Britain's most valuable technology company, UK microchip designer ARM Holdings, is being bought by the Japanese internet giant SoftBank Group.

Britain’s most valuable technology company, UK microchip designer ARM Holdings, is being bought by the Japanese internet giant SoftBank Group.

It will pay 24.3 billion pounds (29 billion euros) in cash in what is the first major takeover of a British firm since the vote to leave the European Union.

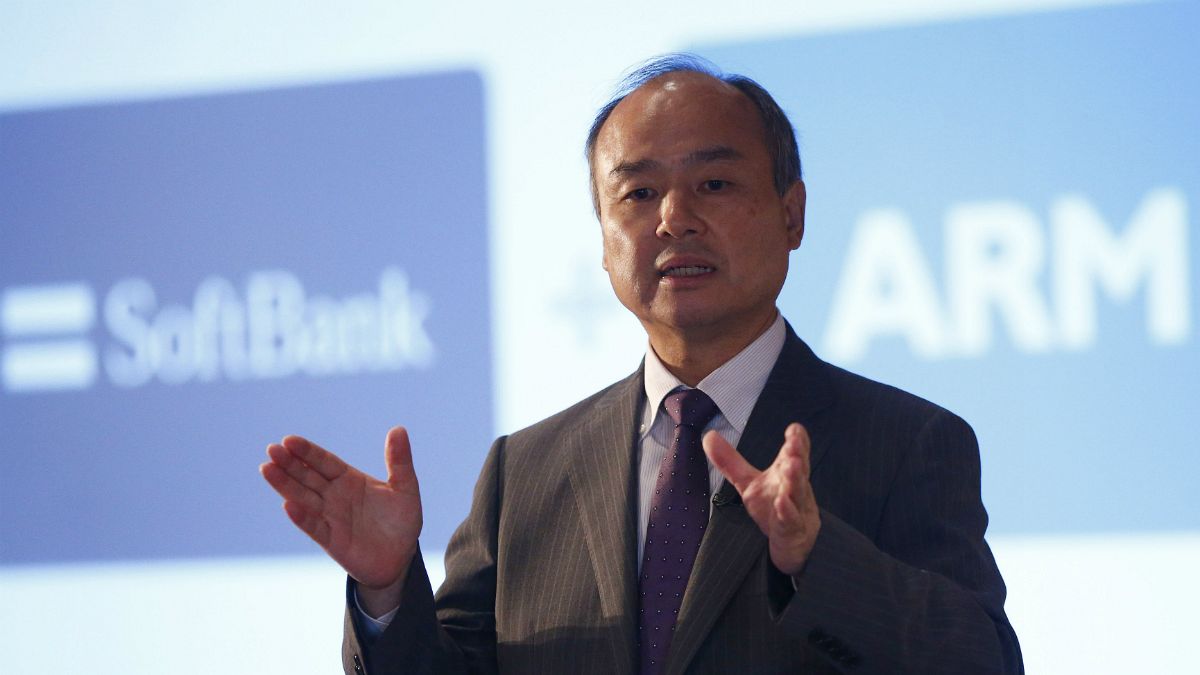

Softbank’s boss, Masayoshi Son, is taking advantage of the Brexit battered pound to bet big on IoT, the internet of things.

Speaking in London Son said: “ARM is a market leader and the next big paradigm shift that is coming is on IoT. So I believe that IoT will be such a big opportunity.”

He said the purchase was “one of the most important” moves in his company’s history.

Masayoshi Son explains why Softbank just bought ARM https://t.co/bkEBI4PZ3Apic.twitter.com/E7vORxTtuV

— Tech in Asia (@techinasia) July 18, 2016

ARM designs the microchips – in essence tiny computers – that control 95 percent of the world’s smartphones and many other devices. It supplies Apple and Samsung.

Putting the best possible spin on this, Britain’s finance minister Philip Hammond welcomed the takeover, which has been made possible by the pound’s slumping value against the Japanese yen: “We want to send a very powerful signal that we are open to investors who want to deploy their capital here, to use British talent to build world class companies and that is what SoftBank are proposing to do with ARM. And they have given us clear assurances about their commitment to the UK economy.”

Decision by SoftBank to invest in

ARMHoldings</a> shows UK has lost none of its allure to global investors - Britain is open for business</p>— Philip Hammond (PHammondMP) July 18, 2016

SoftBank has said it will keep ARM’s headquarters in Britain and double the number of employees in the UK over five years. It currently has just over 4,000 staff worldwide, 1,600 in the UK. However if it fails to increase the number of employees there is nothing the British government could do about that.

Good news or sad news?

A spokeswoman for Britain’s new prime minister Theresa May said she believed the deal was in the country’s national interest — a gauge she will use in all future foreign takeovers.

“This is good news for British workers, it’s good news for the British economy, it shows that, as the prime minister has been saying, we can make a success of leaving the European Union,” the spokeswoman said.

The government’s enthusiasm was not echoed by founder Hermann Hauser who called it “a sad day for technology in Britain” because of the loss of independence.

Arm Holdings founder says the SoftBank buyout is one of the “sad and unintended consequences” of Brexit pic.twitter.com/X69NyWiRNo

— Joel Lewin (@JoelLewin) July 18, 2016

The Japanese conglomerate believes the internet of things – devices in homes, vehicles and sensors in buildings collecting and exchanging data – to be its future cash cow.

And thanks to the 21 percent slide in the value of the pound against the yen since Brexit it saved around five billion pounds (six billion euros). However because ARM reports its earnings in US dollars it share price had risen by 17 percent after the vote and before the bid.

You may not know ARM, today’s $32 billion takeover target—but your smartphone wouldn't work without it https://t.co/jJoypk9rNM

— Quartz (@qz) July 18, 2016