By Trevor Hunnicutt

NEW YORK (Reuters) - BlackRock Inc <BLK.N> Chief Executive Larry Fink said on Thursday the United States is on a path to a full-fledged trade war against China as the world's two largest economies engage in tit-for-tat tariffs.

Fink is one of the most influential figures in global finance, who keeps up relations with politicians in many countries as leader of the world's largest fund manager, overseeing $6.4 trillion in assets from sovereign debt to corporate equity.

"If the path remains the same in the next few weeks, we're going to have a full-fledged trade war," Fink said at the New York Times Co's <NYT.N> DealBook conference.

"China is a very strong, very proud nation. I think they're going to stand pretty firm."

The United States has imposed tariffs on $250 billion worth of Chinese goods, and China has responded with retaliatory duties on $110 billion worth of U.S. goods.

U.S. President Donald Trump has long threatened to impose tariffs on all remaining Chinese imports into the United States if Beijing fails to meet U.S. demands for sweeping changes to Chinese trade, technology transfer and industrial subsidy policies.

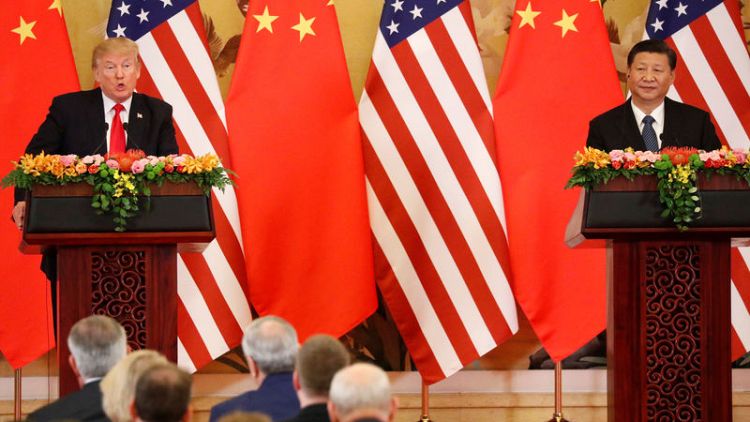

In a tweet on Thursday Trump said he had a "very good" talk with Chinese President Xi Jinping on trade and North Korea and that the two planned to meet at the G20 summit in Argentina which starts at the end of this month.

Fink said he had travelled to China in recent weeks and defined a "full-fledged trade war" as meaning U.S. levies on all Chinese imports.

He said China will likely not buy more U.S. Treasuries as the trade war goes on. That would put pressure on Washington, which has financed its growing debt by selling bonds, often to China and other foreign governments.

Just days after a gunman killed 11 people at a Pittsburgh synagogue, Fink said his company has privately engaged with gun makers on how they plan to respond to the social backlash from mass shootings.

BlackRock is the largest shareholder in several gun makers through its massive index funds, which generally hold shares in all companies in a certain index.

Fink in January wrote a letter to corporate executives saying that companies need to show how they make "a positive contribution to society" in addition to delivering financial performance, as his company faces such demands from shareholders and customers.

(Reporting by Trevor Hunnicutt; Editing by Bill Rigby)