Green hydrogen, with its unique properties to store energy and to be produced by wind or in other sustainable fashions, may be part of the solution to Europe’s future energy security, Joseph Hammond writes.

Russia's invasion of Ukraine has re-drawn the map in terms of how Europe views its relationship to energy forever.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

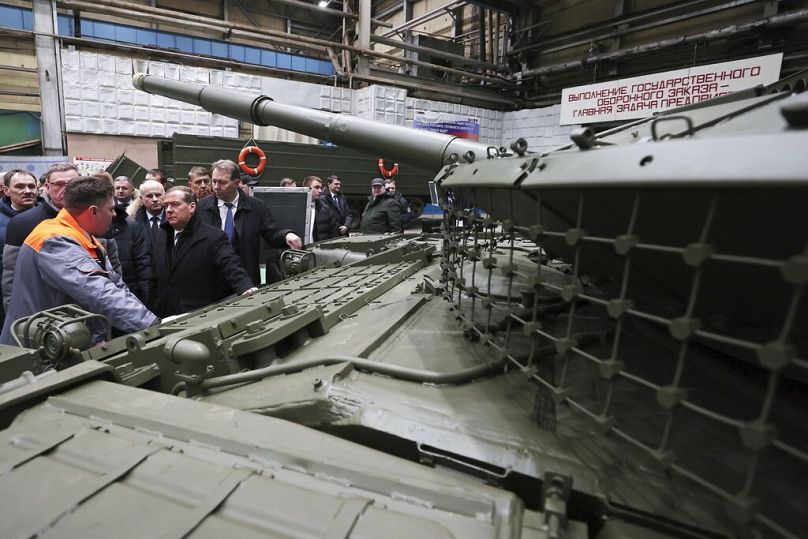

Europe's over-reliance on hydrocarbons from Russia in terms of oil, coal and above all, gas became glaringly obvious the moment that Moscow's Cold War-era tanks made a mad dash to Kyiv.

The international community should have had ample warning that all was not right. Russia’s 2022 invasion was after all its second of Ukraine in less than a decade.

Increasingly, the war in Ukraine seems bogged down in a 21st-century version of trench warfare, at least for the time being.

In the post-war period, Russia will certainly attempt to regain its economic status through commodities. The Kremlin is banking on the fact that its position at the heart of the Eurasian landmass will make it central to the geo-economics of the 21st century.

Battle tanks or hydrogen tanks? Both, actually

Moscow has several options in this regard. For example, Russia has plans to produce a third of the world's helium supply.

Best known for being used in party balloons, helium is no laughing matter: a commodity so strategic that the United States first began stockpiling it in the 1920s.

For now, at least Russia has set its sights on an alternative commodity entirely. As Platts Global warned last year, “Russia plans to leverage its large natural gas reserves, existing infrastructure, and cooperation with foreign partners to take a major stake in the global hydrogen market.”

With an aim to get a fifth of the market by 2030, Russia is ramping up its production of battle tanks and hydrogen tanks at the same time.

We shouldn’t be focused on mere hydrogen, of course. Green hydrogen, with its unique properties to store energy and to be produced by wind or in other sustainable fashions, may be part of the solution to Europe’s future energy security.

In this context, Europe should be concerned that countries have little capacity to produce it. A recent EU study has questioned if producing green hydrogen in Germany will ever be viable.

Elsewhere, it is clear that within the EU green hydrogen investment has lagged in terms of attracting investment. One study found that the United Kingdom’s green hydrogen target would require using half of the UK’s offshore wind energy capability.

Last week, Brussels launched its first-ever green hydrogen auction. Thus, imports remain the only viable solution. From where, though, is the question.

Could Azerbaijan provide an alternative?

Earlier this year, an Emirati energy company and Azerbaijan's national oil company, SOCAR, signed an important energy deal.

Both states are known oil and gas producers, but what was unusual was that the deal focused exclusively on offshore wind and green hydrogen.

When complementary solar and onshore wind projects are included, the project will generate 4 gigawatts of power. Wind is both clean and sustainable. It should be prioritized for green hydrogen projects.

Azerbaijan has already proven itself a reliable partner for Europe in terms of natural gas so it makes sense as a natural partner for Europe’s energy diversification and green hydrogen needs too.

Azerbaijan is already a critical supplier of natural gas and with that experience, it has moved quickly to find markets for the electricity produced by its offshore wind farm.

A subsea interconnection across the Black Sea will send Azerbaijani electricity to Georgia, Romania, and Hungary. For the export of green hydrogen, the extensive pipeline networking linking Azerbaijan to Europe already exists.

Oil's importance will decrease

Conversely, the UAE seeks to position itself as a leader amongst the oil-rich GCC states in post-carbon transition. The country has kicked off COP28 as its host and has committed itself to $300 billion (€276.9bn) in investment in renewable projects intending to triple renewable energy production.

Masdar is expected to produce 1 million tonnes of green hydrogen by 2031 with the remaining 0.4 million tonnes of blue hydrogen, produced using natural gas.

COP28 is also worth noting as it will put green hydrogen on the global agenda. COP28’s President-designate Sultan Al Jaber has unveiled a global plan to double green hydrogen production by 2030. Europe should act now to avoid steeper costs later.

One doesn’t have to be a petroleum economist to understand that, if present trends continue, oil will become increasingly less important geopolitically.

After all, much of the 19th-century economy relied on whale oil — a trend that thankfully did not end with the extinction of the last whale. Similarly, the 20th century saw several “oil shocks” which racked economies across Europe.

It is reasonable to believe that Europe should expect similar in the 21st century — and should be preparing for that now.

Joseph Hammond is a journalist who has reported extensively from Africa, Eurasia and the Middle East, as well as a former Fulbright Public Policy Fellow.

At Euronews, we believe all views matter. Contact us at view@euronews.com to send pitches or submissions and be part of the conversation.