GoHenry, a leading company in the child fintech industry, has acquired Pixpay in a bid to reach customers over Europe. What does this industry boom say about how we teach our kids about money?

Is it ever too early to learn about how to handle money?

Child-focused fintech services — apps and banks designed to educate and teach children about finance — are on a mission to educate the masses from a very young age.

And they’re growing fast, as technology transforms the way we use money, and select private companies rush to fill a gap in the way we teach our children about finance.

GoHenry is at the cutting edge of this emerging sector, having more than doubled its revenue during the pandemic to $42 million (€41.6 million) in 2021 and amassed a consumer base of over 2 million in the UK and US.

Now, the firm is hoping to conquer continental Europe with its acquisition of Pixpay, a leader in teen banking in France and Spain with nearly 200,000 members.

“We’re hugely excited to help further our mission to make every kid and teen smarter wth money,” Louise Hill, cofounder of GoHenry told Euronews Next.

“It allows us to expand into Europe for the first time and accelerate our growth”.

Gamified piggy bank

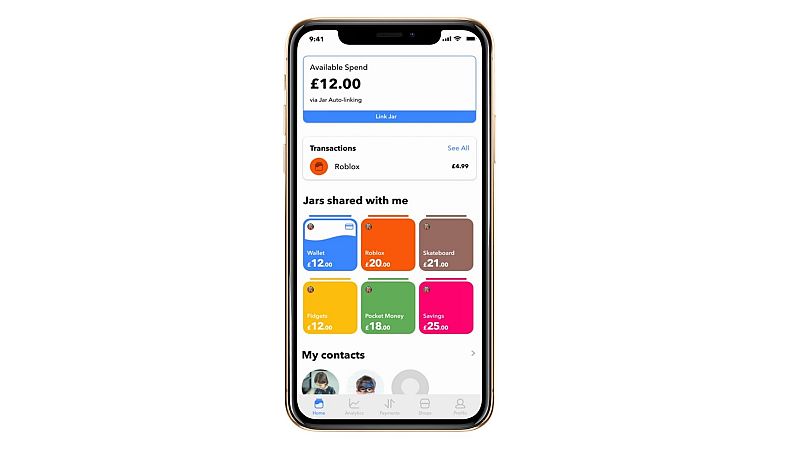

Launched in 2012, GoHenry is a financial education app and prepaid debit card targeted at 6-18 year-olds, featuring “gamified money lessons” with parental oversight.

Pixpay, meanwhile, offers an alternative to banks for children as young as 10. It offers them a Mastercard payment card and a mobile app enabling them to pay, get paid, save money or even get discounts on their favourite brands.

One of the many reasons for the success of the child-centred financial tech industry is its ability to keep up with the changing times.

Children today are given easier access than ever to purchase goods: From microtransactions in gaming to buying media on subscription services, children are faced with countless options for how to spend money online.

Hill said this was one of the key inspirations behind founding GoHenry – finding herself “trying to explain to my children that by clicking the download button on iTunes they were spending money”.

“They just didn’t understand it, and the move to cashless and the acceleration of online shopping in the pandemic has just accelerated the problem”.

Herein lies the secret of the platform’s success: As opposed to the traditional “pocket money” where children would receive a sum of cash money every week, it allows kids to keep up with the evolving financial world.

“It’s vital that we educate our children about money – by that, I mean having an understanding of budgeting, the value of money and what a bank is, what a loan is, and what a credit card is for example,” Amy Goodall-Smith, founder of Goodall-Smith Wealth Management, told Euronews Next.

“To unpick that yourself is a huge responsibility to put on a young person's shoulders. I think there's an element of responsibility in education. But it has to also come with the parents – a lot of that is through showing”.

Apps like GoHenry emphasise showing children the value of money through visualisation – whether it be money pots or games they can play to learn about finance.

Fledgling financial literacy

Despite this industry's relative success over the last decade, it raises the question of where children should receive their financial education – and more importantly who from?

Some may argue that it is unethical to place the responsibility on private and profit-focused companies to educate younger generations about wealth and savings.

According to the Bank of England, “young people get their financial education from various sources – including at school and in the home. But provision can vary between schools, and some parents feel more comfortable than others talking to their children about money”.

However, as it stands, the British education system alone fails to equip children and young people with adequate financial literacy – with Hill going as far as to describe it as a “gaping hole” that needs filling.

If left unaddressed, poor financial literacy caused by inadequate education can lead to crippling debt and money issues in the future – an issue highlighted by Goodall-Smith.

Ultimately, the emergence of child-focused fintech companies highlights a deeper issue around how confident we are with our own money.

A 2020 survey by the UK’s Financial Conduct Authority (FCA) highlighted that 30 per cent of adults felt that they had low financial knowledge.

GoHenry and similar financial education services are, to some extent, filling the vacuum left by the lack of financial literacy caused by the British education system – offering parents the tools to educate their children about the value of money in an engaging way.

Very young customers

However, as with every private company, these child-based fintech apps need to make money from somewhere. GoHenry, for example, has opted for a subscription-based model in order to remain sustainable.

But concerns can be raised over whether this subscription model could exasperate wage disparity and leave working-class students at a disadvantage – locking out this demographic from valuable knowledge as opposed to their peers from wealthier families.

In response, Hill argued that it was very important that they make their service accessibly priced at just £2.99 (€3.53) per month for “exactly that reason” – stating that a significant proportion of GoHenry’s userbase are from lower-income households, as well as very high-income households.

Tricia Beaumont, Communications Manager at Hyperjar – a debit card and money app, with kids’ options that are subscription-free – takes a different approach. Instead, Hyperjar offers a separate tab in the app which sells data to sponsored companies, offering deals to customers.

While this is a better solution for those who may not be able to afford a subscription fee, it also poses the question of whether it’s ethical to market products to children through a child-friendly money education platform.

While Beaumont admits that “financial literacy is generally pretty poor in the UK”, Hyperjar is a “simple way of visualising money” rather than a substitute for education.

“I don’t think we take it upon ourselves to educate kids about money. What we do incredibly well is provide kids with the tools to start managing their money and feeling in control – understanding those basic money lessons,” she said.

Beating the banks

The surge in popularity of these services also raises the question of why traditional banks, which dwarf these companies in size and infrastructure, haven’t hopped on the trend.

On founding GoHenry, Hill admits she had that same worry and was “concerned about the idea of high street banks just coming into the child fintech space, giving it free and blowing us out of the market”.

As of yet, however, few big-name banks have adopted services specifically targeted towards under 16s.

According to Hill, this is because high street banks are “more focused on their consumer base, how they serve their customers and make money from their customers”.

“They have their business model and they've had a lot of challenges over the past 10 years that they've had to deal with,” she added, “so I think we're focused on what they do – from our perspective, that's great”.

“My hunch is they are embracing technology quite slowly due to the data protection and the levels of regulation,” Goodall-Smith added.

“I think we in financial services have to start embracing technology. I believe that we more than ever have to educate ourselves. And the more you're educated, the less chance you have of falling foul of a scam – the knowledge gives you the confidence and the power to understand what you're doing”.