Poland's central bank governor said on Thursday that its large interest rate cut was justified despite high inflation because prices are stabilising.

Adam Glapinski spoke a day after the bank's monetary council announced that it was cutting interest rates by 75 basis points, a much larger reduction than had been expected by economists.

Critics of Poland’s populist authorities accused Glapinski and members of the bank’s monetary policy council of acting to help the governing party ahead of parliamentary elections next month with a large cut seen by economists as premature. Glapinski is an ally of the party, which is fighting for an unprecedented third term.

The bank cut its reference rate from 6.75% to 6%, and other interest rates by the same amount.

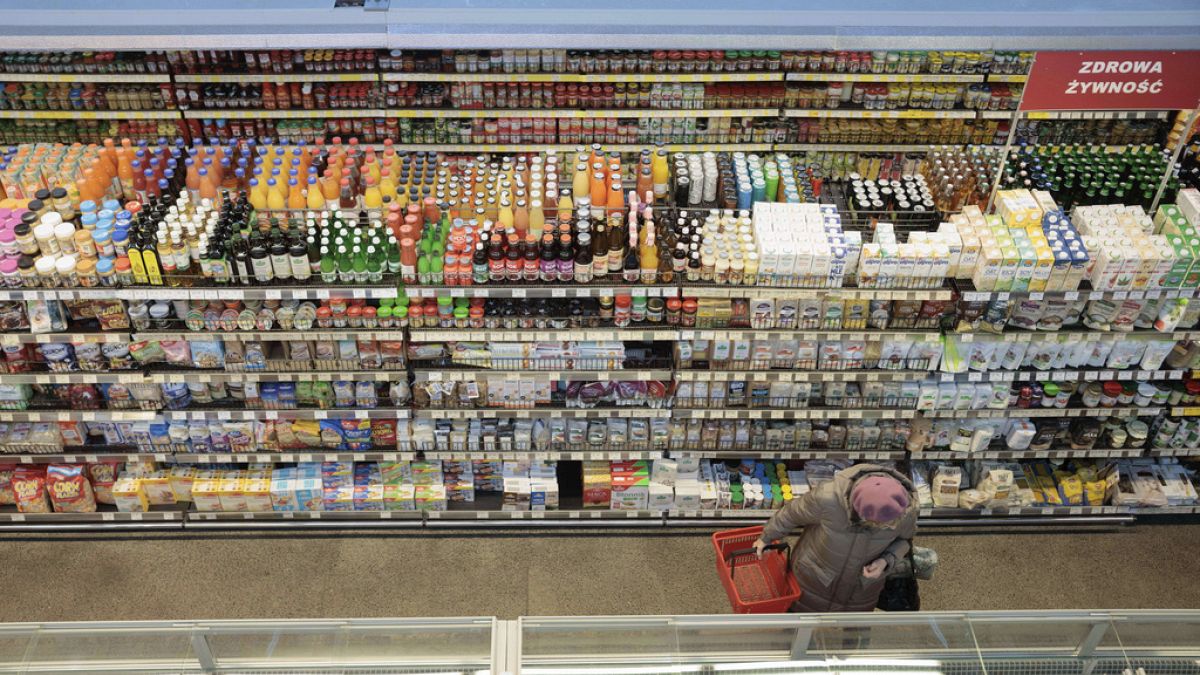

Poles have been suffering from sharply rising prices of food, rents and other goods. Inflation reached over 18% earlier this year and registered 10.1% in August.

Glapinski declared that inflation was coming down steadily. He said he expects it to be slightly above 8.5% in September, and that it might fall to 6% by the end of the year.

Although the bank’s inflation target is 2.5%, Glapinski said conditions have already been met for cutting interest rates.

At a news conference in Warsaw, he declared it a “happy day” because inflation is “already in the single digits.”

The zloty currency fell against the dollar and euro as he spoke to reporters, continuing its sharp decline after the interest rate cuts were announced on Wednesday.

The cuts will give some relief to those with housing mortgages, but will also risk further inflation.

The weakening of the zloty will cause imported goods to become more expensive for Polish consumers.

During high inflation, central banks tend to raise interest rates, which can help bring down inflation over time by discouraging consumption. Interest rate cuts, on the other hand, make financing cheaper and tend to encourage consumers and businesses to spend more. That can stimulate the economy but also make inflation worse.

Marek Belka, a former central bank governor allied with the left-wing political opposition, criticized the rate cut. He said Poland is now “following in the footsteps of Turkey from several years ago.”

In an interview with private radio broadcaster RMF FM, Belka said Turkey President Recep Tayyip Erdogan “tried to combat very high inflation with interest rate cuts. It ended with over 100% inflation.”

Glapinski dismissed such criticism, saying it came from political opponents.