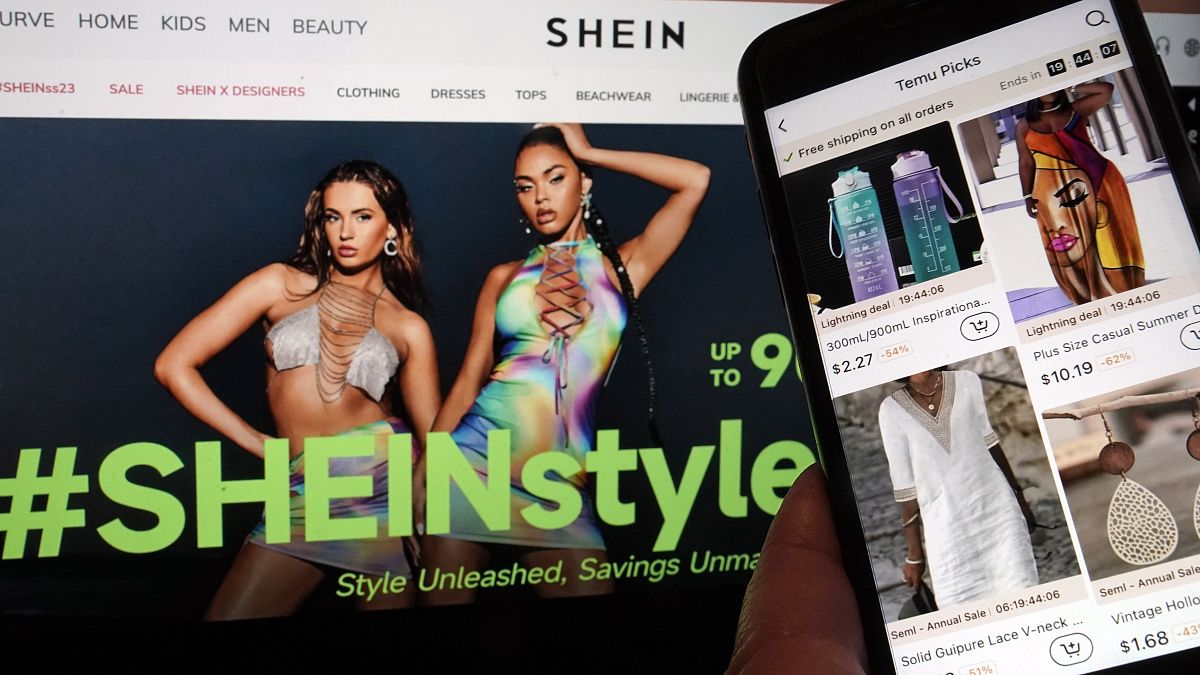

Chinese fashion company Shein, a popular online retailer with European shoppers, has discreetly filed for a US IPO in a major trans-continental move.

Fashion giant Shein, founded in China but headquartered in Singapore, has already successfully made a name for itself on home turf with about 10 brands in its portfolio and over 250 million social media followers with many shoppers also turning to the site in Europe - and now its looking to give other investors a slice of the pie.

The company is estimated to have raked in around $15.7 billion (€14.3 billion) in 2021. However, since it does not publicly reveal revenues, these figures are based on estimates from sources.

In keeping with its secretive nature, Shein has recently filed for a low-profile US IPO, due to launch early next year, in an attempt to test the waters in one of the biggest apparel markets in the world. The US apparel market clocked in about $325.96 billion worth of revenue in 2022, according to Statista.

The company had initially planned to go public in the US back in 2020, although it put those plans on hold.

Shein is likely to be one of the highest-value Chinese companies to list in New York and whether investors bite, given geopolitics, will be interesting.

Although the actual IPO value is yet to be decided, the company had an estimated value of about $60 billion back in May. However, according to Bloomberg, the actual IPO value could very well touch up to $90 billion.

The company has already started roadshows for its IPO, and is reported to be using JPMorgan Chase, Morgan Stanley and Goldman Sachs as its lead underwriters.

Why is Shein opting to keep the IPO under wraps?

Filing for a secret IPO is likely due to Shein being extra-cautious as the US IPO climate is somewhat turbulent and could make it challenging for Shein to stay afloat. The last few big-ticket US IPOs, such as UK’s Arm Holdings, Germany’s Birkenstock and US grocery delivery service Instacart, were all more lacklustre than expected.

Then there are other Chinese companies, such as ride-hailing app, Didi, which did list on the New York Stock Exchange back in 2021, but quickly delisted, following a Chinese cybersecurity review. This review has now become mandatory for any Chinese internet platform company with more than 1 million users, somewhat impeding more companies from trying their luck on US exchanges.

Companies also need to file with the China Securities Regulatory Commission, before they can proceed to a US IPO, further hampering listings.

Shein could face more scrutiny from the SEC

Higher interest rates and soaring inflation have also meant that consumers have less disposable income to spend on discretionary items, even ones as low-priced as Shein’s. This has raised more concerns about the performance of the company’s shares post-IPO.

Not only that, Shein has also been accused of using forced labour in its supply chain, with increasing calls for the Securities and Exchange Commission (SEC) to thoroughly audit the company’s supply chain before its IPO. Accusations of import tariff avoidance have also surfaced.

However, going for an IPO before upcoming US regulatory changes, could also potentially work in Shein’s favour and help it regain a market share from competitors such as Amazon.