Libra, the proposed global digital currency led by Facebook, has raised concerns amongst some governments and financial authorities around the world.

Libra, the proposed global digital currency led by Facebook, has raised concerns amongst some governments and financial authorities around the world.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

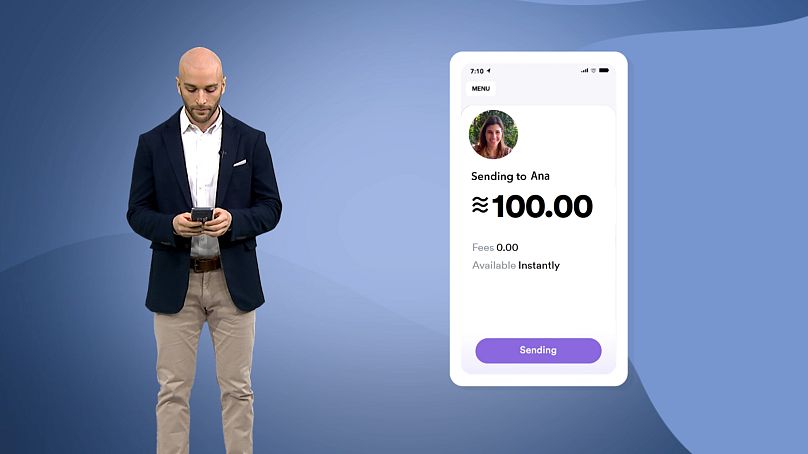

Floated back in June, the cryptocurrency concept means users won’t need a bank account to exchange money online. This has particular advantages for those without bank accounts in developing countries.

Some market analysts suggest the idea has huge market potential, and the World Bank estimates around 1.7 billion adults remained without a bank account in 2017.

If Libra takes flight, users would be able to send and receive money using messaging applications like WhatsApp and Facebook Messenger, meaning anyone with a social media account could qualify.

Why is Libra being criticized?

The cryptocurrency project was originally announced in partnership with aid organization Mercy Corp and rideshare companies like Lyft and Uber.

The concept has been criticized by the US, with France and Germany vowing to block it not least over regulatory concerns. Initial partners like VISA, Mastercard and E-bay have dropped their involvement amid public scrutiny.

It’s estimated that a third of the world uses Facebook and US lawmakers have accused the social media giant of deceptive business practices.

In 2018, Cambridge Analytica used the personal information of users for campaigning purposes in the 2016 US presidential election, without their consent.

In October’s US Congressional hearing, Facebook’s CEO Mark Zuckerberg defended his project, which is planned to launch 2020.

“I get that I’m not the ideal messenger right now,” he said at the hearing. “We faced a lot of issues over the past few years and I’m sure there were a lot of people who wish it were anyone but Facebook who were helping to propose this.”

How would markets in the Middle East respond?

Some say Libra shouldn’t be feared and banks need to adapt to the changing landscape, with adopters in emerging markets, such as the Middle East, being key to Libra’s success.

“We’re talking about the huge database that Facebook has and something like that hasn’t been tried on this particular scale,” said Naeem Aslam, who works as Chief Market Analyst at Thinkmarkets.

“A mass adoption can only happen when you have a large database of users, and Facebook already has that” he explained.

Global remittances reached an all-time high of $529 billion last year, according to the World Bank.

In the United Arab Emirates, the world’s second-highest sender of remittances according to the Central Bank and data from the World Bank, workers repatriated 46 billion dollars in 2018.

UAE resident Marizen Taguinod, originally from the Philippines, opened a hair salon last year in Dubai and regularly remits money to help with the company's cash flow.

“I’m sending to my mum, my sister also sends to me as well, because she’s my partner in the business, so that’s how we do it. It’s very important actually,” she said.

Libra aims to make it more cost-effective for people like Taguinod to conduct her business and home affairs.

Yet for those within the remittance industry, like Al Ghurair Exchange, which has around 25 UAE branches, it’s a different story.

“My industry is going to be badly affected obviously because this is going to be a complete replacement, so it’s going to affect lots of jobs” said the company’s banking manager, Deepak Bulchandani. “In this part of the world, five percent of the workforce works in the exchange and back industries.”

With potential job losses in the remittance industry and resistance from lawmakers on one side, and Zuckerberg claiming his idea could liberate billions financially on the other, it would seem that Facebook’s current relationship status with Libra is “complicated.”

SEEN ON SOCIAL: FINANCE CONSULTING

Finance consultant Eman from Kuwait shared this post hoping to inspire more people to trade for themselves.