The reputation of international banking is under scrutiny once again over another scandal, this time in the foreign currency trading sector.

Global regulators have fined major banks in Europe and the US, for foreign exchange market manipulation. The massive fines are not the end of the matter, with criminal investigations ongoing .

However, a scandal-ridden industry, ineffective regulators, and lax rules have decreased the trust in banks.

Some in the financial world say they are even rethinking their investment strategies in the light of these expensive scandals.

Under a negotiated settlement, six of the world’s top banks have accepted fines totaling nearly 3.5 half billion euros because some of their employees manipulated foreign exchange markets.

They are: UBS in Switzerland; Citigroup, JP Morgan Chase and Bank of America in the United States; and British-based Royal Bank of Scotland and HSBC.

Barclays is negotiating a similar settlement. None have admitted any liability.

After a more than one year-long investigation, British, US and Swiss regulators found bank insiders frequently exchanged confidential information about client orders.

They then orchestrated trades to boost their own profits.This centered on key foreign exchange benchmarks, used to set rates for deals in which banks and other financial firms buy and sell currencies to each other.

As a result more than 30 people have been suspended or sacked. Some could face criminal charges, though that is unlikely to involve senior bank executives.

As well as a further loss of public trust in the sector, some major investors have said this latest costly scandal makes them wary of holding bank shares.

The affair could also lead to more interest in banks that are based in places like the Gulf with tighter regulations and enforcement.

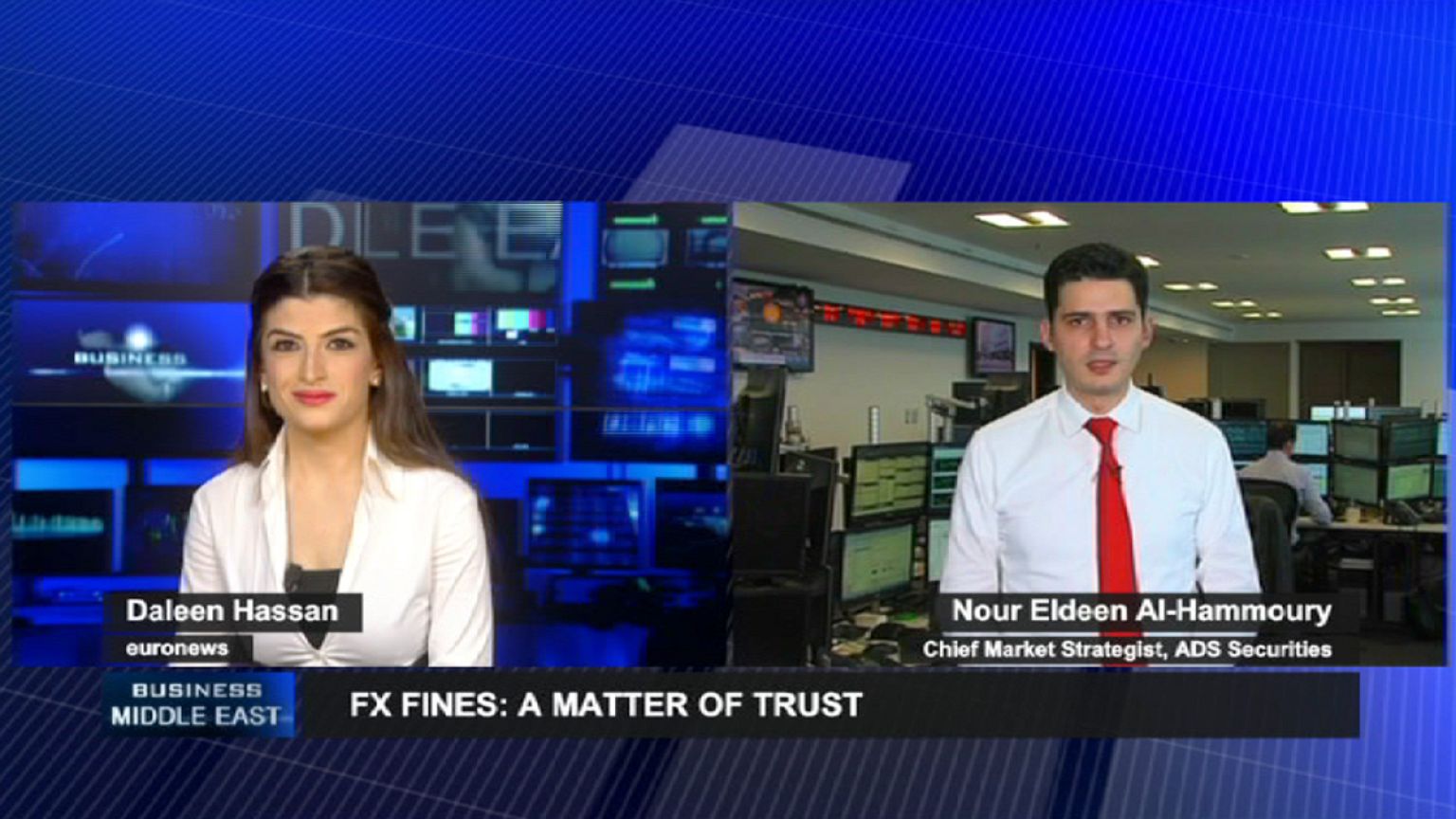

For more on that point Business Middle East’s Daleen Hassan spoke to Nour Eldeen Al-hammoury the chief market strategist with ADS Securities in Abu Dhabi.

DH: “How much does this sort of thing undermine trust and worry people in the industry?”

NAH: “Well this is not the first or the last scandal. However, this year has been the most expensive for the banks due to the fines from the regulators. Of course it affects the trust in the banking sector further, especially that these banks have also a bad record on this kind of manipulations. However, the regulators need to come up with strong measures to cap these acts.”

DH:“It seems to be taking regulators a long time to catch up with these problems, are there concerns that the banks are being monitored effectively?”

*NAH:“They are monitored. However, you cant monitor everything. the last scandal took the regulators a long time to identify the issue after going through a lot of emails and chats. At the end, the regulators cannot monitor everyone at the same time. But I believe the regulators should take strong measures against any manipulation.”

DH: “How do these kinds of scandals play out in the Middle East, both in regards to traders behaviour and banking regulation?”

NAH:“Well this could be more good news for the Middle East and the region where.

the financial institutions and the banks are well monitored by the central banks. Here, we have never heard of any scandals or manipulations from the banks in the region.

“So of course it raises trust in the banking sector here and making it more attractive to foreign investors and traders to deal with the financial institutions and banks in the Middle East, as long as the central banks continue to monitor them well.”