By Leika Kihara

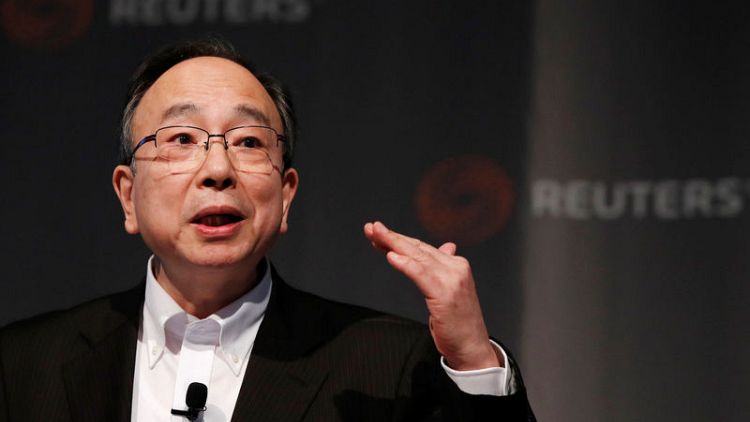

KAGOSHIMA, Japan (Reuters) - Bank of Japan Deputy Governor Masayoshi Amamiya said on Thursday the central bank was prepared to expand monetary stimulus to head off economic risks, warning that uncertainties over the fallout from protectionist policies were on the rise.

Amamiya welcomed the U.S. Federal Reserve's decision to cut interest rates on Wednesday, saying that the move would have a positive effect on Japanese and global economies by keeping U.S. growth on a solid footing.

"The BOJ is no different from other major central banks, in that it is prepared to take, if necessary, policy action to prevent risks from materialising," he said in a speech to business leaders in Kagoshima, southern Japan.

Amamiya said Japan's economy was sustaining its momentum to achieve the central bank's 2% inflation target, with solid domestic demand making up for some of the weakness in exports.

But he said overseas risks were growing and could inflict broader damage to Japan's economy by hurting business sentiment and destabilising financial markets.

"We need to be mindful that the economy may lose momentum (for achieving 2% inflation) if risks, mainly those from overseas economies, materialise," Amamiya said.

If it were to ease, the BOJ could cut rates, ramp up asset buying or accelerate the pace of money printing, he said.

"We may also combine these steps or apply them in various forms," Amamiya added, repeating Governor Haruhiko Kuroda's comments made on Tuesday.

The protracted Sino-U.S. trade war has hurt exports and business sentiment, casting doubt on the BOJ's view that robust domestic demand will offset the pain from the global slowdown.

The BOJ held off expanding stimulus on Tuesday but committed to doing so "without hesitation" if a global slowdown jeopardises the country's economic recovery.

Under a policy dubbed yield curve control (YCC), the BOJ guides short-term rates at -0.1% and 10-year government bond yields around 0%. It also buys government bonds and risky assets such as exchange-traded funds (ETF).

(Reporting by Leika Kihara; Editing by Chris Gallagher and Sam Holmes)