Austerity measures linked to IMF loans are eroding human rights across the globe, according to a human rights NGO.

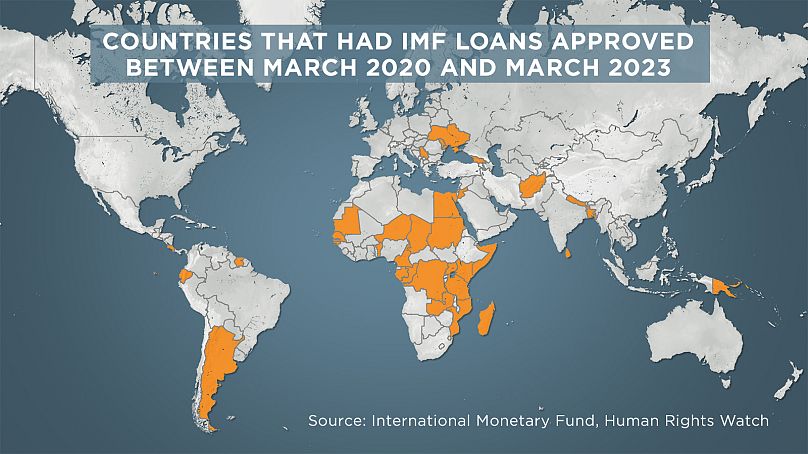

In a report published on Monday, Human Rights Watch (HRW) looked at 38 loan programmes approved by the International Monetary Fund (IMF) between March 2020 and March 2023, which it said directly impacted one in eight people’s economic, social and cultural rights, leading to rising inequality.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

The period followed the breakout of the COVID-19 pandemic which shook economies around the globe, especially in developing countries. In a written comment, the IMF said they mounted an unprecedented response to help the most vulnerable countries and people deal with shocks, injecting $1 trillion in liquidity and financial support since March 2020.

These countries were the main beneficiaries of the austerity-hit loans during said period, impacting 1.1 billion people.

What conditions come with the IMF loans programmes?

IMF loans are designed to help countries invest in vital services such as health and education, but they come with conditions that make this impossible in practice, according to HRW.

One of the main conditions of an IMF loan is that governments’ debts must decrease through public spending cuts, often coupled with tax increases. A common fiscal consolidation approach considered to be key by the IMF.

At the same time, the IMF insists that countries must do so “while protecting social spending”, which refers to countries’ spending on specified social programmes and social safety nets.

The agency establishes social spending floors, setting up minimum amounts countries need to dedicate to social spending such as health, education, and social protection programmes.

But social spending floors do not fulfill their promise of counterbalancing the negative impacts of decreased public spending, HRW said in its criticism of the IMF.

The report cites the specific example of Jordan: while the country has been benefiting from IMS loan programs since 2012, both poverty and debt remain high.

Why does counterbalancing the negative impacts of public spending cuts only work in theory?

One of the major reasons why the IMF’s loans’ conditions don’t work in practice, according to HRW, is because the issues that existed prior to the IMF loan programmes are often too vaguely assessed.

This means that knowing the extent of the social spending increase needed after the loan is virtually impossible, leading to a breakdown in access to basic human rights.

Second, the floors are often too broadly defined to properly compensate what individuals lose when their governments decrease public spending, HRW said.

Sarah Saadoun, senior researcher and advocate on economic justice and rights at HRW told Euronews about the case of a woman in Sri Lanka, who earns $1 a day working seven days a week as a domestic worker.

“The impact of the economic crisis there meant her earnings were essentially cut in half. On top of that, in an effort to reduce public spending, the government cut subsidies for electricity,” she said. “She and her son had to move in with her mother, meaning that she is completely dependent on her relatives and her employer to survive.”

The Sri Lankan domestic worker had been receiving benefits from her country’s social protection system since 1994, which was cut short in an effort to improve said system.

However, she has yet to find out whether she is eligible for the new programme.

Assessing the exact criteria needed to mitigate the impacts of public spending cuts is complicated.

The specific example of the Sri Lankan woman illustrates this difficulty: electricity subsidies being cut means many must spend more on energy.

Subsequently, the state should have compensated this in some way, for instance by spending additional funds on school, so she has less to pay towards her son’s education, or by lowering the cost of healthcare, so she has less to spend in this area.

But broadened to 1.1 billion people, such an assessment of the impact of public spending cuts and how to mitigate their consequences to each individual is virtually impossible.

The IMF's own internal research indicates that fiscal consolidation is not effective for reducing debt ratios, on average. Contacted by Euronews, the agency said that this strategy's goal can be successful "when it's well-timed and well-designed".

"Protecting the poor and the vulnerable"

International financial institutions have human rights obligations, including through their member states, according to HRW.

As such, the NGO says it wants to see the IMF implement more stringent measures when issuing loans, such as conducting an assessment of policies’ human rights impacts before they are enforced.

The NGO also calls attention to the IMF’s vocabulary, which mentions “protecting the poor and the vulnerable”. That means excluding part of the population above a certain income, but not necessarily people who won’t be left struggling by public spending cuts, it said.

For the rest, “those programmes have long track records of failing to reach the targeted population” explained HRW’s Sarah Saadoun.