(Reuters) - Majestic Wine Plc <WINEW.L> will import an extra 5 to 8 million pounds of stock to ensure it is covered against any problems with deliveries following Britain's exit from the European Union, the company said on Thursday.

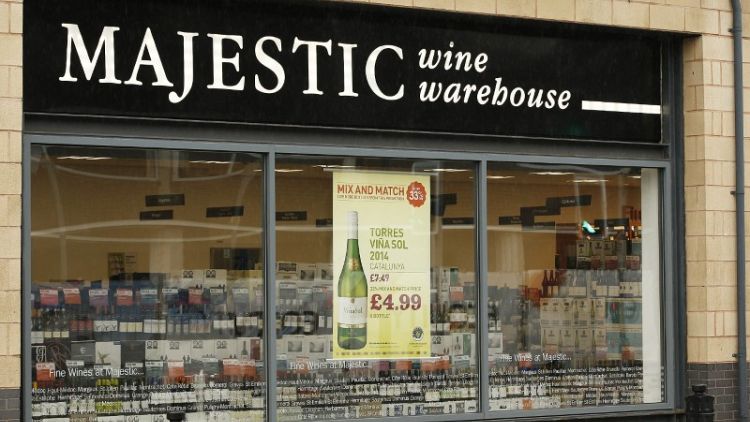

Shares in the company, one of Britain's best-known wine merchants, fell almost 17 percent in early trade after it reported a small loss in the first half compared to profits a year ago and outlined a tough trading environment ahead of Britain's planned departure next March.

Britain is still at risk of falling out of the world's biggest trading bloc without a formal exit deal and companies are having to plan for the chance of substantial interruptions to the smooth flow of goods and parts across its borders.

Some 55 percent of the wine consumed in the UK is imported from the European Union and Britain's Wine and Spirit Trade Association has campaigned against a no-deal scenario which it says would be disastrous for the UK industry.

"We were planning for tough times and we're investing through tough times," Majestic Chief Executive Rowan Gormley said in the company's results release, stressing the company was doing well in a tough market.

The results showed a small pretax loss for the six months ended Oct. 1 compared to a profit of 3.1 million pounds last year.

Adding to the cost implications of a broadly weaker British pound for importers is the fall in discretionary spending by Britons, who are tightening their purse strings amid rising prices of daily essentials and muted pay rises.

Majestic also said that profit at its Naked Wine business would be hit by a speed up in investment. The firm expects to spend 20 million pounds or higher by the end of 2019 to bring new wine drinkers to the unit.

"The weak performance in Majestic Retail is a surprise and should have been better considering the summer," Liberum analyst Wayne Brown said, cutting the stock's rating to "hold".

Majestic's shares were 16.16 percent lower at 314 pence at 0823 GMT.

(Reporting by Karina Dsouza in Bengaluru; editing by Patrick Graham)