By Joshua Franklin, Anirban Sen and Jessica DiNapoli

(Reuters) - WeWork owner The We Company may seek a valuation in its upcoming initial public offering of between $10 billion (8.04 billion pounds) and $12 billion, a dramatic discount to the $47 billion valuation it achieved in January, people familiar with the matter said on Friday.

If the We Company were to press on with the IPO at such a low valuation, it would represent a major turning point in the venture capital industry's growth over the last decade that has led to the rise of startups such as Uber Technologies Inc <UBER.N>, Snap Inc <SNAP.N> and Airbnb Inc.

It would mean that the We Company would be valued less than the $12.8 billion in equity it has raised since it was founded in 2010, according to data provider Crunchbase. And it would represent a major blow to its biggest backer, Japan's SoftBank Group Corp <9984.T>, at a time it is trying to amass $108 billion from investors for its second Vision Fund.

The sources cautioned that no decision has been made and asked not to be identified because the matter is confidential. WeWork did not immediately respond to a request for comment.

Investors have expressed concerns about the We Company's business model, which relies on a mix of long-term liabilities and short-term revenue, raising questions about how it would weather an economic downturn.

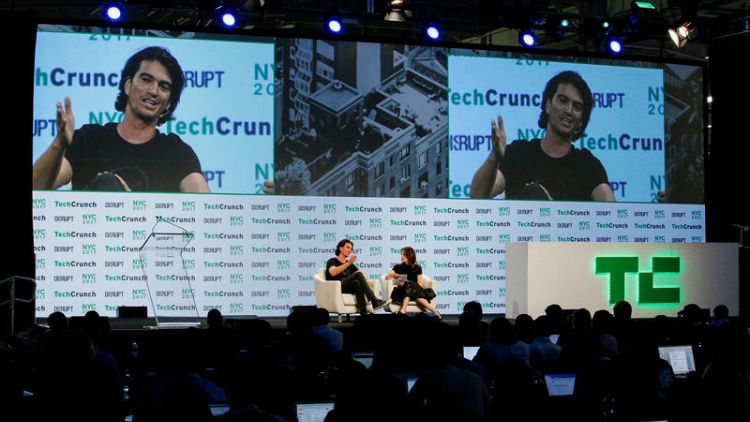

The We Company's deliberations indicate it does not feel confident that the corporate governance changes it unveiled on Friday, slightly loosening CEO and co-founder Adam Neumann's grip on the company, will be enough to woo investors concerned about its lack of a path to profitability.

The changes are largely symbolic in nature, aimed at showing the We Company is listening to investors after being forced to slash its IPO price expectations, corporate governance experts said.

"That change is seemingly cosmetic in nature,” said Charles Elson, a professor of corporate governance at the University of Delaware, referring to the We Company's announcement it will reduce Neumann's voting power. "He will still control the composition of the board."

The office space sharing start-up said it was making the changes "in response to market feedback." It said Neumann's superior voting shares will decrease to 10 votes per share from 20, though he will still retain majority control of the company.

Neumann will also give the company any profits he receives from real estate deals he has entered into with We Company. He will also limit his ability to sell shares in the second and third years after the IPO to no more than 10% of his stock.

No member of Neumann's family will be on the company's board and any successor will be selected by the board, scrapping a plan for his wife and co-founder Rebekah Neumann, who is chief brand and impact officer, to help pick the successor.

The We Company also disclosed its will list shares on the Nasdaq Stock Exchange. It plans to complete the IPO as early as this month, Reuters has reported.

This is the second effort to repair damage done to its image among investors. Earlier this month added a new member, Frances Frei, to its all-male board and said Neumann would return a $5.9 million payment for use of the trademarked word "We."

(Reporting by Anirban Sen in Bangalore, Joshua Franklin in New York, and Jessica DiNapoli in Washington, D.C.; editing by Jason Neely and Nick Zieminski)