By Henning Gloystein

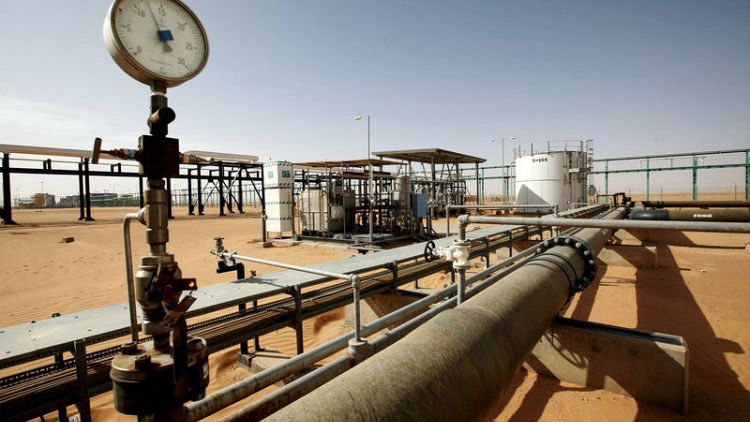

SINGAPORE (Reuters) - Oil prices on Tuesday reached their highest since November as concerns over exports from war-torn Libya stoked tightness in the market, with global supply already hit by OPEC-led production cuts and U.S. sanctions on Iran and Venezuela.

International benchmark Brent futures touched their strongest level since last November at $71.34 per barrel on Tuesday, and were still at $71.16 at 0057 GMT, up 6 cents, or 0.1 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude oil futures also hit a November 2018 high, at $64.77 per barrel, before easing to $64.58, which was still 18 cents, or 0.3 percent, above their last settlement.

"Renewed fighting in Libya ... has seen Brent crude break above $70 per barrel," said Ole Hansen, head of commodity strategy at Saxo Bank.

Libya is a significant supplier of oil to Europe, producing around 1.1 million barrels per day (bpd) of crude in March.

A warplane attacked Tripoli's only functioning airport on Monday as eastern forces advancing on the Libyan capital disregarded international appeals for a truce in the latest of a cycle of warfare since Muammar Gaddafi's fall in 2011.

Hansen said the fighting in Libya added to an already tense market, which has been tightened this year by U.S. sanctions on oil exporters Iran and Venezuela as well as supply cuts led by the producer club of the Organization of the Petroleum Exporting Countries (OPEC).

As a result, Brent and WTI crude oil futures have risen by 41 and 31 percent respectively since the start of the year.

(Reporting by Henning Gloystein; Editing by Joseph Radford)