After several years of stubborn inflation, price pressures are now near the ECB's target. Despite this, one in four Europeans still fails to pay their bills on time.

As the cost-of-living crisis eases, Europeans are generally finding it easier to pay their bills on time, according to the latest European consumer payment report from Intrum.

Even so, 24% of bill payers are still failing to settle their debts within the expected timeframe, compared to 37% in 2023.

Differences between countries and social groups continue to widen, and many are still falling behind on payments.

"We see a clear divide between those who feel financially secure and those who are still living month-to-month. Many consumers remain in 'survival mode', hesitant to invest or spend more, marked by years of economic uncertainty," said Agnieszka Kunkel, CEO of Intrum TFI.

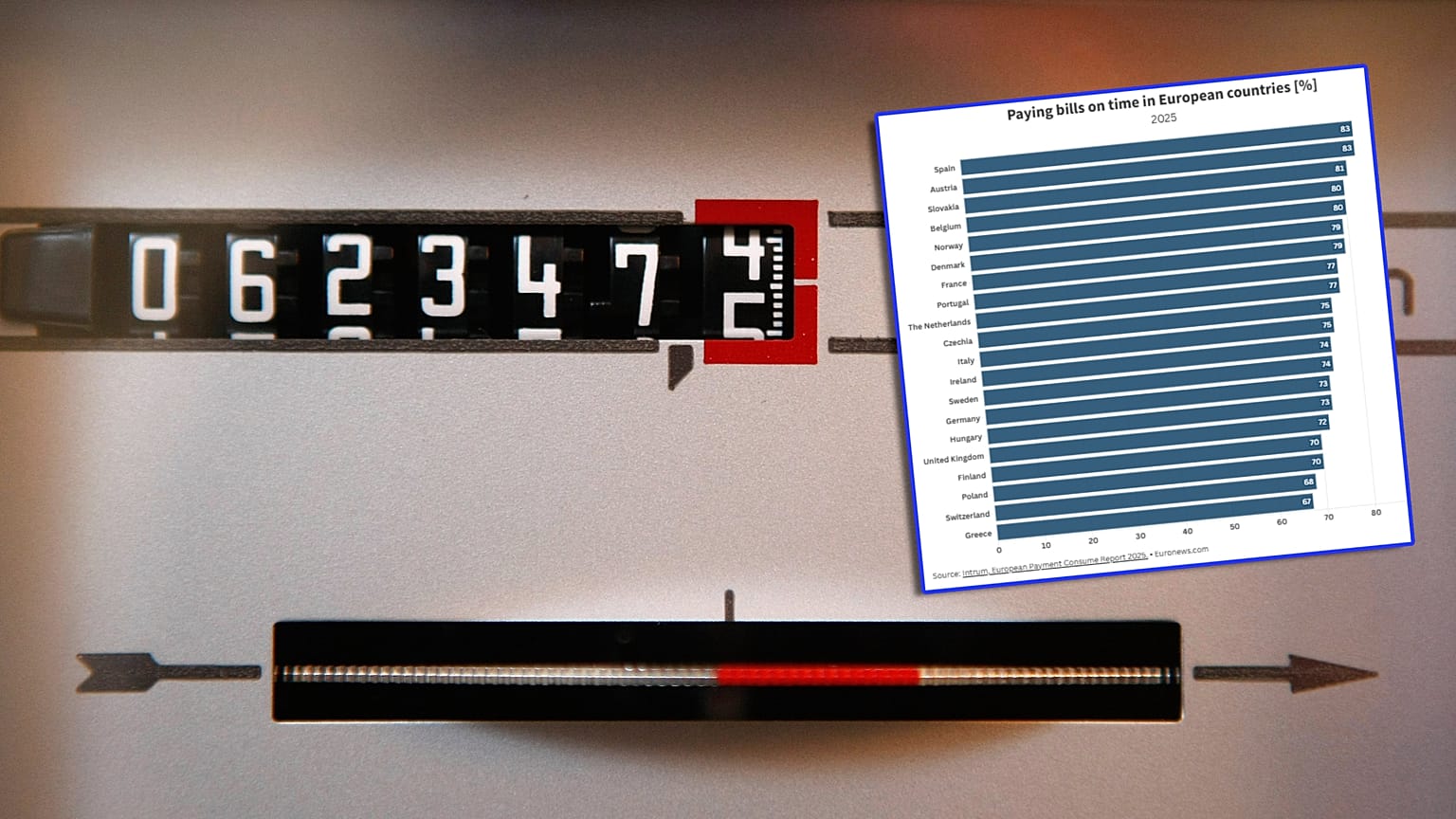

The rate of households paying all fees on time varies from country to country. Spain and Austria are the best performers in this respect, at 83%, while Greece ranks lowest at 67%.

Lasting effects of the cost of living crisis

As many as 43% of consumers in Europe said that recent years have had a lasting negative impact on their financial wellbeing, and younger generations are often the most affected.

Compared with 2024, a larger portion of Generation Z claimed that missing bill payments was a regular occurrence this year, rather than a one-off event. In 2025, 63% of respondents said this was the case, compared with 20% a year earlier.

While Europe's price pressures are settling, interest rates are falling, and the labour market remains resilient, not everyone is benefitting.

Many Europeans are still living from hand to mouth, according to Intrum. Only six in ten regularly set aside an emergency fund for a rainy day, while 29% admit that reports of economic instability make them anxious.

This year's report also shows a shift in the reasons for late payments. A lack of funds has again become the dominant issue, and this phenomenon particularly affects Generation Z. In 2024, 20% said their main reason for defaulting was that they did not have enough money to pay their bills, rising to 52% in 2025.

An additional burden for the young is so-called aspirational pressure. As Agnieszka Kunkel points out, social media often creates unrealistic standards, encouraging young buyers into debt to keep up with their peers. According to the survey, 31% say that trying to replicate influencer lifestyles has pushed them into debt.