By Tracy Rucinski

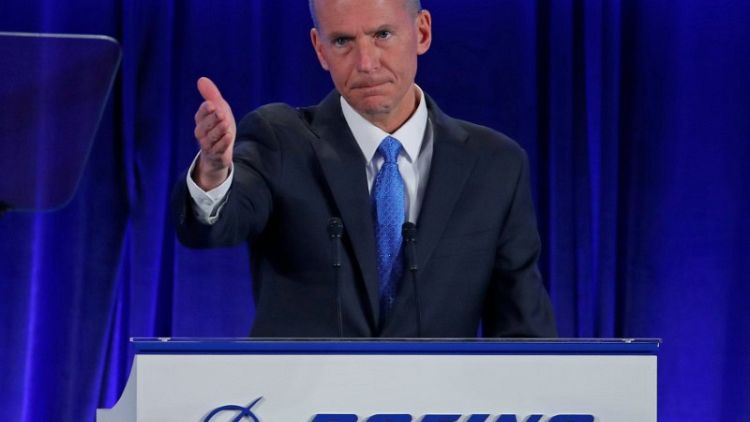

CHICAGO (Reuters) - Boeing Co Chief Executive Dennis Muilenburg tried to bolster shareholder confidence in the company on Monday in his first general meeting since two fatal crashes of the 737 MAX triggered the jet's grounding, lawsuits and investigations.

Battling the biggest crisis of his tenure, Muilenburg said the company was making steady progress towards getting approval for new software as questions linger over the safety of its fastest-selling airplane.

Family and friends of 24-year-old American Samya Stumo, one of the victims of the crash of an Ethiopian Airlines 737 MAX on March 10, held a silent protest outside the meeting site in a cold and rainy Chicago.

That crash, which killed all 157 on board when it plunged to the ground shortly after takeoff, came five months after a similar Lion Air nosedive that killed all 189 passengers and crew.

Daniel Johnson, a Boeing shareholder on and off since 1984, said it had been "a great investment, better than anything else.” But Johnson, who is an engineer, said Boeing "really stubbed their toe" by allowing MCAS to rely on only one sensor.

"The question is, will they need to rebrand. We don’t know how much the general public actually knows what a 737 MAX is,” said Johnson outside the meeting.

About 150 shareholders gathered in the auditorium of the neoclassical Chicago Field Museum for the meeting.

Muilenburg will hold his first press conference since the grounding after the general annual shareholder meeting in Chicago on Monday, exactly six months after the Lion Air crash.

Boeing is under pressure to deliver a software fix to prevent erroneous data triggering an anti-stall system called MCAS and a new pilot training package that will convince global regulators, and the flying public, that the aircraft is safe.

Boeing has acknowledged that the accidental firing of the software based on bad sensor data was a common link in the separate chains of events leading to the two accidents.

"We know we can break this link in the chain. It’s our responsibility to eliminate this risk," Muilenburg told shareholders.

The U.S. Federal Aviation Administration could clear Boeing's 737 MAX jet to fly in late May or the first part of June, two people familiar with the matter said on Friday, though Boeing has yet to submit the updated software and training for review.

Some pilots have warned that draft training proposals do not go far enough to address their concerns.

Meanwhile, deliveries of the 737 MAX, which airlines around the world had been relying on to service a growing air travel industry for years to come, are on hold.

Last week Boeing abandoned its 2019 financial outlook, halted share buybacks and said lowered production due to the 737 MAX grounding had cost it at least $1 billion (£774.7 million) so far.

Shareholders have filed a lawsuit accusing the company of defrauding them by concealing safety deficiencies in the plane. The model is also the target of investigations by U.S. transportation authorities and the Department of Justice.

Muilenburg is Boeing's chairman and president in addition to CEO, and faces calls that could strip him of one of those titles at Monday's meeting. Boeing has recommended against the move.

Boeing must also contend with lawsuits filed on behalf of dozens of victims of the two crashes, including the family of Stumo, who are asking whether the Ethiopian disaster could have been prevented after what happened to Lion Air.

"Those in charge of creating and selling this plane did not treat Samya as they would their own daughters," her mother Nadia Milleron told reporters in early April.

Shares in the company, worth $214 billion, have lost nearly 10 percent of their value since the March 10 crash.

(Reporting by Tracy Rucinski; additional reporting by Eric M. Johnson in Seattle and David Shepardson in Washington; Editing by Chizu Nomiyama and Phil Berlowitz)