European defence stocks rallied as plans for a Trump–Putin summit were taken off the agenda. Analysts expect sustained defence spending, driven by NATO pressure and ongoing Russian threats despite ceasefire efforts.

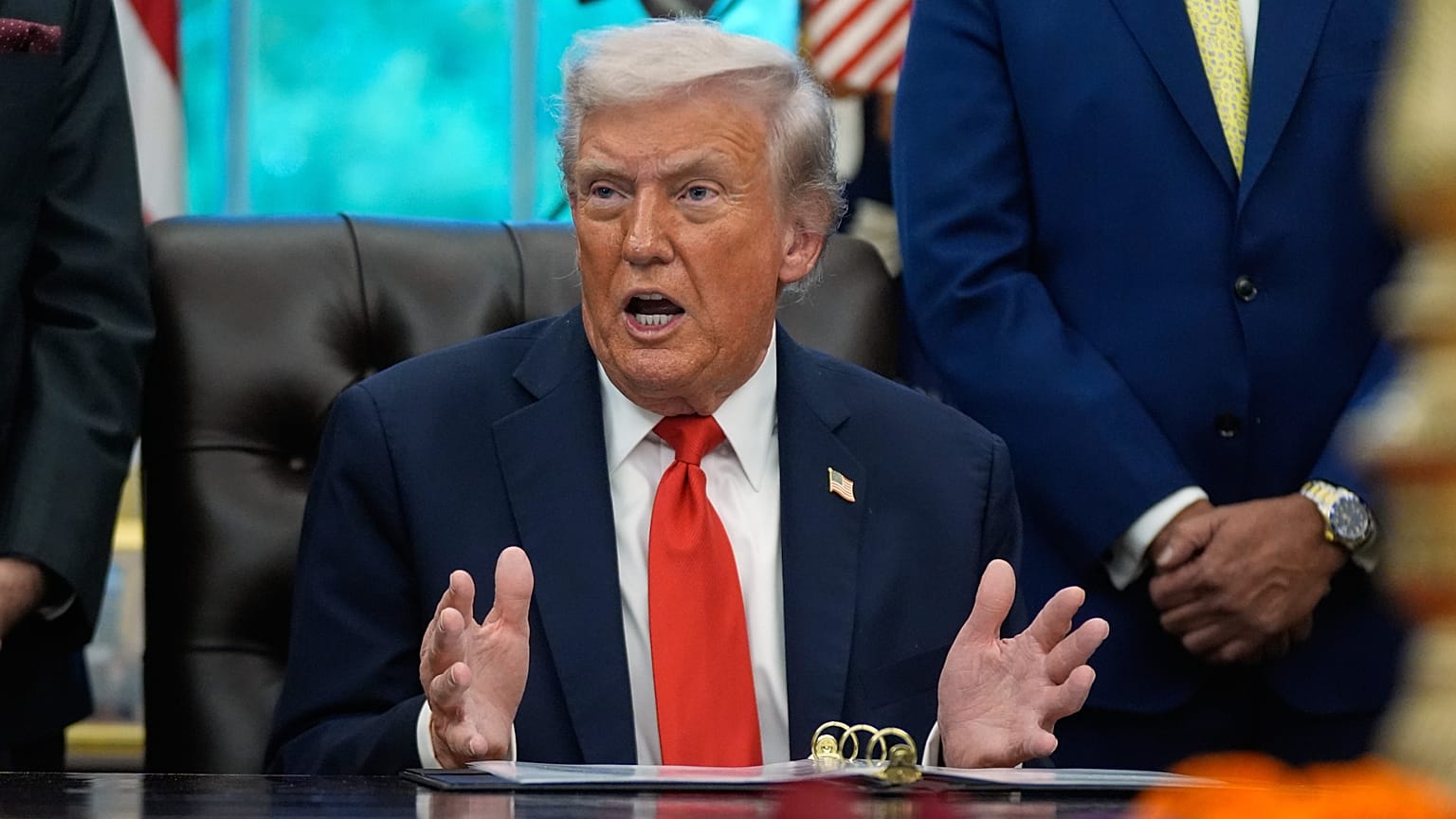

Plans for a summit between US President Trump and Russian President Putin in Budapest have been shelved, at least for now, amid stark disagreements between Moscow and Washington on the conditions for a ceasefire in Ukraine.

Kyiv and its European allies have rejected the idea of territorial concessions as a precondition for peace, arguing that any negotiated settlement must respect international borders.

The European Commission echoed this position in a statement on Tuesday, aligning itself with the US president’s call for a halt to hostilities while firmly rejecting any redrawing of boundaries.

“We strongly support President Trump's position that the fighting should stop immediately, and that the current line of contact should be the starting point of negotiations,” the Commission said.

“Russia's stalling tactics have shown time and time again that Ukraine is the only party serious about peace... Ukraine must be in the strongest possible position – before, during, and after any ceasefire.”

The EU is reportedly preparing new measures to target Russia’s economy and defence sector, including proposals to channel frozen Russian sovereign assets towards Ukraine’s reconstruction and military resilience.

European leaders are expected to meet later this week in Brussels, and in the Coalition of the Willing format to coordinate support and assess the evolving geopolitical landscape.

Strong long-term outlook for European defence stocks

Last week’s downturn in defence equities had been triggered by heightened speculation over a potential Trump–Putin deal. Shares in Rheinmetall and Leonardo dropped more than 10% from early October highs, while Thales and other primes also retreated.

However, Wall Street analysts remain optimistic on the European defence industry, irrespective of short-term diplomatic manoeuvres.

This week, Goldman Sachs reiterated its “buy” rating on selected European defence stocks, including Rheinmetall AG and BAE Systems plc. They indicated that a peace deal — if it ever materialises — is unlikely to meaningfully alter the threat perception among European NATO members.

"In the eventuality of a peace deal, European states are unlikely to perceive a significant reduction in risk," strategist Sam Burgess said in a note.

“Russia would use any pause to reconstitute its forces, and NATO must prepare accordingly,” he added.

The bank pointed to large multi-year procurement backlogs, new spending targets agreed at the NATO Hague summit, and rising pressure from the US to increase burden-sharing as structural tailwinds for the sector.

Goldman Sachs concluded that the sector is not detached from real market conditions.

“While this does not imply a blanket buy on the sector, it reassures us that the defence theme is not yet detached from fundamentals," they noted.

Last month, Bank of America raised its target price on Rheinmetall to €2,225 (current share price sits at around €1,818), citing the firm’s acquisition of Naval Vessels Lürssen as a key growth catalyst.

The deal expands Rheinmetall’s footprint into naval defence and offers significant potential for vertical integration and margin improvement. The company sees €5 billion in revenue opportunities from the naval segment by 2030.

No summit, no slowdown for European defence

The shelving of the Trump–Putin summit has, for now, taken the prospect of a ceasefire based on territorial concessions off the table — reinforcing investor confidence in European defence stocks.

With enduring security threats, firm budget commitments, and expanding procurement pipelines, analysts see Europe's rearmament as not just a reaction but a long-term structural shift.