SHANGHAI - Tianyan Capital has become the latest hedge fund manager in China to limit the size of its quantitative investment business, after the main securities regulator advised bourses to pay attention to the explosive growth of "quant" funds.

The regulators' remarks on Monday came amid heightened market concern over regulatory activity across a range of sectors, from technology to private tutoring.

Tianyan Capital, which employs fast computers that use mathematical and statistical analyses to trade, said it had suspended fresh fundraising on Sept. 7 after prudent considerations.

"Recently, the company has actively curbed growth in assets under management (AUM) using various methods, but we think we're still growing too fast," Tianyan said in a statement to clients on Tuesday.

The fundraising suspension is aimed at safeguarding investors' interest, and "managing the size cautiously has become a key part of our long-term success," said Tianyan, whose AUM has tripled so far this year to 30 billion yuan, according to its website.

A Shanghai-based official of the company confirmed that quant fundraising had been suspended, but declined to say if the decision was a result of pressure from regulators.

Tianyan's decision came days after rival quant fund manager Evolution Asset Management announced it would not launch new quant products this year, and suspended fundraising in some existing funds.

Another hedge fund manager, Starvast, made a similar announcement in late August in a bid to manage its pace of growth.

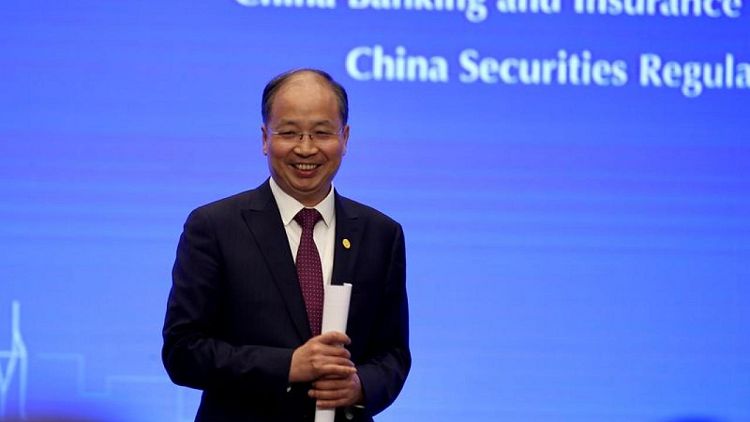

Yi Huiman, chairman of the China Securities Regulatory Commission (CSRC), said on Monday the rapidly growing number of "quants" was a challenge to stock exchanges.

In mature markets, such quantitative and high-frequency trading had led to better liquidity, but also fueled herd behaviour, greater volatility and unfairness, he added.

A senior executive of a quant fund manager, who declined to be identified, said regulators have been in constant communication with the industry, and collecting information on Chinese quant funds.

China's quantitative private funds totalled nearly 1 trillion yuan ($154.6 billion) at the end of June, according to Citic Securities. That is almost ten times their size in 2017.

($1 = 6.4627 Chinese yuan renminbi)

(This story Corrects typos in final paragraph.)