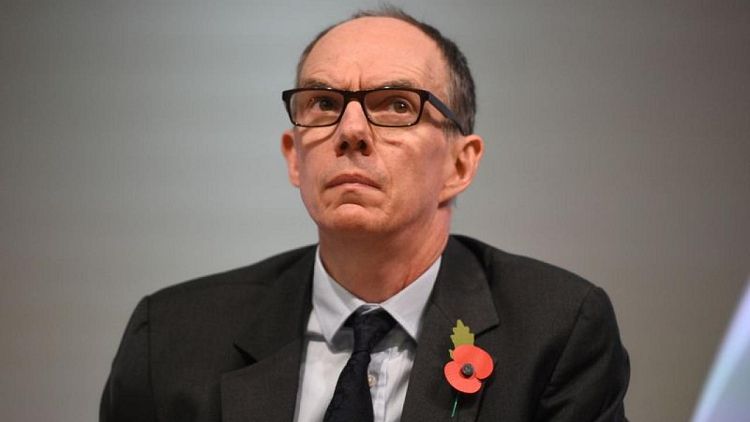

- The Bank of England is carefully monitoring Britain's booming housing market as it weighs chances that a rapid recovery from the COVID-19 pandemic will lead to a broader pick-up in inflation, Deputy Governor Dave Ramsden said.

While he was optimistic about the recovery, Ramsden said it was also possible that inflationary pressure may prove lower than anticipated if the economy slowed after an initial burst of post-lockdown activity, according to a Guardian newspaper https://bit.ly/3i6xix3 interview published on Tuesday.

The BoE would guard carefully against the risk of a generalised pick-up in inflationary pressure.

"We are looking carefully at the housing market and a raft of real-term indicators," Ramsden was quoted as saying.

"If (inflation is) not temporary we know what to do about that. We can push bank rate up from its historically low level (of 0.1%) and we know what that will do to demand."

British house prices rose by 10.9% in May compared with the same month last year, the biggest annual increase in nearly seven years, data from mortgage lender Nationwide showed on Tuesday.

Also not ruling out a possible rate cut, Ramsden said lower than anticipated inflation could result if new COVID-19 variants emerged or some of the cautious behaviour of the past 15 months became habitual.

"Having a policy ready is distinct from whether you actually use it," he said. "Negative rates would certainly come as a surprise to the markets but we will be governed by our assessment of the state of the economy as it is then."