“Blockchain” and “cryptocurrency” have been around for nearly a decade now. What do we know about these technological developments? Would you be able to explain clearly what they are and how they function? What practical application does the blockchain technology offer and how may it change the world?

Euronews asked an expert in this field, Zurich-based lawyer Fabio Alves Moura, to put these complex concepts in simple terms. Some of the answers are also commented by Tomaž Levak, Co-Founder & CEO of the Ljubljana-based OriginTrail, one of the many tech startups exploiting the blockchain know-how.

What is the blockchain technology? What are its biggest benefits?

Fabio Alves Moura: Blockchain technology could be explained in a way that even a 4-year-old child would understand. This explanation, however, would be neither realistic nor useful, as it would reduce the technology to a set of generalisations. So, if we really want to understand blockchain, we should not oversimplify the answer. And yet, it is quite simple.

First, let us take two steps back in order to see the big picture. The first step back is necessary to revise the nature of the internet. Today, the internet is one of the key structural backbones of our society. Almost 100% of all telecommunications flow through the internet, where information and knowledge are registered, shared and developed online.

The whole global financial system works online via the internet. Marketing and consumption, entertainment and political campaigns, social networks — all of these human activities increasingly happen online, over a network known as internet, designed in the 1970s, which still maintains at its core the same structural design, same architecture and data sharing protocols that it had in the beginning almost 50 years ago.

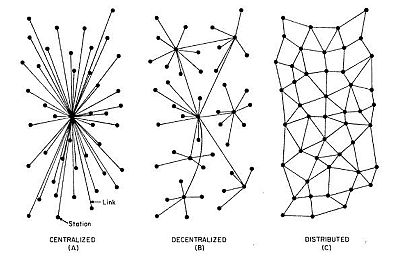

The internet is designed as a decentralised network. This means that the computers, smartphones and other devices are connected to a certain node — a focal point, a server, an Internet Service Provider or a supercomputer. This node, in turn, connects to other nodes in a way that allows all connected devices to communicate via an intermediary: the established connection or several in-between nodes.

This is where blockchain comes in: it changes the way in which the data is stored, distributed and even generated. The blockchain is, at its core, nothing more than a new way to structure data registers. This is done in a way that was first developed in 2009, generally called “distributed network” as opposed to the “decentralized network”.

In a traditional internet model, all computers connect to nodes that centralise and redistribute the information, forming a flow. In the blockchain, the structure of data storing and distribution is entirely different. Thanks to several technological developments, such as cryptography and advanced data compression, all the computers in a blockchain network store ALL the information shared in that network. At the same time, all the computers connect to ALL the others. The system works without centralising nodes, as all the connected devices are nodes themselves.

In a very simplified way, this is what the different systems look like: a centralised, a decentralised and a distributed (blockchain type) networks. In the third figure below all points would be connected to all other points, not only to some of them!

This is why blockchain is also described as a Distributed Ledger Technology (DLT). It is the ledger, or registry, that is completely distributed over the network. [There are also other DLT models that are not blockchains and, theoretically, you might have a blockchain that is not a DLT].

So, why “block” and why “chain”?

The name is easy to understand once we get a grasp of how the distributed network functions.

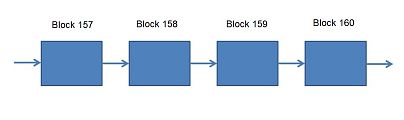

How do we reach some order in a network with no central authority controlling the nodes? There may be (and, in fact, there are) several networks structured under a blockchain model. Every computer or device that joins a blockchain network receives a file with all the information ever created in that blockchain, and adheres to a simple set of rules known as protocol. The main rule says that after X minutes (or X seconds) all the information on the network is packed, compressed and cryptographed. This packaged information forms what is called a block, which is followed (after X minutes or seconds) by another linked block, and so on. These blocks form a chain of blocks, or a blockchain.

The “sealed” blocks are still accessible, so one can consult the information stored in them. However, all this information is ‘written in stone’ and can never be deleted or changed. Changing the data in a chained block is technically impossible. And there is only one way of even deleting it: you would have to delete the whole blockchain. Every single computer that has ever been connected to the blockchain would be able to re-establish the blockchain structure and content. This process may be automated by the blockchain rules.

Why is this revolutionary?

It’s time now for the second step back that we talked about earlier. Consider the structure of society and the world today. Think about the internet and about its decentralised structure based on several nodes. Who controls the nodes, controls the internet. To a certain constantly growing degree, who controls the internet controls the world.

You can control some nodes to bring censorship to a whole country or region, as it happened with Facebook, WhatsApp or Telegram. One can control the nodes to introduce a financial/economic embargo to a country. Such is the case of Iran, which was “disconnected” until last year from the global financial system: you could not draw cash from an ATM in Iran, nor pay with a credit card, or send/receive funds to and from abroad. The only solution was a physical delivery of a sum, in your pocket, in an aeroplane or by train.

Controlling the right nodes allows for data retrieval, manipulation and even for the creation and massive distribution of information, including fakes.

Today, there is much more digital money than the real money: about 92% of the world’s cash is in fact digital. This means that it was not created by the governments, but rather created by private and commercial banks, and exists only on the internet. At the same time, online portals and social networks have become the main space for promoting political agenda and influence, no matter if you live in a democracy or a dictatorship.

Regardless of conspiracy theories, the fact is, ruling the world has always remained within reach of very few privileged and powerful. The internet architecture simply reproduces this fact. The blockchain technology finally came to change everything.

How powerful is blockchain?

Considering its architecture without centralising nodes, it is potentially impossible for a blockchain network to be controlled or suspended by any authority. This is true once the network reaches a certain maturity level, i.e. a high degree of acceptance in the society. This means that a blockchain, once put in place and sufficiently adopted with a reasonable number of workstations connected to it, is virtually unstoppable.

Just to have a perspective on the computational power of a blockchain network, a Forbes article affirms that the Bitcoin blockchain global computational power is 256 times greater than that of the world’s top 500 supercomputers combined. This article appeared back in 2013: nowadays it is estimated to be more than 800 times greater than the whole Google system.

What change comes with the blockchain?

To understand its potential impact on society and why many influential people criticise the bitcoin and other cryptocurrencies so ferociously, let us look at a simple scenario regarding the adoption of a cryptocurrency. Let’s say, I own an electronics shop and I start to accept payments in bitcoins. Then the authorities adopt a law saying that the bitcoins are banned in my country. I can still accept the payments in bitcoins since on the blockchain network the authorities have absolutely no power to control or block it.

If I don’t sell my bitcoins for fiat money (i.e. state-issued traditional currencies such as euro, US dollar, etc.), there is no way for a government to know that I have them. So, if then the baker around the corner, the supermarket, the pharmacy and the family doctor start to accept payments in bitcoins, I may very well cover most of my expenses with them. As more and more businesses and people start to accept bitcoin, we have a declining need for the fiat money.

However, if we stop using the fiat money for most of our transactions, the risk is I might one day perceive the government as corrupt or inefficient, and then, will I declare all the bitcoin operations for the tax authorities? I have a choice not to. What happens with a government if people start to have the option of not paying taxes? We should keep in mind, that by this point we also do not pay any banking fees. So with that point, the banks have either changed radically to try and retain you as a client, or they are obsolete by now.

This might sound like science fiction, but let us recall a few simple facts:

Blockchain networks are unchangeable and unstoppable.

Once set up, they cannot be controlled.

Most people in the world dislike their government and often are not satisfied with the traditional financial system, which in some countries charges up to 15% monthly interest rates for late payments on credit.

Most of the people in the world live in countries with weak political systems and low-quality financial systems with shaky national currencies.

Today, less than 1% of the global money is represented by cryptocurrencies. This percentage, however, has been annually growing since the introduction of bitcoin in 2009. Back then it was worth less than a cent. Today, it is worth around USD 6.200 and no other asset or currency in human history has ever experienced a similar growth in value.

What applications the blockchain technology might have?

There is a multitude of applications. Here is only a short list:

Cryptocurrencies;

Documents certification;

Tracking of products and goods;

Voting systems;

Project management;

Financial services;

Supply chain management;

CRM (Client relationship management);

Dispute settlement;

Tokenisation of assets, rights, etc.: creating tokens in a blockchain platform to represent anything, from a fraction of a house to a share of a company, from rights under a contract to the possibility of use of some features in a platform. These tokens can be sold anywhere, be easily transferred or stored, tracked or left untraceable, all depending on the blockchain’s protocol;

Being more specific, I'd like to mention these three existing projects:

Arcade City: an Uber-like app without the Uber company behind it. The blockchain, in a distributed way, gets the car lift requests and sends them to the closest registered drivers, and it does the same with the payments. As there is no company behind the scheme, it does not charge the drivers any fee on each ride (which in some countries is as high as 25% of the value settled by the passenger), thus resulting in a better pay to the drivers and cheaper ride prices.

Ehab: a blockchain platform in which anyone can finance the construction of their own house selling tokens to people all over the world. They get the money from these investors, the token buyers, and build the house, paying back the token holders at better rates than otherwise received from a bank loan. At the same time, the token holders get more value for their money than they would get by investing in a traditional bank investment option.

Inflr: a platform in which your influence on different target audiences in social networks is measured by artificial intelligence coupled with big data and you can be offered to post, comment or share content and get paid for it — without any middle-man charging you a fee.

Crypto exchanges are usually not built on a blockchain, they are simply trading places in which people trade fiat money for cryptocurrencies, or between different cryptocurrencies, so they can still be as vulnerable to hacker attacks as any other website. This is why it is always advisable to have a physical cyber-wallet, a USB pen-drive with a strong security protocol, which you keep safe and disconnected from the internet, only connecting it at the moment you need to sell or buy cryptocurrencies, thus limiting exposure to the unnecessary risks.

Interestingly enough, these wallets never contain the bitcoins or cryptocurrency as such. They only store private cryptographic keys that every user of a blockchain network may access, while the cryptocurrencies are always stored at the blockchain platform itself. Regardless of the exchanges, cryptocurrency owners can always sell and buy cryptos in a peer-to-peer way, i.e. directly from other people, thus rendering the whole operation inside the blockchain network risk-free.

What happens at the cryptocurrency farms?

That might be hard to believe if you do not have a mindset of a software developer. Perhaps, this is why people give so many different answers to this question, although the answer is simple.

Every time a blockchain system seals a new block (i.e. every 10 minutes in case of the bitcoin blockchain, or every 45 seconds for ethereum), this block is “packed” with four elements: its content (the operations and data registered), a time stamp, the block’s hash and the hash of the previous block.

What's a hash? In simple terms, it is a function (expressed in a combination of numbers and letters) that encrypts a pack of data. So, every pack of data in a blockchain, or every block, has its own hash, and the blocks have the hash of the previous block, too, so that they are organised in a chronological order. The hash’s final format, though, is a random number, generated by the computers connected to a blockchain network. This random number, albeit encrypting all the information on the block, has to be different from any other hash number ever generated for a previous block in that blockchain. These are the calculations made at the cryptocurrency mining farms. In order to reward the computer that first calculates this hash number at the closing of every new block, a certain number of bitcoins (or the respective cryptocoins in other blockchains) is issued as a sort of payment for the work produced.

This is a mechanism known as “proof of work”, invented along with the bitcoin as a way to generate, seal and link the blocks of its blockchain. However, new ways of doing this operation are emerging, such as the “proof-of-stake”, for instance.

Most of the energy used to mine the bitcoins is consumed by the mini-ventilators used to cool down the computers’ microprocessors that are working 24/7. To mitigate this effect, mining fields are taken to colder countries or regions, such as Iceland, Finland or the Russian Siberia, and in some cases even to the underwater farms, among other creative initiatives.

Blockchain has been accused of helping criminals and terrorists. Does it have a negative impact on society?

When the internet was created, some people — for the very first time in human history — came up with an amazing set of criminal activities. Some started selling drugs, some sold human organs or weapons illegally, others took part in human trafficking. Also, the internet was used to give a digital support for money laundering, something impossible without the existence of the internet. With the appearance of blockchain, a new circle of criminal initiatives came up once again, and a conservative view would make us believe that, if it wasn’t for the bitcoin, the drug dealers would have never existed.

I prefer to turn to humour in my answer, as I often have to address this question. On a more serious note, there is no statistical evidence of an increased criminal activity due to the creation of the blockchain technology and its most famous application, the cryptocurrencies. When a new technology is created, the “baddies”, who are under pressure in other fields, usually get a grasp of these new technologies fast enough to perform their regular “business”. However, eventually, new ways of chasing the criminal minds always make the system safer. This is also the case of blockchain with its privacy protection, which may present a bigger challenge for tracking criminals.

How can consumers avoid getting scammed?

The behaviour should be the same as we would normally adopt: if you were to open an account in an online bank, you would carefully check the bank’s website and perhaps try to find out who the owners are, and so on. Same as when you think of buying an exotic fruit in a supermarket: if you don’t know how to select a good one, you would ask someone for help or quickly Google it on your smartphone. If the fruit may be both delicious and poisonous, you would run a double and even a triple check. It's exactly the same with cryptocurrencies and blockchain.