The world would look very different without steel. No railways, bridges, bikes or cars. No washing machines or fridges.

Most advanced medical equipment and mechanical tools would be almost impossible to create. Steel is essential for the circular economy, and yet some policymakers and NGOs continue to see it as a problem, and not a solution.

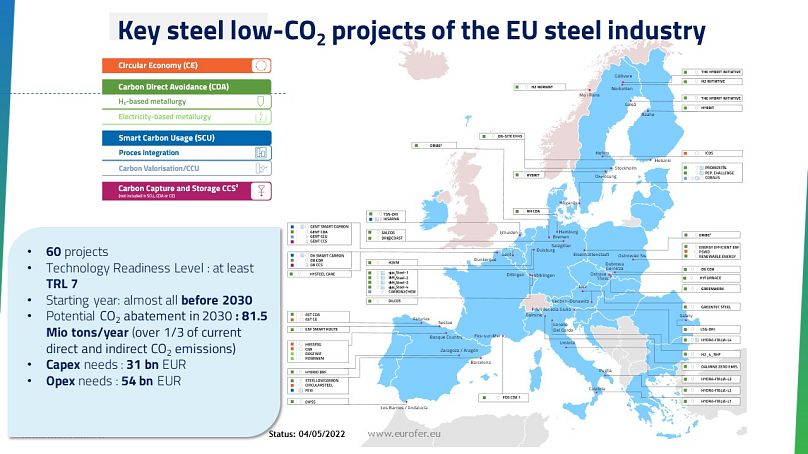

The European Steel Association (EUROFER), which represents almost all of the steel industry in Europe, is committed to changing this, and is calling for the EU’s support to put 60 major low-carbon projects in place across the continent by 2030.

“Let’s go back to basics: steel is innately circular, 100 per cent reusable, endlessly. It is the most recycled material in the world with 950 million tonnes of CO2 saved every year. In the EU we have an estimated recycling rate of 88 per cent,” says Axel Eggert, EUROFER’s director general.

Cutting-edge steel products are constantly in development. “There are more than 3,500 types of steel, and over 75 per cent – lighter, better-performing and greener – have been developed in the last 20 years. This means that if the Eiffel Tower were to be built today, we would only need two thirds of the steel used at the time,” says Eggert.

The proposed projects would cut carbon emissions by more than 80 million tonnes over the next eight years. This equates to more than a third of today’s emissions and is a 55 per cent cut compared to 1990 levels. Carbon neutrality is planned by 2050.

The continuous innovation in steel-making also allows products in other sectors – such as automotive or energy – to be more efficient, reducing their carbon footprint by six times on average, according to a 2013 study.

Climate change and the reduction of CO2 emissions have been on the agenda of European steelmakers for a while. Over the last decade, there has been a decisive push in research and development in breakthrough technologies that will either lower emissions or replace carbon-based materials and energy sources with renewables. Even so, EUROFER believes European policies – in particular faster access to hydrogen and renewables, as well as funding for innovation and strengthened carbon leakage protection – are lagging behind.

According to Eggert, a huge effort is needed to decarbonise steel. “The current production processes have improved over time, but now they have reached their thermodynamic limits.”

The introduction of innovative technologies that will allow the switch from fossil fuels to green materials will constitute the biggest revolution in steelmaking since the birth of the industry. Currently, there are four promising technology routes to achieving this, as identified in the EU report Climate-neutral Steelmaking in Europe.

Firstly, the optimised blast furnace route, which reduces carbon emissions via capture, storage and usage. The next method is direct reduction of iron ore, using gas or hydrogen instead of coal.

The third route is based on smelting reduction, which enables the transformation of iron ore directly into steel. Lastly, the electrolysis route, which is, at this stage, at a lower level of technological readiness.

Steel scrap will also play an increasing role: already today 43 per cent of the EU steel production comes from recycled steel made in furnaces powered by electricity. However, millions of tonnes are currently exported from the EU to countries with lower environmental standards.

“There is no prevailing or best technology. On the contrary, they can be combined in multiple ways. Their take-off will depend on local conditions, such as access and availability of energy and resources at competitive costs, and the existence of energy and carbon storage infrastructure,” says Eggert.

It’s here that EU policies enter into play. “The estimated financing needs for implementing our 60 low carbon projects by 2030 amount to €85 billion, of which €31 billion would be capital investment and €54 billion in operational expenditure. In terms of energy, we will need more than 150 TWh of ‘clean’ electricity, half of which is needed for the production of hydrogen,” he says. This is twice the yearly electricity consumption of Belgium.

Several low-carbon steel projects initially envisaged replacing coal with gas pending the large-scale availability of hydrogen, but the devastating war in Ukraine has jeopardised the possible role of gas as a transition fuel. “Now the steel industry will need more hydrogen from day one, but how do we switch massively from coal and gas to green hydrogen within the next years with basically no infrastructure available?”, asks Eggert.

So far, his questions have been left unaddressed by EU policymakers, as have his concerns around soaring energy and carbon prices, not to mention the shortage of raw materials, which could jeopardise investment in clean technologies. “Strengthened carbon leakage protection, access to affordable green energy and speedier funding support are key elements for making EU and national policies really fit for a successful industrial decarbonization,” he says.

In EUROFER’s view, the main EU Emission Trading System (ETS) funding tool, the Innovation Fund, has proven to be insufficient. The fund was swamped with applications, and requests came to ten times the available EU budget.

As a result, Eggert is calling for transitional free allocations to reward new investments in breakthrough technologies, at least in the early years, when they are introduced at industrial scale.

“Rules on benchmarks need to reflect the gradual transformation of the sector and ensure a longer transition period to allow steel companies streamlining financial resources on low carbon projects,” he says.

“Expecting capital investment of €30 billion in just eight years and at the same time removing free allocations will not support investment decisions in favour of Europe. The objective should be to remove emissions, not investment ability of the companies.”

It remains to be seen if the EU is ready to live up to the steel industry’s climate ambition.