Paris, Frankfurt, Luxembourg and Dublin are stepping up a charm offensive to lure London's financial institutions following the Brexit vote.

European financial centres are stepping up a charm offensive hoping to lure London’s financial movers and shakers following the Brexit vote.

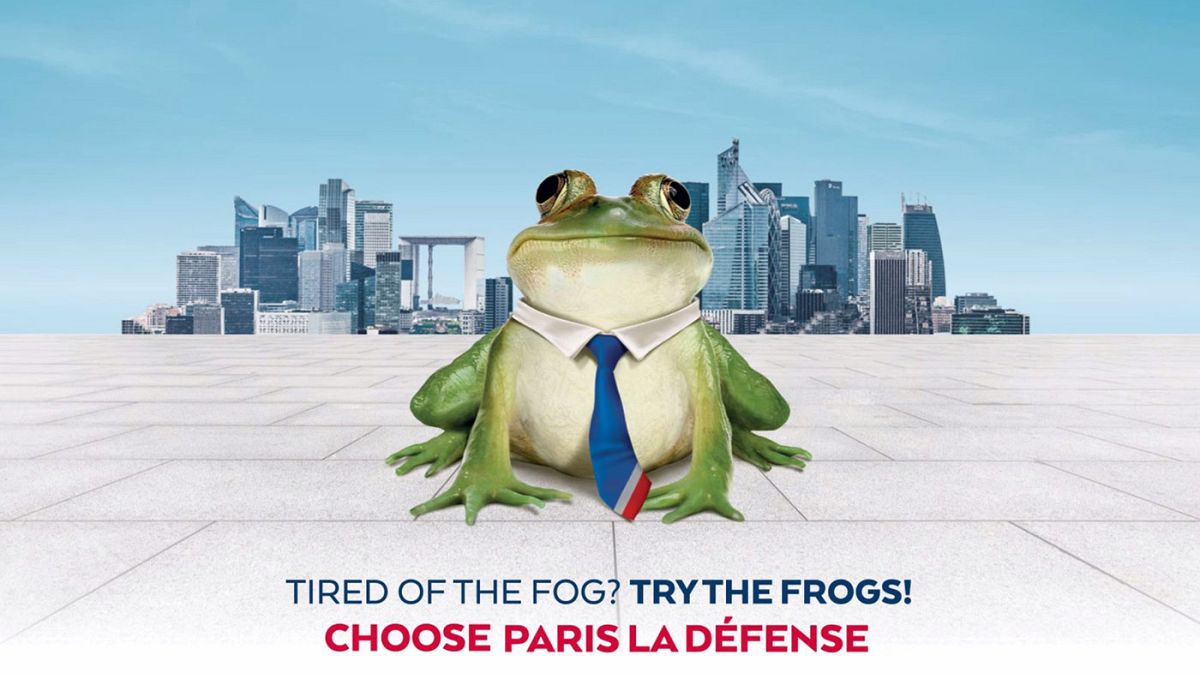

La Defense, the financial district in Paris, has launched an advertising campaign.

It features a green frog wearing a tie in the blue, white and red of the French flag and the slogan ‘Tired of the fog? Try the Frogs! Choose Paris La Defense’.

TERRITOIRE – De la City à Paris La Défense, il n'y a qu'un saut ! Bienvenue à Paris La Défense ! Plus d'infos sur https://t.co/L5QoJN8E8rpic.twitter.com/Ty3kmNEKVN

— Paris La Défense (@ParisLaDefense) October 17, 2016

Posters featuring the amphibian have gone up at London’s Heathrow Airport and Eurostar’s London terminus, St. Pancras.

Officials from La Defense said the adverts were to underscore its attractiveness, including things like lower rentals and good public transport.

Pragmatic promotion

“As regrettable as Britain’s exit from the European Union may be, we have to be pragmatic and promote our own assets,” said Patrick Devedjian, head of the elected council representing the Hauts-de-Seine district where La Defense is located.

Arnaud de Bresson, chief executive of Paris Europlace, a lobby group for the French financial district, said banks have told him there are only two choices when it comes to relocating operations from London – France or Germany.

“Our estimate is that close to 10,000 people involved in the financial sector could move from London to Paris in the next few years, and Paris is getting fully organised for that,” de Bresson said.

Paris is not only the city of love, but also a city for business says Arnaud de Bresson

europlace</a> <a href="https://twitter.com/hashtag/gxpsummit?src=hash">#gxpsummit</a></p>— Paris EUROPLACE (europlace) October 17, 2016

This summer the French government announced extra tax concessions for foreigners in the hope Paris could profit from Brexit, but experts say other centres with more flexible labour and tax rules are likely to be bigger beneficiaries.

Where else?

Frankfurt, Luxembourg and Dublin are among the European cities hoping to attract banks and other institutions from London.

They are banking on London losing its dominance as Europe’s top financial capital and want to capitalise on that.

Hubertus Vaeth, chief executive of Frankfurt Main Finance, which promotes Frankfurt as a financial centre, said the aim was not to inflict “as much damage as we can” on the City of London, but to siphon off some of Britain’s “entrepreneurial spirit”.

Where in Europe will they go? If London loses its luster, Dublin and #Frankfurt look like winners #Brexithttps://t.co/I3BWqh9tCZ

markets</a></p>— FrankfurtMainFinance (FMFdigital) October 17, 2016

“We already see small teams, explorative teams looking into certain aspects,” Vaeth said. He added: “The big moves will start in the second half of 2017.”

However Rupert Peters, a senior account manager at Britain’s trade and investment ministry, said Frankfurt lacked both the liquidity of Britain’s financial markets and its cluster of support services.

Banks say they are already starting to look at relocating some staff and operations in case future access to the EU market turns out to be restricted, a scenario known as a hard Brexit.

“We can only plan on the basis of a hard Brexit,” said Ronald Kent, a managing director at the British Bankers’ Association (BBA) said.

Brexit: interesting analysis of Euro contenders for re-location: Ireland for insurers; Germany for banks #FThttps://t.co/f2CfZgFo0Q via

FT</a></p>— Orla (orpwr) October 10, 2016

Luxembourg ‘Natural Pick’ for Banks After Brexit, Gramegna Says (Bloomberg–New York– Oct. 6, 2016) https://t.co/7y9FNfbgnqpic.twitter.com/SEQG03IBDX

— LTIO NY (@LTIONYC) October 7, 2016