By Paulina Duran

SYDNEY (Reuters) - Australia's banking watchdog accepted criticism levelled against it by a powerful financial sector inquiry as "reasonable", and said it may need to take a fresh look at its approach to prosecuting and punishing poor conduct.

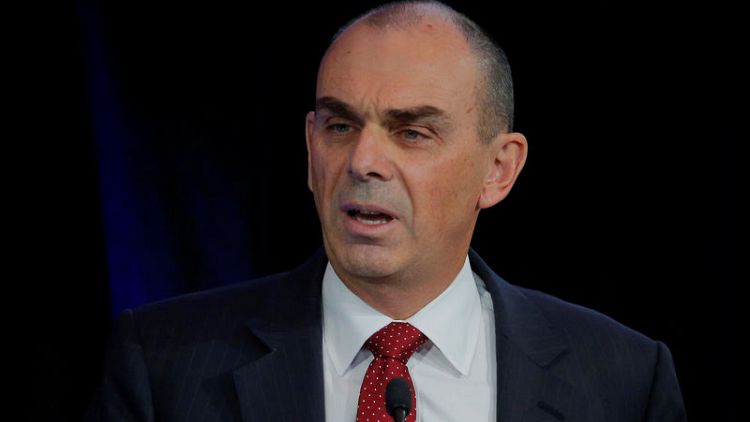

In the regulator's first public remarks to criticism from the quasi-judicial inquiry, also known as the Royal Commission, Australian Prudential Regulation Authority (APRA) Chairman Wayne Byres accepted responsibility for the stability of the banking system and the four powerful Australian banks.

"The Royal Commission has suggested, amongst other things, that regulators can and should do more to actively enforce standards of behaviour within the financial sector, and punish those who breach them," Byres said in a statement on Thursday.

"Based on what has been revealed, that is a quite reasonable conclusion. We will clearly need to reflect on that approach."

He, however, pointed out in the statement that APRA's mandate does not include "conduct risk" or "misconduct".

Banking cannot be described as a profession and lacks strong professional standards like those that guide doctors and lawyers, Byres said. "There is no defined body of knowledge or high entry standards for those who perform key roles. Where codes of conduct exist, they are often totally voluntary."

The inquiry, in an interim report last month, had rapped APRA for not paying enough attention to the way remuneration frameworks at the banks were incentivising misconduct.

"It would be surprising and cause for concern, if APRA's approach to prudential governance of remuneration remained as narrowly focused," Kenneth Hayne, the former judge leading the Royal Commission, said in the report.

APRA is due to give a full response to the inquiry by an Oct. 26 deadline.

Corporate regulator Australian Securities and Investment Commission, criticised by the Haynes report for not punishing malfeasance appropriately, has not yet commented beyond saying it was considering the remarks and would respond to the inquiry later this month.

In gruelling public hearings over the last nine months, the commission has been airing allegations of misconduct, revealing several instances of fraud and law breaches that have triggered executive resignations, class-action lawsuits and wiped billions off the valuations of the big four banks and other large financial institutions.

The year-long inquiry is due to deliver its final recommendations in February, which could include tougher regulation and civil or criminal prosecutions.

(Reporting by Paulina Duran; Editing by Himani Sarkar)