By Kane Wu

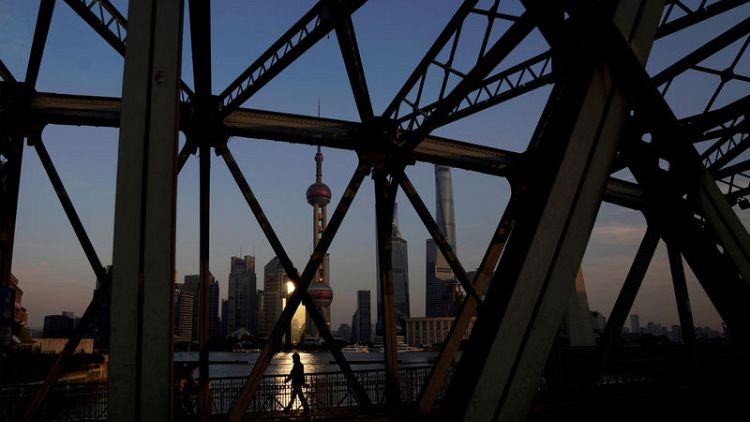

HONG KONG (Reuters) - China's private equity industry is cooling, with fundraising on course for one of its worst years since the global financial crisis and returns under pressure, hurt by tighter domestic liquidity following Beijing's war on debt and Sino-U.S. trade tensions.

Industry players have raised $19.7 billion in yuan and foreign-currency funds so far this year, according to data provider Preqin, compared with an average $46.5 billion per year raised since 2010. The figures include venture capital as well as growth and later-stage private equity funds.

Yuan-denominated funds have been hit particularly hard, with fundraising running at $6.9 billion, or a little over a tenth of the full-year number for 2017.

A fundraising slowdown in Asia's biggest private equity market could narrow investors' exit options, impact deals and disrupt companies' funding plans.

Liquidity in China has tightened as an escalating trade conflict between Washington and Beijing has stoked market volatility. That comes as China's multi-year deleveraging programme has weighed on banks, insurers and trust firms who are the main investors, or limited partners (LPs), in private equity funds.

"For yuan-denominated funds, indeed some of the industry's previous fundraising channels, money from banks for example, are getting more difficult or have simply disappeared after the new asset management regulations came out," said Wei Ke, a partner at investment bank China Renaissance’s Huaxing Growth Capital.

"Such doors are basically shut," he added, referring to China's new restrictions on banks' wealth management products and how they can invest.

China's onshore traded stocks have lost a total market value of 8.24 trillion yuan ($1.21 trillion) since March 22, when Donald Trump unveiled tariff plans for Chinese exports.

Wealthy individuals and enterprises have also seen their assets shrink due to market wobbles and are therefore less keen or less able to invest, said Lily Liu, founder of Greater China private equity recruiter The Fathoms Group.

"So far we are seeing LPs becoming more cautious and their investments more restricted due to the policy environment," she said. "The only funds that can survive would be the more professional and specialized ones."

As a result, some of the funds had to cut back on their fundraising targets, Liu added, without naming the funds.

"BRUTAL WINTER"

The drop in fundraising comes as venture capital and private equity investments in Chinese companies reached an all-time high. As of Aug. 29, such investments totalled $56 billion, according to Thomson Reuters data.

Companies, especially tech startups such as Ant Financial Services Group [ANTFIN.UL] and Beijing Bytedance Technology Co, have been embracing ever-bigger valuations at an unprecedented pace.

The shrinking pool of dry powder could eventually hurt investment returns, some investors and analysts said.,

Between 70 percent and 90 percent of the funds operating now would not be able to realise their desired returns, according to a report by Chinese research firm Fuhang, which looked into onshore yuan-based funds and investments.

Fuhang predicted that China's deleveraging and liquidity squeeze would continue until at least 2020.

"In the next three years, investments or capital in the primary market will experience a brutal winter," said the report.

TOP FUNDS GAIN

As uncertainties grow, investors who still need to allocate their capital are staying with funds that have a proven performance track record.

The biggest China-based fund raised this year is a 10 billion yuan logistics focused fund under Asia's largest warehouse operator, Global Logistic Properties (GLP), according to Preqin.

YF Capital, backed by Alibaba <BABA.N> founder Jack Ma, closed the biggest dollar fund at $2.5 billion, the data showed.

A few mega funds yet to close could, however, still give a boost to the disappointing volume this year.

Sequoia Capital China, the local arm of the Silicon Valley-based venture capital giant, is close to raising 15 billion yuan in its fifth yuan-denominated China-focused fund, the largest of its kind.

And Hillhouse Capital, an investment house that reaped good returns from its earlier bets on Tencent Holdings <0700.HK> and JD.Com Inc <JD.O>, has also received commitments of over $10 billion for its third pan-Asia dollar fund, industry sources have said.

"A lot of sophisticated LPs we've seen are only investing in two to three funds or maximum five funds, consolidating their resources into certain funds they feel (that) have the ability to generate the returns," said Nisa Leung, managing partner at Qiming Venture Partners.

"The trend will be more and more prevalent."

(Reporting by Kane Wu; Additional reporting by Julie Zhu in Hong Kong and Samuel Shen in Shanghai; Editing by Philip McClellan and Muralikumar Anantharaman)