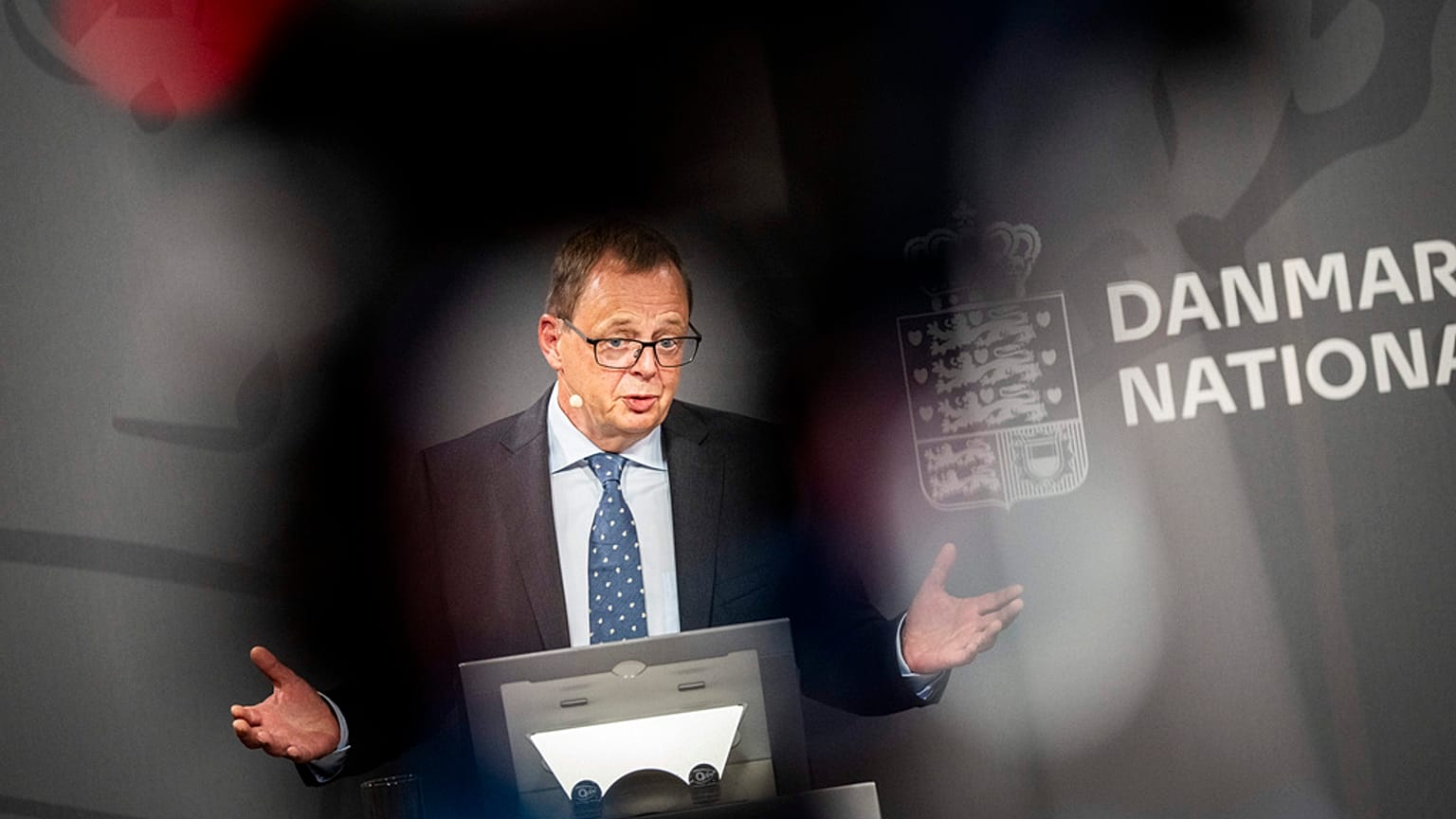

Nationalbank Director Christian Kettel Thomsen stressed the importance of careful decision-making by politicians that could impact the economy, stating, "We are still not where we need to be in relation to securing low and stable inflation in Denmark."

One noteworthy metric is core inflation, a measure that excludes energy and raw food products.

It’s expected to stand at a substantial 6.5% for this year and 3.5% for the next. The metric serves as an indicator of how deeply ingrained inflation has become within the economy.

Unlike some countries with explicit inflation targets, Denmark does not have a specific target, but the European Central Bank (ECB) and the UK have set their respective inflation goals at 2%.

While there has been a significant drop in inflation since its peak of over 20% in late 2022, the Nationalbank remains vigilant.

Thomsen pointed out that if current negotiations for the 2024 budget introduce measures that stimulate economic activity, there should be equally balanced measures to temper that activity.

Financial politics and economic policy going hand in hand

Interest rates have been raised for the tenth time since the previous summer, a move intended to slow inflation. Most recently, the central bank hiked inflation in keeping with the ECB's interest rate increase last Thursday.

Thomsen emphasised the importance of ensuring that "financial politics do not work against fiscal policies."

The Danish government's draft 2024 budget, presented at the end of the last month, aligns with the central bank's recommendations. It strikes a balance that the Nationalbank finds favourable, indicating that "financial politics should continue to enable a tight economic policy," as outlined in the current draft budget.

Despite the concerns voiced by the central bank about inflation, the Danish economy is anticipated to expand by 1.7% this year. This upward revision comes after initially forecasting a 0.9% GDP growth rate in March.

It’s clear that Denmark's policymakers face a challenging task in navigating the delicate balance between economic growth and inflation control. With the spectre of high inflation lingering, the Nationalbank's call for fiscal restraint underscores the importance of prudent economic decision-making in the coming years.