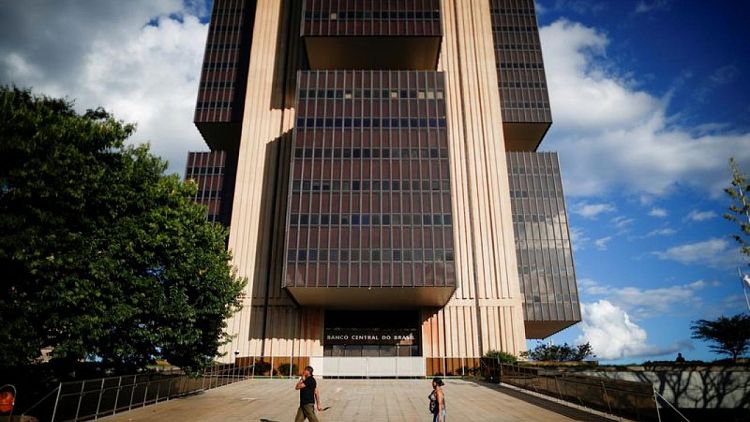

BRASILIA - Brazil's central bank aims to launch its digital currency in 2024 after a closed pilot program next year with financial institutions, bank president Roberto Campos Neto said on Tuesday, adding that the project had received international attention.

Speaking at an event hosted by the news website Poder 360, Campos Neto said the design of the central bank's digital currency would encourage banks to tokenize their assets, with considerable efficiency gains.

"If the digital currency is actually a tokenized deposit, it inherits all the regulation that already applies to deposits," he said, adding that it should not disturb monetary policy or hurt banks' balance sheets.

Campos Neto said representatives of the International Monetary Fund (IMF) have approached the central bank and given feedback that this model seems the easiest to implement and other central banks should look into it.

"In the end, we were even flattered to have thought of a system that other central banks are now thinking of," he said.

The tokenization of deposits should also improve the banks' settlement, auditing and funding costs, said Campos Neto.

The central bank chief also predicted a jump in use of the bank's popular instant payment system, Pix, once users can access cheaper credit through the system, without a fee known as the merchant discount rate (MDR).

Merchants pay the MDR fee to the companies that supply card machines, such as Cielo, Stone and Getnet.

Launched in November 2020, Pix is free for individuals, but the system lets banks and payment institutions freely define merchants' costs both for transfers and receiving funds.

The Pix system has grown immensely popular in Brazil, with use now surpassing transactions with credit and debit cards in the country.