Here's what to know about why SVB failed, who was affected most, and how it may or may not affect the wider banking system.

A bank run dealt a lethal blow to Silicon Valley Bank on Friday (March 10), forcing its failure after the US Federal Reserve raised interest rates, scaring away potential investors from the financial institution best known for its relationships with high-flying world technology startups and venture capital.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

Its downfall is the largest failure of a US-based financial institution since Washington Mutual collapsed at the height of the financial crisis in 2008.

Here's what to know about why the bank failed, who was affected most, and how it may or may not affect the wider banking system in the US and worldwide.

US Federal Reserve increased interest rates

Silicon Valley Bank (SVB) was hit hard by the downturn in technology stocks over the past year as well as the Federal Reserve's aggressive plan to increase interest rates to combat inflation.

The bank bought billions of dollars worth of bonds over the past couple of years, using customers' deposits as a typical bank would normally operate.

These investments are typically safe, but the value of those investments fell because they paid lower interest rates than what a comparable bond would pay if issued in today's higher interest rate environment.

Usually, that's not an issue because banks hold onto those for a long time - unless they have to sell them in an emergency.

SVB's customers became increasingly cash-strapped

But SVB's customers were largely start-ups and other tech-centric companies that started becoming needier for cash over the past year.

Venture capital funding was drying up; companies were not able to get additional rounds of funding for unprofitable businesses and therefore had to tap their existing funds - often deposited with SVB, which sat in the centre of the tech startup universe.

So, SVB customers started withdrawing their deposits.

At first, that wasn't a huge issue, but the withdrawals started requiring the bank to start selling its own assets to meet customer withdrawal requests.

SVB sold its bond portfolio at a loss

Because SVB customers were largely businesses and the wealthy, they likely were more fearful of a bank failure since their deposits were over $250,000 (€234,575) or the US government-imposed limit on deposit insurance.

That required selling typically safe bonds at a loss and those losses added up to the point that SVB became effectively insolvent.

The bank tried to raise additional capital through outside investors but was unable to find them.

A bank run sank the ship

The fancy tech-focused bank was brought down by the oldest issue in banking and one of the few means that can surely tank a bank: a run on it.

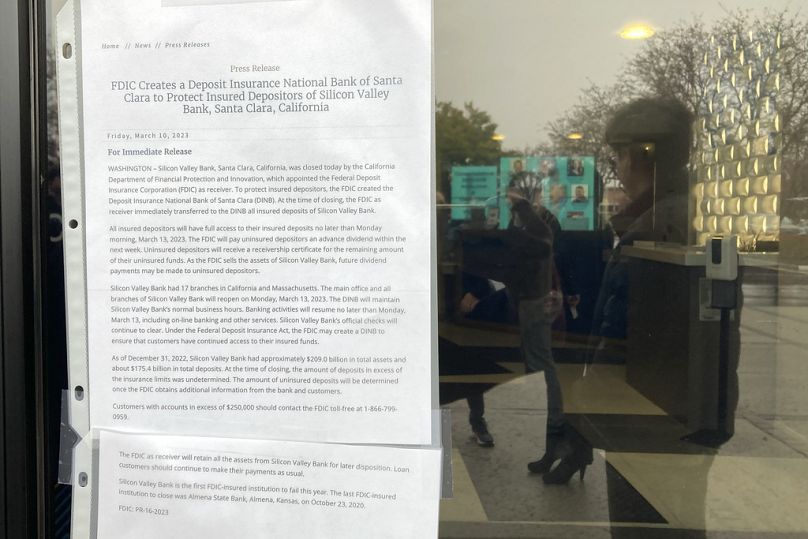

Bank regulators had no other choice but to seize SVB's assets to protect the assets and deposits still remaining at the bank.

What happens now?

At the moment, experts don't expect there to be any issues spreading to the broader banking sector.

There might be some pockets of instability caused by this, as seen in the dip the crypto market took on Saturday morning, but it showed signs of recovery later in the day.

SVB was large but had a unique existence by servicing nearly exclusively the technology world and VC-backed companies. It did a lot of work with the particular part of the economy that was hit hard in the past year.

Other banks are far more diversified across multiple industries, customer bases and geographies.

However, there might be economic ripple effects, especially in the US tech start-up world, if the money that was deposited at SVB can't be released quickly.