MUNICH (Reuters) - Infineon Technologies <IFXGn.DE> slightly beat its profit guidance in the fourth quarter and said the semiconductor market showed signs of picking up in 2020, triggering a share rally for the German chipmaker.

Shares in Munich-based Infineon, widely seen as relatively resilient to the industry's ups and downs, rallied 6% as Chief Executive Reinhard Ploss said the market was steadying and would pick up next spring.

"The business environment in our markets is bottoming," Ploss told analysts on a conference call. "The inventory correction is playing out, but given the absence of macro improvement, recovery will take more time."

Infineon forecast revenue would grow by 5% in its fiscal year to Sept. 30, 2020, down from 6% in the year just ended. It also said it expects the main margin metric that it uses to compress further to 16% from 16.4%.

The outlook did not factor in any contribution from Infineon's $10 billion agreed takeover of Cypress Semiconductor <CY.O>. Infineon expects the deal, which awaits regulatory approval, to close in late 2019 or early 2020.

The merged entity would target long-term revenue growth of 9%, while segment margins would expand to 19% from Infineon's goal now of at least 17%, according to a company presentation.

MARGIN SQUEEZE

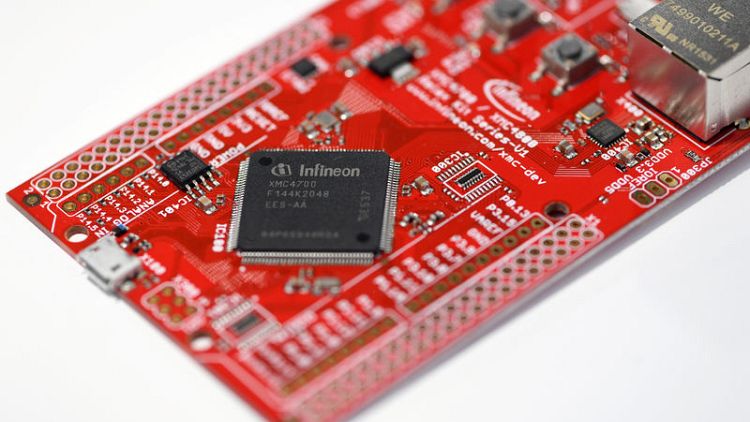

Infineon, a specialist in semiconductors used in electric drivetrains, wind turbines and security systems, reported a fourth-quarter segment margin - an indicator of operating profitability at its business units - of 15.1%.

That was down from 15.7% in the preceding quarter and 19.5% in the same period a year earlier, but slightly ahead of the company's earlier guidance.

"The outlook tone remains cautiously optimistic with management citing markets recovery only starting in the second half of fiscal 2020 despite the improving inventory situation," said Citi analyst Amit Hirchandani.

Infineon forecast a quarter-on-quarter revenue decline of 7% in its fiscal first quarter, which is seasonally typically weak, with a segment margin of around 13%.

Infineon proposed an unchanged dividend of 27 euro cents per share. After taking into account the issue of new shares to fund the Cypress deal, the total cash payout will rise by around 10%, the company said.

(Reporting by Douglas Busvine and Joern Poltz; Editing by Michelle Martin and Edmund Blair)