2022 was a “turning point” for global wealth, says German financial company Allianz in its latest Global Wealth Report.

2022 was a horrible year for savers as asset prices fell, cutting down savings across the world.

Households' financial assets fell by 2.7% globally compared to the previous year - the biggest drop since the financial crisis in 2008. A total worth of €6.6 trillion was lost in 2022, says the report.

The dismal decline was mainly due to the overall gloomy and uncertain outlook on the markets in which asset prices fell across the board.

The decline was most pronounced in North America (-6.2%), followed by Western Europe (-4.8%).

Asia, on the other hand – with the exception of Japan – still recorded relatively strong growth rates. China's financial assets grew robustly, by 6.9%. Compared to the almost 16% average gain of the last 20 years, this was still rather disappointing.

The overall sum in total financial assets was €233 trillion across the globe - an amount equivalent to ten times the US GDP. The report claims that 85% of this sum is owned by the richest top 10%, or around 560 million people across the world.

Which investments struggled the most?

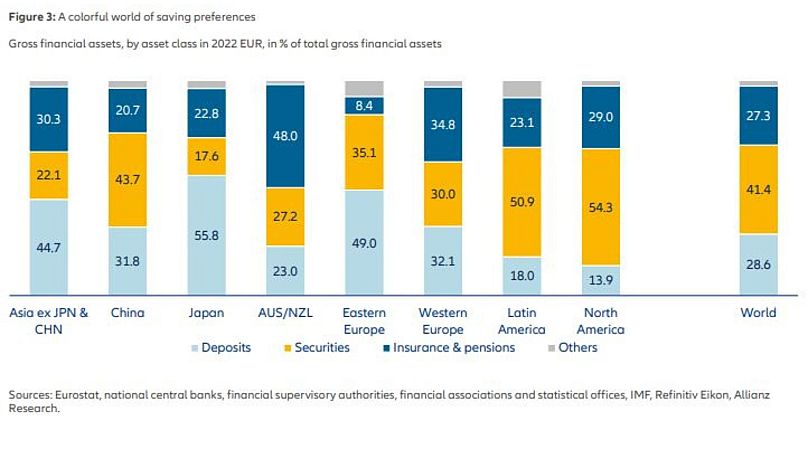

While securities like shares and bonds saw an overall 7.3% loss and insurance and pensions-related investment had suffered 4.6% deficit, bank deposits grew by 6%.

Inflation played a role in eating up almost two-thirds of nominal wealth growth, which is clearly visible when the savings are compared to their pre-Covid level.

Global household financial assets were still nearly 19% above pre-Covid-19 levels at the end of last year – in nominal terms. Adjusted for inflation, almost two-thirds of (nominal) growth fell victim to price increases, reducing real growth to a meager 6.6% in three years.

While most regions could at least preserve some real growth in wealth, the situation in Western Europe was different: any nominal gains were wiped out, real wealth decreased by -2.6% over 2019.

A brighter outlook on the horizon

After the decline in 2022, global financial assets are expected to return to growth this year. Mainly due to the positive development on the stock markets with Allianz predicting 6% growth of global financial assets in 2023 and around 4%-5% over the next three years.