In the final instalment of this three-part series on the housing crisis in Ireland and Italy, Euronews examines the role of landlords in the Irish housing market, where one-third of people renting require financial assistance from the state to pay their rent.

Over 11,500 people facing homelessness in Ireland were forced to use emergency accommodation in December 2022, a 30 per cent increase on figures from the same month in 2021, according to a report published by the Irish Department of Housing.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

Some officials blame inflation for the unprecedented rise in homeless, as well as the government's failure to freeze rents and clamp down on vacant properties that could otherwise be used for emergency housing.

In their report published in May 2022, the Economic & Social Research Institute (ERSI) found that about 100,000 households were using some sort of state support to rent from private landlords.

This figure is hardly surprising given that Eurostat noted a 90 per cent increase in rental prices across Ireland in 2022 compared to 2010.

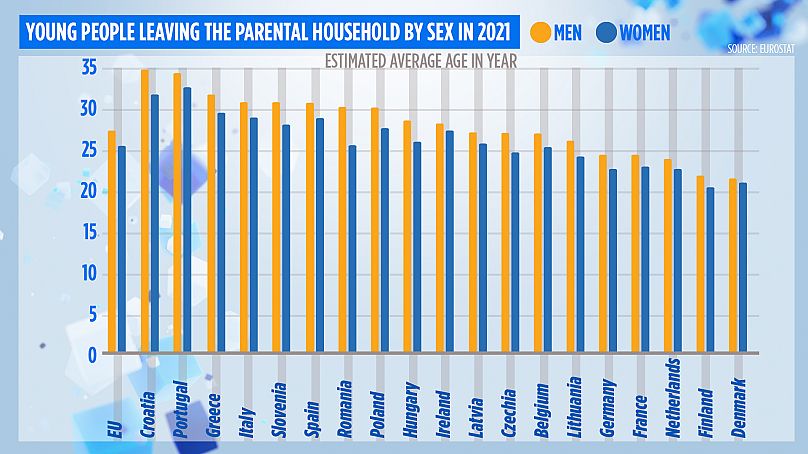

"This is placing a great strain on young people who are looking to move out of their family homes. They are forced to live at home for longer as a result," said Ciaran Lynch, a former member of the Irish Parliament.

Who are the landlords behind these soaring rents?

Ireland doesn't have a strong tradition of corporate landlords. The vast majority are small property investors, who Lynch described as "incidental landlords" - 'mum and dad investors' who own one or two properties.

Mark Rose, the managing director of Rose Properties in Cork agreed: "Eighty per cent of rental properties in Ireland are supplied by small mum and dad landlords, but the problem is that 40,000 of these landlords or property owners have left the market since 2017," he told Euronews.

So why are landlords leaving the renters' market in droves?

According to Rose, ever-changing legislation and high taxes are prompting small investors to sell up.

"Don't forget that landlords have to pay tax on their rental income at 52 per cent, so they are only getting a fraction of what they are actually charging for a property," he said.

Rose added that, given that they might also still be making mortgage repayments on the property, the situation quickly becomes untenable.

"I am paid to understand the legislation that governs the rental market and I can tell you that it is so complicated and is a nightmare for investors."

However, 10 years ago, the market was very different.

In order to support the demand for housing, post the 2008 economic crash, young families looking to trade up and buy bigger homes were encouraged by banks in Ireland to keep their smaller properties, rent them out, and then leverage the new mortgage against the rental.

The market was flooded with landlords, increasing competition for tenants and, as a consequence, keeping prices down.

But now that house prices are at record highs, the few landlords remaining are pushing to exit the rental market.

"Property has never been at the value it is now, so it's a good time to get out and get a good return on your investment," Lynch said.

"And yet, in my estimation, rent owners or rent gatherers (in Ireland) are generating approximately €4 billion per year," he added.

What about the eviction ban?

In October 2022, a temporary eviction ban was introduced to ensure renters affected by the cost-of-living crisis could not be forced out of their homes by landlords over the winter months.

However, this measure expired at the end of March, in a move opposition politicians labelled "cruel and heartless".

However Rose argued that landlords are not considered in the equation.

"You might call it an eviction ban, I call it a ban on selling your property. I am not saying it is right or wrong, but if you own a car or a house and hold the deeds but are suddenly told you can't sell it, then do you actually own it?"

Rose maintained that a more attractive market for landlords, and a reduction in property taxes, could be a solution to Ireland's housing crisis. However, he warned that it is a deeply polarising issue and that promoting the welfare of landlords doesn't serve politicians well when they are looking to be re-elected.

"It's not very attractive for a politician to be saying, you know what, actually hang on, let's look at the landlords here for a second. It doesn't bode well for an election campaign."

Lynch made similar comments: "Ireland has long been behind the curve in terms of tenant legislation and tenant protection. And so we see a lot more regulation of the market now."

"Everyone wants more rental properties, the disagreement or the misunderstanding is how we get more properties on the market and the solution might be unpalatable to some people" concluded Rose.

"Do whatever you have to do to keep small landlords on the market. But that's political suicide here."