What’s on the minds of Europe’s hoteliers?

Booking.com has teamed up with Statista Inc. to find out. The result is the second edition of the European Accommodation Barometer.

As a sector responsible for over 22 million EU jobs and €1.3 trillion (or 9.5%) of the bloc’s economy, we think it’s important to understand the hopes and fears of the people on the ground. After all, the hospitality industry is not an abstraction: it is men and women who come to work every day and deliver unforgettable experiences for their guests.

Hard times don’t last forever

Breathing a sigh of relief after a few tumultuous years, the majority of hoteliers view the recent past in a positive light.

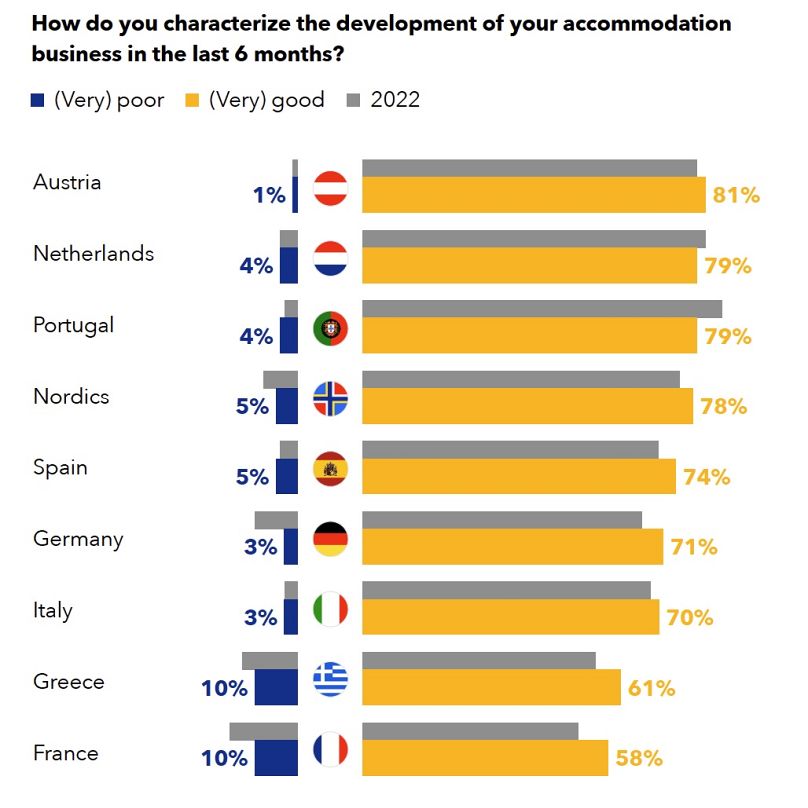

For every accommodation in Austria that assessed the developments over the last six months as poor, there were 81 who thought they were good or very good. Even for countries with a lower ratio, like France and Greece, the celebratory mood eclipsed the pessimism six to one.

There are regional disparities, however. Spain, Portugal, Austria, and the Nordic countries are more optimistic about the current state of affairs and future outlook, while France, Italy, and Greece have more subdued assessments.

Assessing the next six months, every second travel property in Europe is feeling cheerful. One-third are neutral, and only one in ten is feeling gloomy. Portuguese hoteliers are the most optimistic about the future, having seen some of the strongest growth in occupancy and room rates.

Spain and Greece expressed the most upbeat revenue outlook, reflecting their popularity among summer vacationers. More than others, the beach and seaside establishments expect 2023 to be a record-breaking year. Tellingly, 57% of accommodations see the increased appreciation for travel as a significant business opportunity. And, to top it all off, occupancy levels and room rates have increased for the majority of European accommodation businesses over the past six months.

AI adoption

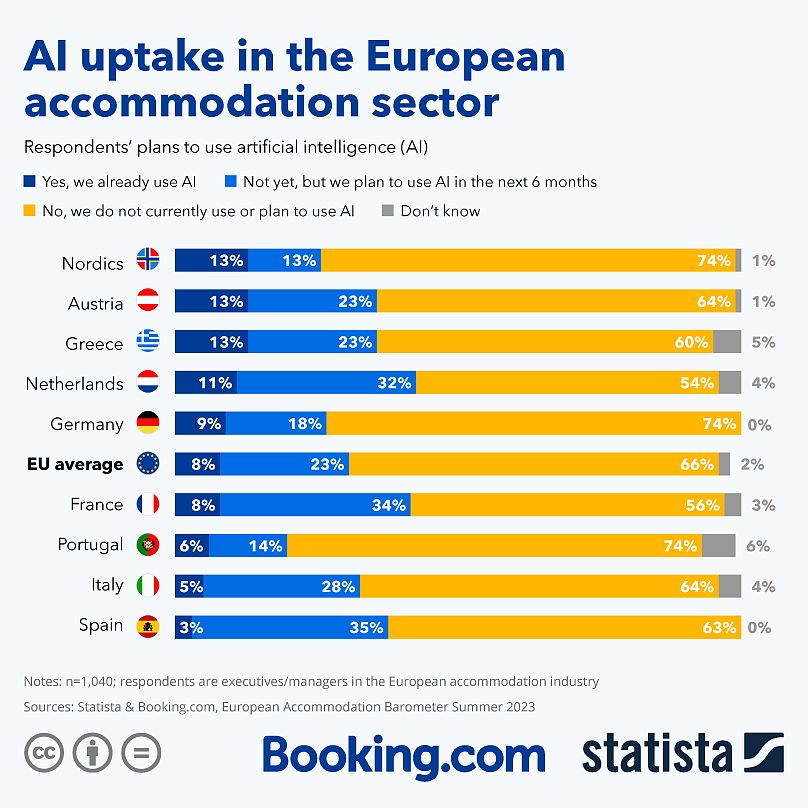

In the second edition of the European Accommodation Barometer, we introduced a question on AI, given its newly found prominence. By leveraging machine learning and artificial intelligence, hoteliers can streamline operations, improve guest experiences, and drive revenue growth. But the current rates of AI adoption are low.

When it comes to the adoption of AI, hoteliers in the Nordic region were the most invested, with 13% saying they use it already. In The Netherlands, 32% of hoteliers were keen to start deploying AI in the next six months.

Government policies

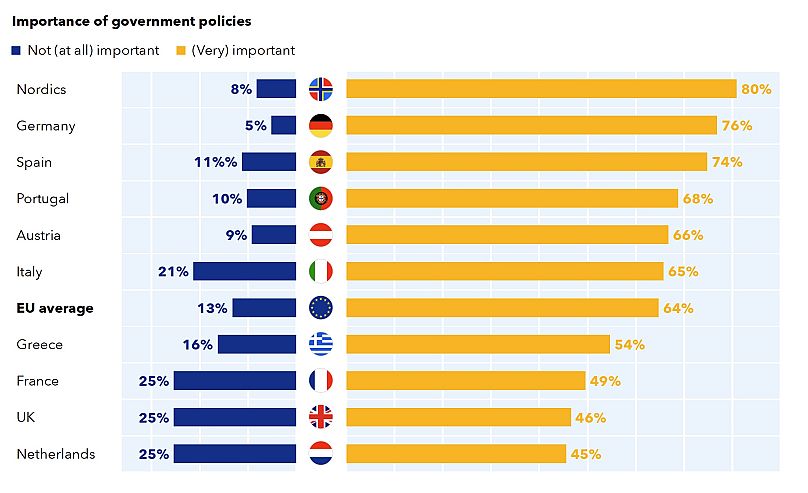

Accommodations across Europe recognize the importance of government policies vis-a-vis their business success. Even in countries where this sentiment is a bit more subdued, like France, UK, and The Netherlands, the ratio of respondents who believe that policies matter is two to one versus those who do not.

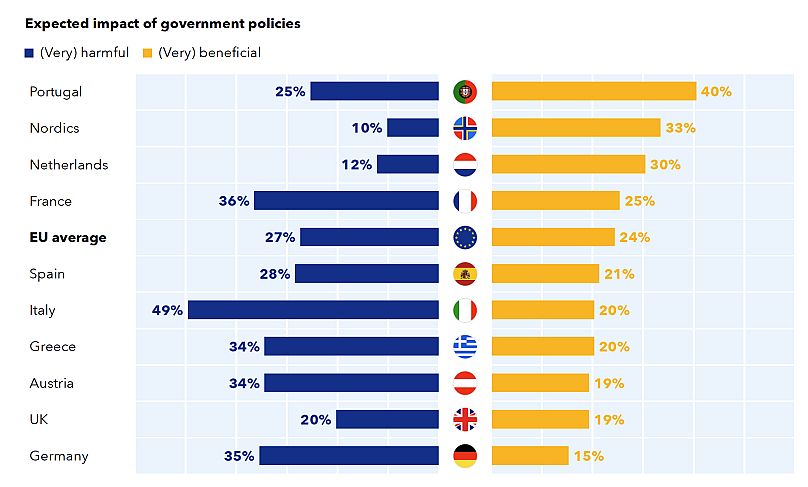

There is less of a consensus when it comes to the impact of the said government policies. Hoteliers in Italy, Germany, Austria, and Greece still view them as mostly harmful. At the same time, their counterparts in Portugal, The Netherlands, and the Nordics consider government policies to be beneficial as far as their expected net impact.

While COVID-19 and travel restrictions are becoming less significant concerns, energy costs remain the top challenge for the accommodation industry. Furthermore, the survey respondents are worried about the macroeconomic conditions, staffing, and rising costs of inputs. Overall, the perception of challenges the industry faces has increased compared to the previous Barometer.

Challenges Faced by Individual and Chain Hotels

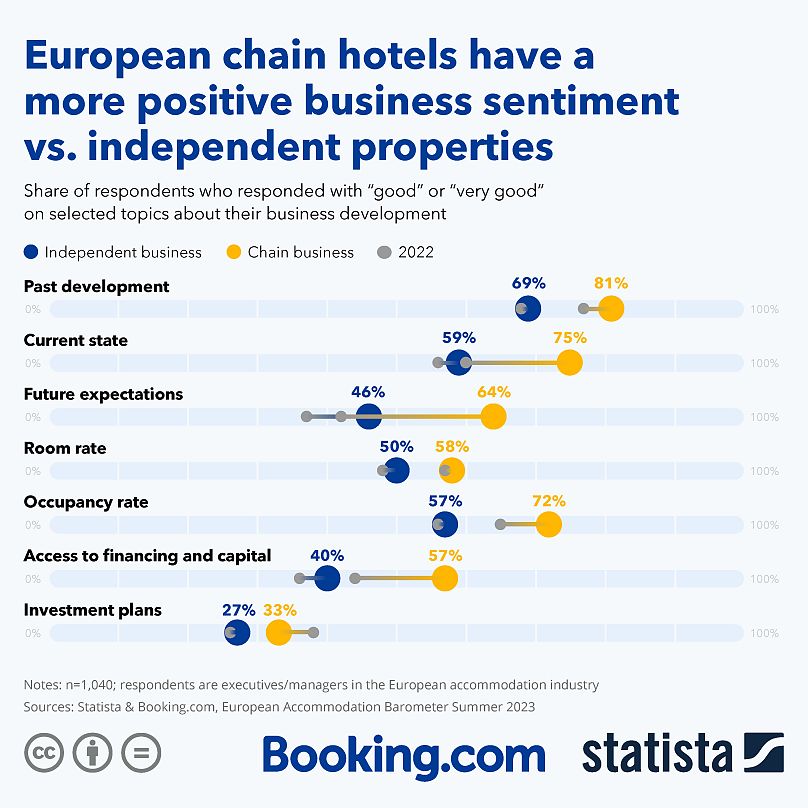

The survey reveals significant differences between individual hotels and chains, with independently managed properties facing greater challenges across all metrics covered in the accommodation barometer. They encounter more difficulties accessing capital; plus, their occupancy and room rates have seen slower growth.

Chain businesses are feeling bullish: around two-thirds (64%) anticipate a positive or very positive development in the next six months, up from 42% in 2022. Furthermore, the expectations for future performance are also higher for chain businesses compared to independently-managed establishments

Larger hotels and those with higher star ratings are in a better position than smaller ones with lower star ratings.

Support from digital platforms

As the Barometer shows, the challenges and opportunities for Europe’s hoteliers are many and varied. What is common among them, however, is their perennial task: filling beds and wowing guests. This is where digital platforms can help.

While representing just one distribution channel available to European accommodations, digital platforms are a risk-free and cost-efficient way of showcasing rooms to a global audience.

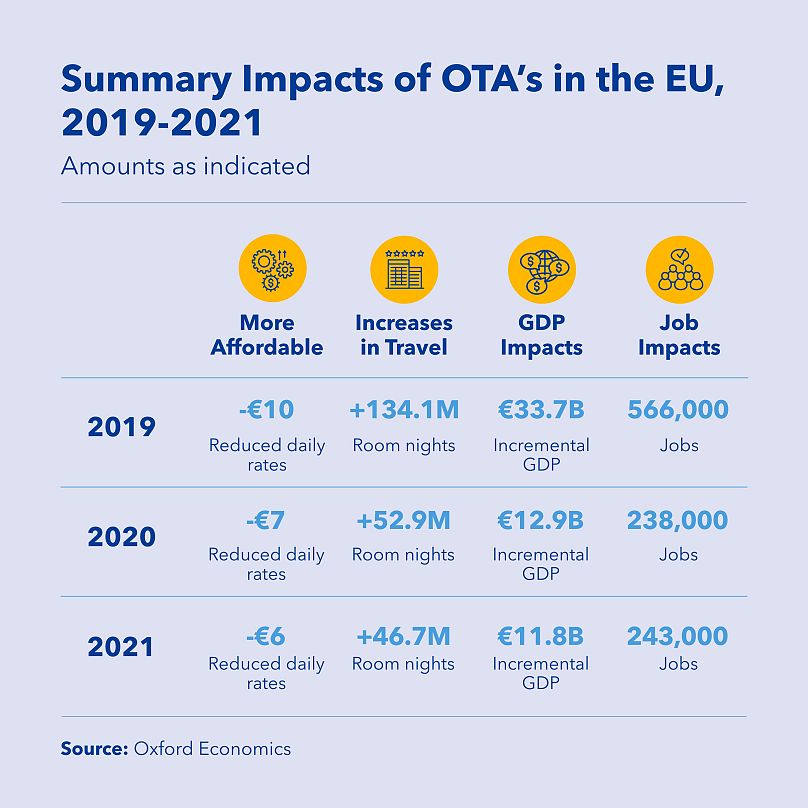

As a study by Oxford Economics shows, in the three years leading up to 2022 — despite the pandemic — online travel platforms delivered over 230,000,000 additional nights to the European hotel market. What’s more, these incremental bookings went predominantly to small and midsize hotels.

Testimonials, compiled in a study by EY Parthenon, show us that hoteliers agree that digital platforms are a useful addition to their distribution matrix. 91% of respondents said that platforms help them to realise incremental bookings, while 85% agree that they are a cost effective way of sourcing guests from a diverse pool. Whatever comes their way, digital platforms remain a reliable partner for Europe’s hoteliers.

The future is bright

Europe’s accommodations are hopeful about their prospects, and the recovery is gathering speed. Given the vital importance of the travel and tourism sector to Europe’s economic success, we can all celebrate this remarkable comeback.