House prices in EU countries mostly rose year-on-year from April to June, with the largest jumps seen in countries like Portugal and Bulgaria.

House prices in the EU continued to rise in the second quarter of 2025, marking the seventh consecutive year-over-year increase.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

Nominally, prices increased in all EU countries except Finland, while costs also rose in 21 out of 26 countries when adjusted for inflation.

The data shows that while many Europeans are still struggling to get on the housing ladder, affordability concerns are not yet pushing prices down in many areas.

But which countries have seen the strongest increases over the past year? And how do these trends compare to long-term changes?

Seven EU countries record over 10% nominal rise

According to Eurostat, house prices in the EU rose by an average of 5.4% year-on-year in the second quarter of 2025. Seven countries recorded increases of more than 10%, with Portugal (17.1%), Bulgaria (15.5%), and Hungary (15.1%) recording the strongest growth.

Croatia (13.2%), Spain (12.8%), Slovakia (11.3%) and Czechia (10.5%) also posted double-digit increases.

In contrast, Finland was the only country to record a decline, with house prices falling by 1.3% year-on-year in the second quarter of 2025.

In three countries, house prices rose by 1% or less: France (0.5%), Sweden (0.7%), and Cyprus (1%).

Among the EU’s other major economies, price increases were more modest and below the EU average. Germany recorded growth of 3.2%, while Italy saw a 3.9% rise.

House prices in Turkey have surged in recent years, although data for the most recent period is not yet available. According to the latest data from the fourth quarter of 2024, prices rose by 28.5%, making Turkey the top performer.

Deflated prices surge in Portugal and Bulgaria

Deflated, or real, changes offer a more accurate view of price movements by accounting for consumer price inflation. When adjusted for inflation, EU house prices rose by 2.8% on average.

Portugal (14.3%) and Bulgaria (14.1%) recorded the strongest real price growth, both exceeding 14%. Hungary and Spain (9.2% each) and Croatia (8.9%) also saw significant increases, approaching double-digit levels.

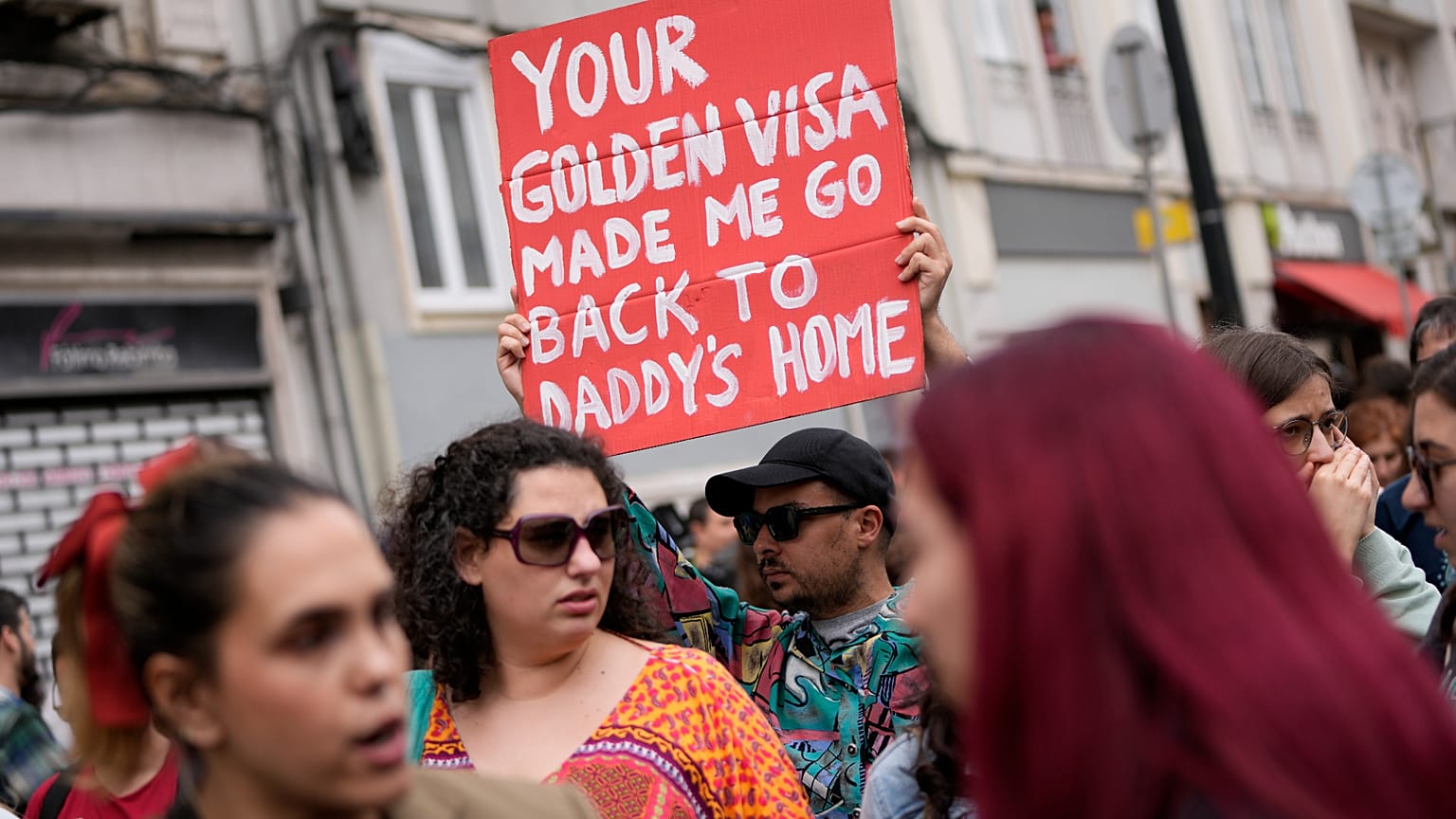

“Portugal’s surge in real house prices has been driven by strong foreign demand, particularly from digital nomads and expats relocating under tax incentives and residency programs, combined with a persistent housing supply shortage,” Mikk Kalmet from Global Property Guide told Euronews Business.

He noted that limited new construction, especially in Lisbon and coastal regions, has amplified competition for existing properties, pushing prices well above local income growth.

According to the Deloitte Property Index 2025, “economic growth, easier access to mortgages, and optimism around Eurozone accession” played a significant role in recent rises in Bulgaria as demand remains robust.

House prices declined in five countries in real terms, though the drops were mostly modest. Finland recorded the largest fall at 2.6%, followed by Sweden (1.7%) and Romania (1.2%). In France (0.1%) and Austria (0.3%), the decreases were minimal.

In Italy (1.8%) and Germany (0.7%), the increase was modest, remaining below 2%.

Five-year change in real estate prices

Examining long-term price changes also offers a better picture of how the residential real estate market is evolving.

Between the second quarters of 2020 and 2025, real house prices rose the most dramatically in Portugal, up by 40.6%. Portugal stands apart, with all other countries rising by less than 30%.

“The influence from the pandemic is still a key driver as increasingly employees and entrepreneurs can operate remotely from anywhere and the Non-Habitual Resident (NHR) tax regime has added to Portugal’s popularity,” Alex Koch de Gooreynd from Knight Frank told Euronews Business.

He emphasised that the traditional market across Portugal has always been led by lifestyle buyers and investors seeking opportunities across all key centres of Porto, Lisbon, Cascais, Comporta and the Algarve.

“One new trend has been the increase in demand for the quieter countryside of the Alentejo by both investors and families alike,” he added.

Croatia (29.9%), Hungary (29.4%), Lithuania (28.8%), Bulgaria (25.1%), Estonia (22.5%), and Slovenia (20.3%) also recorded strong real growth, each exceeding 20%.

Finland recorded the largest decline over this period, with real house prices down 18%, followed by Romania (–13.7%) and Sweden (–10%).

“Finland’s sharp house price decline reflects a combination of weak economic growth, rising unemployment, and the sharp increase in interest rates since 2022, which eroded affordability and froze demand,” said Mikk Kalmet.

He noted that transaction volumes fell to near record lows, while a large stock of unsold new homes placed further pressure on prices, especially in Greater Helsinki.

Among the EU’s four largest economies, only Spain (+14%) saw an increase, while prices fell in Germany (–8.5%), France (–6.1%), and Italy (–3%).

As for Spain, Croatia, and Greece, Kalmet noted that these markets benefit from international buyers, tourism-linked demand, and relative affordability compared to Northern and Western Europe. However, rising borrowing costs are gradually slowing price growth in some cities.

Over the past five years, Turkey has experienced a dramatic surge in house prices. From late 2019 to late 2024, nominal prices increased by 1,175%, while inflation rose by about 500%, according to Eurostat.