Hungary's PM Viktor Orbán scored a big win by forcing an exemption into the original proposal.

With the war in Ukraine entering its fourth month with no end in sight, the European Union has taken its sanctions against Russia into uncharted territory.

In a bold move poised to reverberate across global markets, the 27 member states have agreed to phase out Russian oil, both crude barrels and refined oil products, by the end of the year.

The breakthrough followed almost four weeks of fraught negotiations that culminated in a high-stakes extraordinary summit in Brussels, where leaders gave in to a key demand vigorously advocated by Hungary: the total exemption of oil supplies flowing through pipelines.

Accordingly, the EU-wide ban will target seaborne imports, which represent more than two-thirds of the bloc's daily purchases of Russian oil.

The pipeline derogation went further than an initial compromise that suggested Hungary, together with other landlocked countries, would be allowed two extra years, until December 2024, to complete the embargo.

As it stands now, the exemption, touted as "temporary", will remain in place for an indefinite period of time.

The deal offers an incontestable political victory for Hungary's Prime Minister Viktor Orbán, who doggedly stood his ground and blocked the measure until all his demands were satisfied.

"Hungarian families can sleep peacefully tonight," declared Orbán at the end of the meeting.

"Brussels' proposal would have been similar to an atomic bomb, but we managed to avoid it."

A lasting Soviet legacy

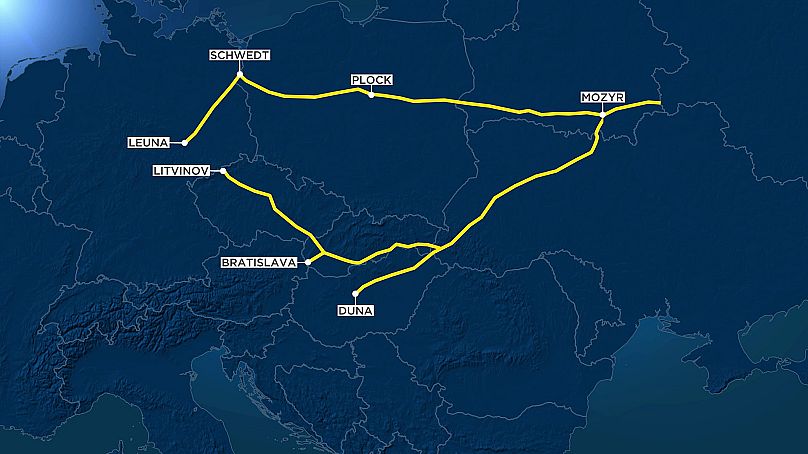

At the heart of the dispute is the Druzhba pipeline, a massive conduit dating back to the Soviet era and currently operated by Russia's state-controlled giant Transneft.

The pipeline, whose name translates to "friendship", began construction in the early 1960s and today stretches over a 5,500-kilometre-long network, pouring Urals oil directly into refineries in Poland, Germany, Hungary, Slovakia and the Czech Republic.

Druzhba pumps between 750,000 to 800,000 barrels of crude on a daily basis and has a capacity of up to 1.4 million daily barrels. The fuel is then refined by EU companies into diesel, naphtha, gasoline, lubricants and other commodities that are sold in and outside the bloc.

These enormous and consistent volumes have turned the pipeline into a centrepiece of Central Europe's energy sector, building an entire ecosystem that sustains thousands of direct and indirect jobs but at the same time, it's created a high degree of dependency on Russia.

As soon as European Commission President Ursula von der Leyen proposed phasing out both seaborne and pipeline oil imports, the cracks began showing.

Hungary, the Czech Republic and Slovakia, three countries that lack access to sea and are heavily reliant on Russian oil, quickly raised concerns and asked for tailor-made deadlines, ranging from two to four extra years, to revamp their energy systems.

The Slovak government argued the country's only refinery, Slovnaft, worked exclusively with a heavy type of Russian oil and that repurposing the technology to a lighter crude would take up half a decade and require €250 million in investment.

Using similar arguments, Budapest put on the table a demand for €550 million to adapt its refineries, while Prague said it needed until June 2024 to expand the capacity of the Transalpine pipeline, which enables the transport of non-Russian oil from the marine terminal in Trieste, Italy.

The behind-the-scenes discussions intensified to bring all 27 states on board: talks involved complex technical questions – how to find alternative providers and trade routes –, economic fears of an inevitable recession and political anxiety over the impact on the electorate's daily life.

Altogether, the dilemma briefly threatened to derail the EU's enduring unity throughout the continent's gravest crisis in the 21st century.

In the end, EU leaders, wary of an endless impasse and fearing reputational damage, chose to compromise and pushed the sixth package of sanctions over the finish line.

While the final result has been punctured by a seemingly unlimited exemption, the scope of the oil embargo is nevertheless impressive for the energy-thirsty bloc: the EU is Russia's number one oil client, with a pre-war trade of around 3.5 million barrels per day worth €74 billion in 2021.

Soaring energy prices made the need for a boycott an imperative for the EU: thanks to the profitable sale of fossil fuels, the Kremlin has managed to boost the rouble and register a €90 billion account surplus.

"The embargo is still a hugely positive step for Europe and shows that the EU is serious about sanctioning Putin over the atrocities being committed in Ukraine," said Anna Krajinska, oil campaign coordinator at Transport & Environment, an organisation that advocates for zero-emission mobility.

Level playing field

Hungarian, Slovak and Czech officials have openly celebrated the deal, expressing their satisfaction with how their considerations were taken into account.

Meanwhile, Poland and Germany, which are linked to Druzhba's northern branch, have pledged to go beyond legal obligations and phase out pipeline imports on top of seaborne supplies.

If the two make good on their (non-binding) promises, the EU will end 2022 without 90% of the Russian oil it currently buys, according to the Commission's own estimates.

But the fate of that remaining 10% flowing through the southern branch is still up in the air.

The Dutch and Belgian prime ministers acknowledged Hungary's difficult position but suggested the exemption should be revised in the coming months to narrow down its duration. Given Budapest's insistence, it seems unlikely the government will be willing to open up the discussion, let alone amend the compromise.

The pipeline carve-out has already raised the spectre of unfair competition: in practice, a small group of states will be able to receive reliable oil supplies while the majority struggle to get hold of barrels from other providers.

"Countries will enjoy a competitive advantage and that is a risk that should be considered for the integrity of the single market," Ben McWilliams, a research analyst at Bruegel, told Euronews.

"It is not yet clear to what extent Hungary and others will be able to refine Russian crude oil and sell it into secondary markets – but this must be limited and closely monitored."

The EU summit's joint conclusions include a vaguely-worded vow to ensure a "level playing field" between member states. But Brussels will not get to see the full picture until the embargo is completed in late December.

The fact that Russia is offering Urals crude with an eye-catching $35 discount below the benchmark Brent is set to make things more awkward for the bloc, particularly if non-Russian providers capitalise on the embargo to hike prices and make bigger profits.

In another notable win, Orbán secured a provision saying that "in case of sudden interruptions of supply, emergency measures will be introduced to ensure security of supply," a line he pushed after a Ukrainian official ominously warned that "something could happen" to the Druzhba segment running through the country.