Cryptocurrencies are known for their volatility but cryptos have lately been hit especially hard.

Crypto winter is coming - or perhaps it is already here - as the last month has shown the industry has been frostbitten.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

Cryptocurrencies are known for their volatility, but the wild price swings were made worse in the wake of the TerraUSD and Luna meltdown, which is estimated to have wiped half a trillion dollars (around €500 billion) off the sector’s market capitalisation.

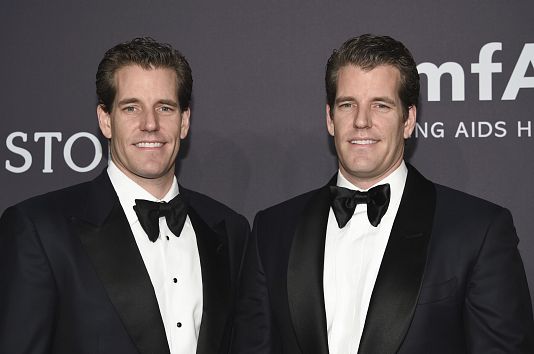

The Bitcoin billionaire twins Cameron and Tyler Winklevoss said in a blog post on Thursday that the industry is already in a “contraction phase” known as “crypto winter,” which has been “further compounded by the current macroeconomic and geopolitical turmoil”.

As such, they announced they would be cutting 10 per cent of its staff at Gemini, the US-based cryptocurrency exchange they founded eight years ago. It is the first time the company has cut jobs.

Gemini has around 1,033 staff, according to PitchBook, which would mean about 100 of them will be impacted by the layoffs.

Gemini is not the only company to suffer from the after-effects of the crypto crash.

Crypto exchange Coinbase, which reported a 27 per cent fall in first-quarter revenue, has now extended its hiring freeze “for the foreseeable future”.

Fintech companies BitMEX and Robinhood have also recently cut staff.

What is a 'crypto winter'?

The term “crypto winter” refers to a period of flat trading after a price crash.

The last crypto winter was from early 2018 until mid-2020 as crypto prices dropped and stayed down.

What has caused the latest crypto crash?

Even before the Terra USD and Luna crash, the most popular cryptocurrency was already in trouble.

Bitcoin has lost around 60 per cent of its value since reaching an all-time high of $69,000 (€64,000) in November 2021. At the time of publication, Bitcoin’s price hovered at around $30,000 (€27,000), according to CoinGecko.

Rising inflation and global markets nervous in the wake of Russia’s invasion on Ukraine had already put a strain on crypto assets.

But a further shockwave occurred in early May after the two main so-called stablecoins from the crypto project Terra went into free fall.

Stablecoins claim to be a relatively safe haven in the highly volatile crypto market. They are meant to be tied to a fiat currency and usually maintain a 1-to-1 peg with the US dollar.

But recent events have proven that they are just as volatile as other cryptocurrencies.

TerraUSD, or UST, crashed almost completely at one point in May and lost its $1 peg (€0.93) to the dollar, tanking to a low as $0.26. Meanwhile, TerraUSD’s sister token Luna collapsed to nearly $0.

The crash of these two coins has been compared to a mini 2008 financial crisis within the crypto ecosystem, with their collapse having a knock-on effect on other digital coins and projects, wiping billions of dollars off the market.

Policymakers are now keeping a closer eye on cryptos, with more regulation expected.

Despite the uncertain times, some investors are continuing to pour money into the sector.

Venture capitalist firm Andreessen Horowitz recently announced a new $4.5 billion (€4.1 billion) fund to support crypto and blockchain companies. That investment could be the secret weapon against the crypto winter.