The U.S. Federal Reserve should shore up its ability to fight economic downturns by committing to let inflation run above 2% when times are good, a top policymaker said on Monday.

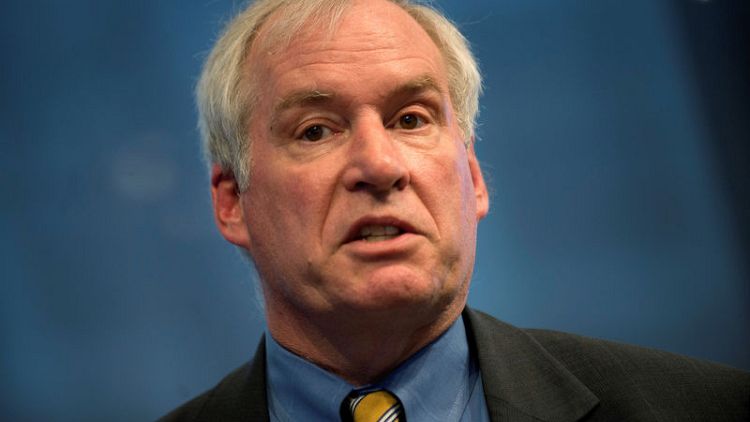

The comments by Eric Rosengren, president of the Boston Fed, echoed remarks made earlier in the day by another Fed policymaker who cited the U.S. economy's falling a bit short on the central bank's inflation target as a problem. The Fed's preferred inflation measure, the core personal consumption expenditures (PCE) price index, is currently at 1.8%.

Rosengren said he supports an approach that would see the Fed, which is "forced to accept" inflation below its 2% target during recessions, commit to achieve above-2% inflation "in good times." Policymakers, for instance, could target a range of 1.5-2.5%.

"Looking forward, achieving a symmetric inflation target is likely to be that much more difficult in a world where interest rates are low, given the constraint on reducing rates enough to move inflation back towards (or above) the Fed policymakers' target," Rosengren said in remarks prepared for delivery at Davidson College in North Carolina. "My own preference is for the Federal Reserve to adopt an inflation range."

The Fed, which adopted the 2% inflation aim in 2012, calls its current target "symmetric," meaning it is not a cap.

The remarks come ahead of a broad policy review being conducted by the Fed this year. How the Fed meets its inflation target is one of the key topics.

The president of the Chicago Fed, Charles Evans, said earlier on Monday that the U.S. central bank should embrace inflation above its target half the time and consider cutting rates if prices do not rise as fast as expected. Both Rosengren and Evans are voting members on the Fed's policy-setting committee this year.

Some policymakers and analysts think the Fed is better equipped to respond to upward spikes in prices than to persistently low readings. That is because interest rate cuts lose their potency as borrowing costs approach zero. The Fed now targets short-term rates between 2.25-2.50%, leaving relatively little room to cut in the face of a recession.

But even though the Fed says its current inflation target is "symmetric," in practice, people have seen the figure as a "ceiling," and prices have tended to grow less than 2% each year, Rosengren said. The Fed has kept rates steady this year after raising them four times in 2018, and Rosengren said one reason is policymakers want evidence that inflation will stay around 2%.

Alternatives to the Fed's current approach, including the one endorsed by Rosengren and others discussed by his colleagues, come with their own risks, including the possibility that the public might not think the Fed will keep up its end of the bargain and keep prices in line with its target growth.

(Reporting by Trevor Hunnicutt in New York; Editing by Leslie Adler)