By Huw Jones

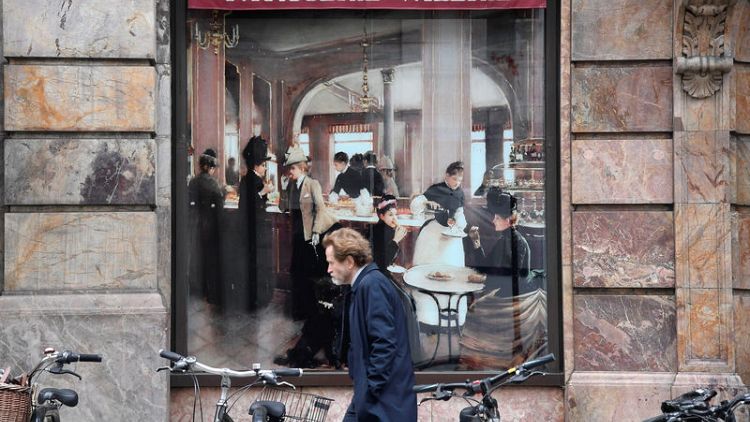

LONDON (Reuters) - Grant Thornton announced an independent review and a 7 million pound revamp of its UK accounting operations on Saturday to improve standards after regulators opened an investigation into its audit of café chain Patisserie Valerie that came close to collapse last year.

The accounting firm said the measures were part of its response to recent "scrutiny of its audits of large listed companies", and wider efforts to prepare the business to compete for audit work from Britain's top 350 listed companies "should changes in the market present a more level playing field for competition".

Britain's accounting watchdog, the Financial Reporting Council, said in November it was investigating Grant Thornton's audit of Patisserie Valerie for 2015-2017.

Dave Dunckley, chief executive of Grant Thornton in Britain, said the firm would work with clients and the regulator to go further.

"The independent review of our audit practice this autumn will be an important part of our continued efforts to improve," Dunckley said in a statement.

Britain's Competition and Markets Authority has proposed sweeping reforms of the UK audit market after questions were raised about accounting standards following the collapse of retailer BHS and construction company Carillion, which took place before Patisserie Valerie's problems were came to light.

The CMA wants nearly all of the top 350 listed companies to have two auditors, one of them not from among the "Big Four", a reference to Deloitte, KPMG, EY and PwC, which check the books of nearly all big companies.

If implemented, it would mean far more work for the next tier of accountants, including Grant Thornton, BDO and Mazars, from large clients.

The success of the reforms will depend on smaller accountants like Grant Thornton being willing to take up the work. The government has yet to step forward with the legislation needed to put the CMA's proposals into law.

"Grant Thornton will be ready to compete, but we will only re-enter the market if the regulatory and commercial conditions allow," Dunckley said.

Some accounting industry officials say that non-Big Four firms like Grant Thornton would need to invest many millions of pounds in expanding capacity for years to come to be in a position to attract far bigger clients.

Grant Thornton, which audits 12,000 firms in Britain, said it was also creating an Audit Quality Board with powers to hold top officials to account if it believes that audit quality is not receiving appropriate investment.

The firm will also commission an independent review of its work that will take place later in the year, led by an expert with no previous connection to the firm, to make further recommendations for change and improvement.

New "centres of excellence" will be created in London and Birmingham for the most complex audit work, and will become hubs for all major audit work, if participation in top 350 listed company audits becomes "economically viable", the firm said.

Rival PwC said earlier this month it will invest an extra 30 million pounds to hire 500 more auditors after receiving a record 6.5 million pound fine for its audit of BHS, an illustration of the far deeper pockets the Big Four have to bolster their operations.

(Reporting by Huw Jones; Editing by Ros Russell)