BEIJING (Reuters) - China's central bank said on Tuesday that it will not resort to strong stimulus to support the slowing economy but will keep liquidity reasonably ample and offer more help to companies which are having trouble obtaining financing.

Policies will also be made more forward looking, flexible and effective, the People's Bank of China (PBOC) said in a statement issued at a briefing in Beijing.

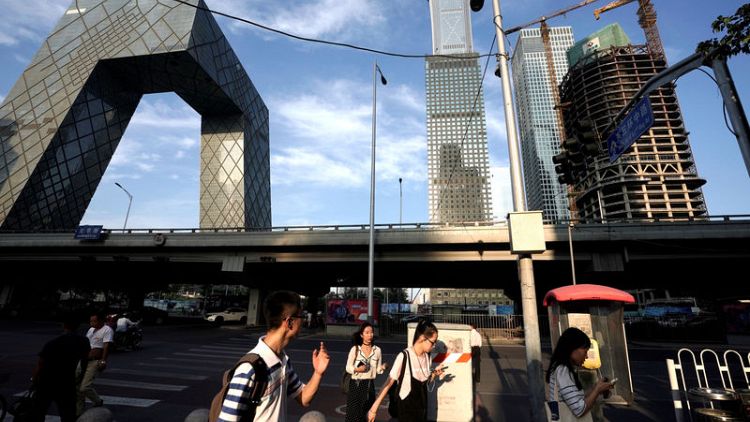

The rare central bank news conference follows a spate of weaker readings from the world's second-largest economy in recent months, a sharp drop in its yuan currency against the dollar and a plunge in Chinese stock markets.[CNY/][.SS]

With China's economy cooling and the impact of U.S. trade tariffs still to be felt, its policymakers are shifting their priorities to reducing risks to growth.

Smaller companies, in particular, are having a tough time securing loans and are grappling with rising borrowing and operating costs, fuelled in part by a lengthy official clampdown on riskier lending like shadow banking.

The PBOC said it will "effectively ease" companies' financing problems and improve coordination with other agencies to ensure monetary policy measures are being transmitted into the broader economy.

Analysts expect further cuts in corporate taxes and fees, and the central bank has specified that some funds freed up from reductions in banks' reserve requirements should be earmarked for loans to smaller businesses.

Beijing also is accelerating infrastructure spending to cushion the economy as it braces for the blow from escalating U.S. tariffs.

But the growing stream of new stimulus measures and easing credit policies have raised fears that Beijing is putting debt reduction efforts on the back burner again.

Vice Premier Liu He said on Monday that China needs to beef up capital markets and broaden financing channels for small and medium enterprises.

However, the effectiveness of such moves is far from clear. Policymakers have tried for at least eight years to improve financing for smaller firms, but most analysts say the problem has only grown worse, with state-backed companies continuing to get the lion's share of cheaper credit.

China's economic growth rate slowed slightly to 6.7 percent in the second quarter year-on-year, still well above the government's full-year target of around 6.5 percent. But some key activity indicators have weakened more sharply and policymakers are getting edgy.

Fixed-asset investment is growing at the slowest pace on record, while non-performing loans surged in the second quarter, defaults climbed and the jobless rate rose to 5.1 percent.

(Reporting by Elias Glenn and Beijing Monitoring Desk; Editing by Kim Coghill)