By Brenna Hughes Neghaiwi

ZURICH (Reuters) - Shareholders approved Credit Suisse's 2018 compensation report with an 82 percent majority on Friday, overriding frustrations expressed at its annual general meeting over jumps in executive pay during a year its share price plummeted.

Three shareholder advisers had recommended investors vote against the remuneration report at Switzerland's second-biggest bank, while a fourth backed the report but expressed reservations about whether management pay matched performance.

"The divide between the compensation proposed today and the roughly 40 percent share price loss your bank recorded last year is untenable for these long-term investors," Vincent Kaufmann, head of proxy adviser Ethos, told board directors and executives.

Just out of a three-year restructuring, Credit Suisse said a 30 percent pay rise awarded executives in 2018 reflected a job well done, with the bank last year having turned its first annual profit since 2014, slashed costs and focused growth on managing wealth for private clients.

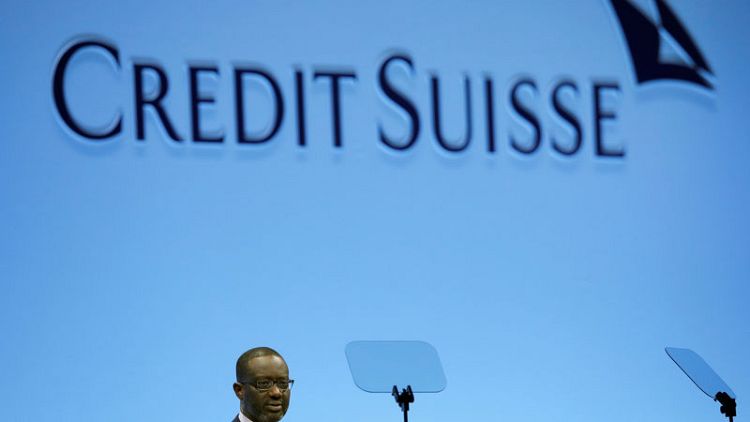

The 12-member executive board got a combined 93.5 million Swiss francs ($91.7 million) in 2018 fixed pay and incentives. Chief Executive Tidjane Thiam's compensation rose to 12.7 million francs.

Unrest over pay packets had moved senior management to take a voluntary 40 percent bonus cut two years ago after a 2.7 billion Swiss franc loss.

"We can be anything but satisfied with the development of our share price," Chairman Urs Rohner told investors.

"That said, it needs to be borne in mind that our share price is not just influenced by our performance...At the heart of this problem lies the persistently low interest rate environment in Europe, which also makes European banking stocks less attractive than their U.S. counterparts."

Credit Suisse shares have rebounded 27 percent in 2019 as the bank has pulled in fresh money and grown profitability during challenging quarters but -- at around 13.7 francs -- still trade at roughly half the level they did when Thiam took charge in 2015.

"Let's be clear: we all bought into Credit Suisse because we want to make money," one shareholder said. "I was dumb enough to buy the stock when it was at 80 (francs)," he said, adding he intended to sell it after the meeting's end.

Approval of group compensation has steadily increased over the last three years from 57.98 percent in 2017 and 80.8 percent in 2018.

($1 = 1.0193 Swiss francs)

(Reporting by Brenna Hughes Neghaiwi; Editing by Michael Shields)