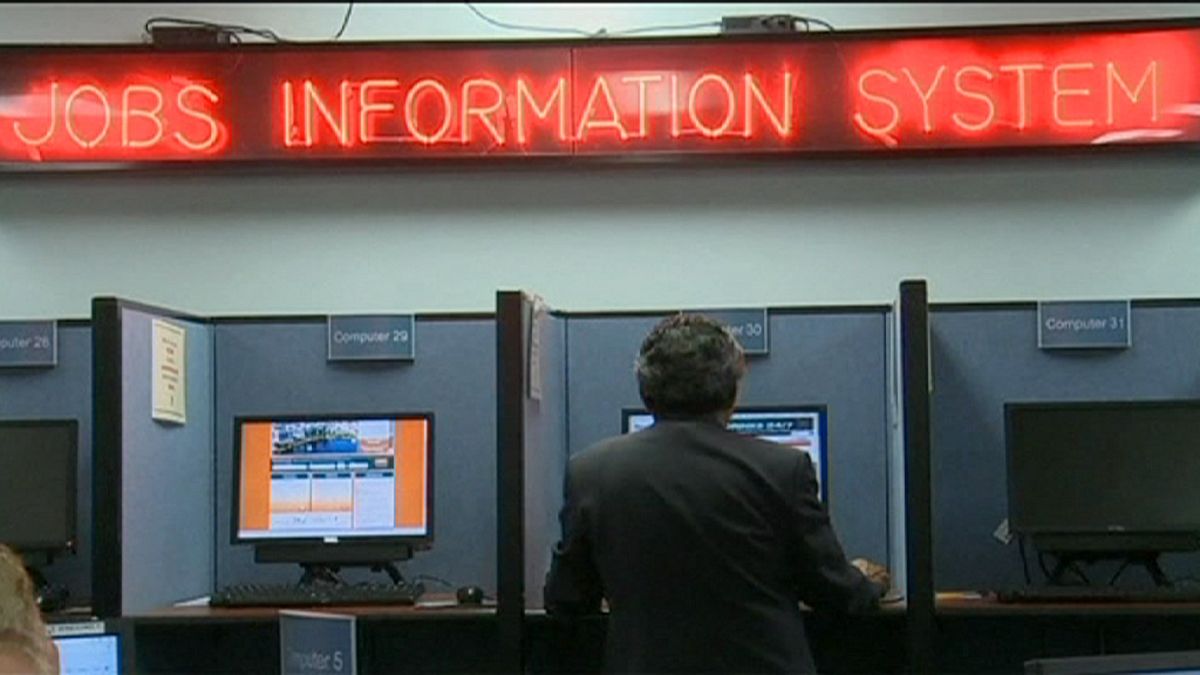

US employers added 215,000 jobs and wages picked up in March. The jobless rate rose to 5.0 percent as more Americans returned to the labour market.

The US jobless rate rose in March, even as employers added 215,000 jobs and wages picked up.

The increase in the unemployment rate – from 4.9 percent to 5.0 percent of the workforce – was because more Americans are returning to the labour market, a sign of confidence.

The strong numbers seem to indicate the US is not taking too big a hit from slowing economic growth elsewhere in the world.

Average hourly earnings increased 0.3 percent from February.

The payroll gains for March were broad-based, though manufacturing lost 29,000 positions.

14.4m jobs created since February 2010. #JobsReporthttps://t.co/ZZsz8Zoc0Ypic.twitter.com/OY3uEHFqHz

— US Labor Department (@USDOL) 1 April 2016

The signs of economic resilience could allow Federal Reserve chief policymaker Janet Yellen to gradually raise interest rates this year.

Just this week she again expressed caution over the effects on the US economy of slowing world growth and lower oil prices.

#Yellen says #Fed should proceed 'cautiously' given '#global risks'… https://t.co/lzG7DKULZo

— BreakingNewsFeed.com (@NewsBreaksLive) 29 March 2016

Fed officials last month downgraded their economic growth expectations and forecast only two more rate rises this year. The US central bank raised its benchmark overnight interest rate in December for the first time in nearly a decade.

Financial markets see little likelihood of a rate hike at the Fed’s June policy meeting. They think there is a roughly 47 percent chance of an increase in November and a 57 percent probability at the December meeting, according to CME FedWatch.