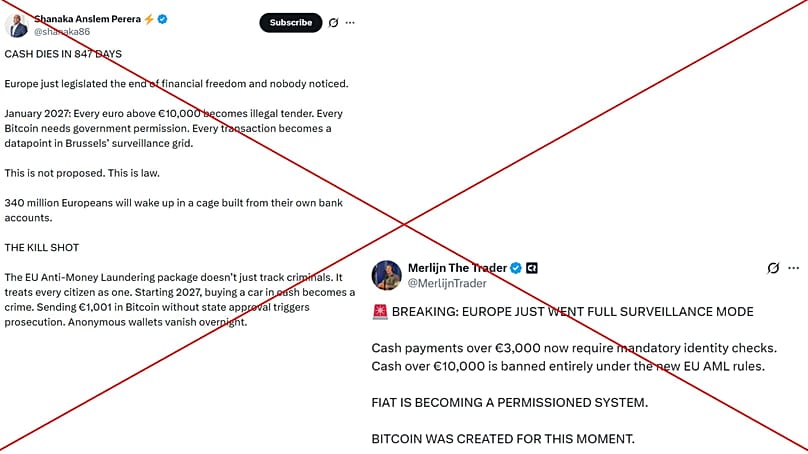

Viral claims about the EU's new Anti-Money laundering package have claimed that cash in Europe will soon be "contraband." Here's what the new €10,000 cap really means.

"Every euro above €10,000 will become illegal tender," according to a post which has attracted more than 2.6 million views and which says that "cash will soon be contraband" under EU law.

In reality, the EU hasn't banned cash. It is, however, introducing a bloc-wide limit on how much you can pay in banknotes to a business, as part of a sweeping overhaul targeting money-laundering set to come into force in 2027.

The regulation is part of the EU's Anti-Money Laundering package, which — among other measures — sets a bloc-wide cap of €10,000 on cash payments in business transactions

Although businesses will no longer be able to accept cash payments for amounts that surpass that threshold, deals between two private people in a non-professional context are generally excluded from these legal provisions.

Meanwhile, national governments will still be able to set their own lower caps for sums below €10,000.

Will it be illegal to buy a car in cash?

According to the viral post, the EU is making "buying a car in cash" a crime. This is misleading.

From 2027, buying a car in cash is not automatically a crime, but it could be an illegal transaction depending on who you buy it from.

For example, if you're looking to buy a car over €10,000 from a dealership, they can't legally accept that amount in cash. You could, however, still buy the vehicle via bank transfer or card.

Otherwise, Europeans will still be able to save, hold and withdraw any amount of cash they like. Daily transactions, for coffee and groceries, for example, will remain unaffected. So it's incorrect to suggest that the EU is killing cash.

As the new regulation largely impacts transactions involving businesses, two private individuals will still be able to buy and sell something up to any amount using cash, unless a given member state already has stricter national limits. Some EU countries, such as Italy, already limit cash transactions between private individuals.

The main change under the new regulations is that large cash payments to businesses will be capped at €10,000. Businesses won't be able to accept an amount of cash above this threshold.

Why is the EU doing this?

The EU's Anti-Money Laundering package aims to tackle money laundering by ramping up coordination between member states.

Until now, the EU has had a patchwork of different rules on national limits for cash transactions. In Italy, the limit is €5,000, while Austria has no limit, for example.

By putting a €10,000 cap on cash payments, the EU aims to force more payments into traceable channels and therefore reduce the opportunities for money laundering and other forms of financial crime.

The European Commission says closing the discrepancy between countries "harmonises anti-money laundering rules" and closes "loopholes for fraudsters".

Money laundering is prevalent globally and in the European Union. The United Nations Office on Drugs and Crime estimates that between 2 and 5% of global GDP, up to €1.87 trillion, is laundered annually.

A 2023 report found that almost 70% of criminal networks in the European Union use money laundering to fund their activities and hide their assets. The majority of them use cash.

According to the European Commission, large amounts of cash remain "difficult, if not impossible, to trace back to some criminal act".

What's next?

The package is set to take effect in July 2027 and, alongside other measures, includes the establishment of an EU Anti-Money Laundering Authority in Frankfurt, which will see its full powers come into effect at the same time.

Banks, businesses and regulators will be given a three-year time window to adapt their systems to enforce the new rules.

Although criticism of the package online is largely sensationalised, the package itself is not without controversy.

Experts have questioned whether imposing the cash limit is actually effective, and whether criminals will simply shift to other methods, such as crypto and cross-border movement.

Others have pointed out that the policy's success depends on its smooth implementation across all member states, which might prove uneven.

It's not the first time sensationalised and false claims involving cash in European countries have spread online. The elimination of cash is a common conspiracy theory.

Earlier this year, a false online narrative that Spain was withdrawing the €50 banknote sparked panic about the damaging impact it would have on the pockets of thousands of citizens. Spain's central bank confirmed it hadn't ordered any such withdrawal.

In March, news reports in Norway and Sweden that the countries were curbing plans to become fully cashless due to concerns over national security triggered a false online narrative that both were doing away with digital payments altogether.