Designed to treat obesity, a new class of drugs is also an opportunity for investors.

A new generation of weight-loss drugs could help to combat the global health problem of obesity.

Pharmaceutical laboratories and investors are racing to develop new drugs and are already reaping substantial profits.

Obesity is a chronic illness that is a risk factor for cardiovascular disease, diabetes, and certain cancers. Its causes are not solely lifestyle-related, but can also be influenced by genetics.

It’s also difficult to treat and costly for healthcare systems.

If prevention and medical treatment do not improve, the World Obesity Federation predicts that by 2035, half of the world's population will be overweight or obese.

According to its calculations, the global economic impact would be great and could exceed $4 trillion (€3.6 trillion) per year.

New options available

A new family of anti-obesity drugs leads to more significant weight loss than medicines available up to now, with fewer severe side effects. They are also effective against diabetes and have been shown to potentially reduce the risk of cardiovascular disease.

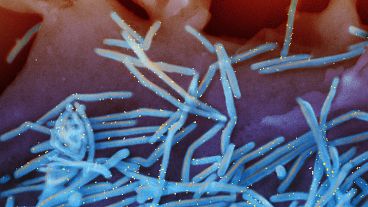

These drugs mimic a hormone secreted by the intestines (GLP-1) to signal to the brain that a person is feeling full.

US pharmaceutical company Eli Lilly and Danish pharma giant Novo Nordisk saw their sales take off in the second quarter thanks to these increasingly popular weight-loss drugs.

Eli Lilly made a breakthrough at the end of April when it confirmed that its blockbuster anti-diabetes drug, marketed under the name Mounjaro (tirzepatide), also helped people to lose weight.

Given the size of the market - some 40 per cent of adults suffer from obesity in the United States - a possible green light for Mounjaro for obesity would be a commercial success for the group. Its sales of Mounjaro already raked in nearly $1 billion in the second quarter alone.

"The therapy is likely to prove a popular alternative to bariatric surgery, as Mounjaro has been shown to produce equivalent weight loss," said Akash Patel, a pharmaceutical analyst at GlobalData.

High-demand products

The future looks just as bright for Novo Nordisk: a recent study showed that its anti-obesity treatment Wegovy (semaglutide) reduced patients' risk of cardiovascular accidents by 20 per cent. Its sales more than quadrupled in the second quarter.

But is it enough to convince insurers across the Atlantic to cover these treatments?

"One of the main barriers to patient access to GLP-1 drugs is cost," according to the American Pharmacists Association, which also noted that obesity needs to be monitored over the long term.

According to experts, one way of reducing the cost and simplifying the administration of the drug (which is currently administered as an injection) would be to develop pills to be swallowed daily. Novo Nordisk is already in clinical trials for this.

Eli Lilly and Pfizer are also looking to develop this type of pill.

According to Morgan Stanley, the global market for anti-obesity treatments could be worth €49 billion by 2030.