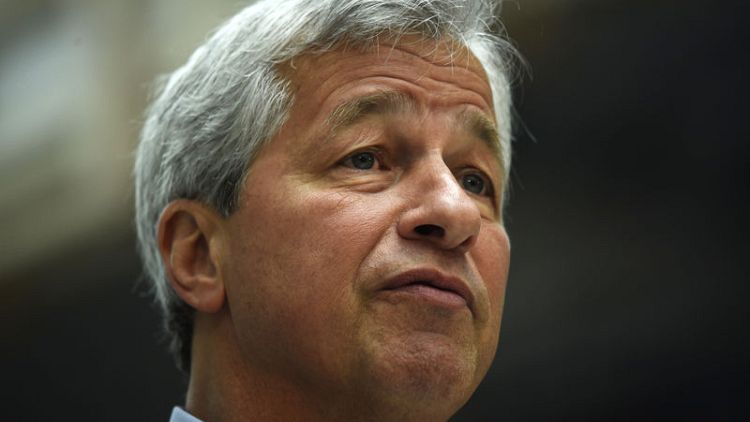

BERLIN (Reuters) - There is at least a chance that Italy's rising borrowing costs could trigger a new sovereign debt crisis in the euro zone, JP Morgan chief Jamie Dimon told the German newspaper Handelsblatt.

His position appeared at odds with that of European Economic Affairs Commissioner Pierre Moscovici who said on Friday that he saw no signs of any contagion at this stage from problems over Italy's economic and political situation.

Italy's borrowing costs have been rising under a new anti-austerity coalition government that plans to boost deficit spending to revive the economy.

The risk premium Italy pays over safer German Bunds has climbed to a 5-1/2 year high due to Rome's plans to raise next year's deficit to 2.4 percent of domestic output under a draft budget which has been rejected by the European Commission and has raised concerns of a credit crunch.

"I don't know if the likelihood is two or 20 percent," Dimon said. "But, yes, it could happen."

Asked about the exposure of banks in Italy which hold a large chunk of the country's sovereign bonds to a future debt crisis, Dimon said the banking sector could not be stable if the government in Rome was unstable.

"If the sovereign debt of their country are worth nothing then the banks would not manage," Dimon said. "This relationship is closer than most people think."

European banking supervisors have stepped up their monitoring of liquidity levels at Italian banks after a sharp increase in the country's government bond yields, although there is no cause for alarm, a source told Reuters this week.

A budget standoff between Rome's anti-establishment government and European Union authorities on Tuesday pushed Italy's benchmark 10-year debt costs to 3.72 percent, the highest level since February 2014.

Italian banks are vulnerable to sovereign debt problems because they hold around 375 billion euros of domestic bonds - or 10 percent of their assets - and the spike in yields, by hurting the value of those holdings, eats into their capital levels.

Shares in the country's lenders have fallen sharply in recent months and the cost of insuring major banks' debt against a potential default has increased.

(Reporting by Joseph Nasr; Editing by Matthew Mpoke Bigg)